Memorex 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

potential of up to an additional $4.0 million consideration over the next three years, contingent on performance of the

business. Upon closing, we received a cash payment of $16.0 million and a note receivable of $1.0 million due in four

years subject to certain post-closing adjustments. A gain of $4.6 million, net of taxes of $2.7 million, was recognized on

the sale. We sold virtually all of the assets of our Specialty Papers business, including the Nekoosa manufacturing plant.

Approximately 90 employees were also transferred as a part of the sale. These operations are presented in our

Consolidated Statements of Operations as discontinued operations for all years presented.

During the second quarter of 2006, we renegotiated the contingent consideration due from Nekoosa Coated Products,

LLC noted above. As a result, on June 16, 2006, we received a cash payment of $2.3 million in full satisfaction of all

future potential payments from Nekoosa Coated Products, LLC, including the outstanding note receivable. This resulted in

an after-tax gain of $1.2 million from discontinued operations.

Other Discontinued Operations Activity. In the fourth quarter of 2004, we recorded the settlement, reached in

February 2005, of the Jazz Photo litigation associated with the Photo Color Systems business we sold in 1999. Pursuant

to the Settlement Agreement, we paid $20.9 million in 2005 to Jazz Photo in exchange for a complete release of all claims

by Jazz Photo (see Note 18 for further information).

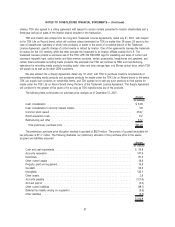

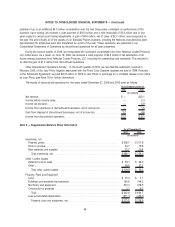

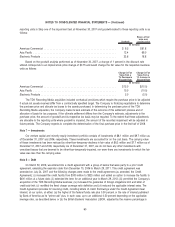

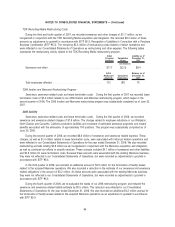

The results of discontinued operations for the years ended December 31, 2006 and 2005 were as follows:

2006 2005

Years Ended December 31,

(In millions)

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $20.1

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2.4

Income tax provision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.9

Income from operations of discontinued businesses, net of income tax . . . . . . . . . . . . — 1.5

Gain from disposal of discontinued businesses, net of income tax . . . . . . . . . . . . . . . . 1.2 4.6

Income from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1.2 $ 6.1

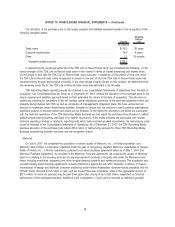

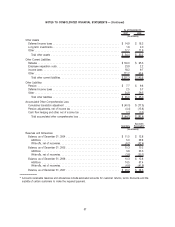

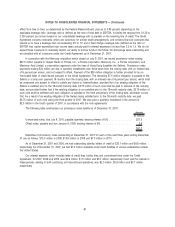

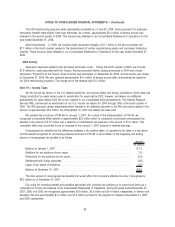

Note 5 — Supplemental Balance Sheet Information

2007 2006

As of December 31,

(In millions)

Inventories, net

Finished goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 308.7 $ 217.6

Work in process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.7 19.6

Raw materials and supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.7 20.8

Total inventories, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 366.1 $ 258.0

Other Current Assets

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 53.1 $ 26.0

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56.8 32.3

Total other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 109.9 $ 58.3

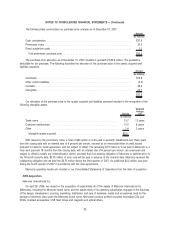

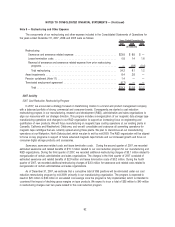

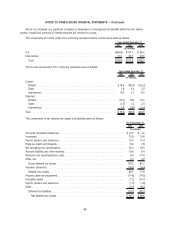

Property, Plant and Equipment

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10.4 $ 1.7

Buildings and leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160.8 148.3

Machinery and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 370.3 478.5

Construction in progress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1 6.2

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 542.6 $ 634.7

Less accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (371.1) (456.7)

Property, plant and equipment, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 171.5 $ 178.0

56

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)