Memorex 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

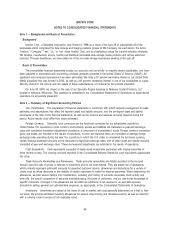

shares). TDK also agreed to a voting agreement with respect to certain matters presented to Imation shareholders and a

three-year lock-up on sales of the Imation shares acquired in the transaction.

TDK and Imation also entered into two long-term Trademark License Agreements, dated July 31, 2007, with respect

to the TDK Life on Record brand, which will continue unless terminated by TDK no earlier than 26 years (10 years in the

case of headphones, speakers or wholly new products) or earlier in the event of a material breach of the Trademark

License Agreement, specific change of control events or default by Imation. One of the agreements licenses the trademark

to Imation for the U.S. territory, while the other licenses the trademark to an Imation affiliate outside the U.S. The

trademark licenses provide us exclusive use of the TDK LIFE ON RECORD logo for marketing and sales of current and

successor magnetic tape, optical media and flash memory products, certain accessories, headphones and speakers, and

certain future removable recording media products. We anticipate that TDK will continue its R&D and manufacturing

operations for recording media products including audio, video and data storage tape, and Blu-ray optical discs, which TDK

will supply us as well as its other OEM customers.

We also entered into a Supply Agreement, dated July 31, 2007, with TDK to purchase Imation’s requirements of

removable recording media products and accessory products for resale under the TDK Life on Record brand to the extent

TDK can supply such products on competitive terms, and TDK agreed not to sell any such products to third parties for

resale under the TDK Life on Record brand during the term of the Trademark License Agreement. The Supply Agreement

will continue for the greater of five years or for so long as TDK manufactures any of the products.

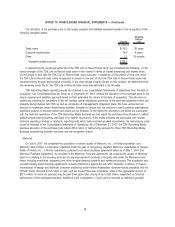

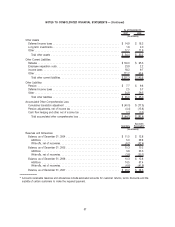

The following table summarizes our purchase price analysis as of December 31, 2007:

Amount

(In millions)

Cash consideration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 54.9

Cash consideration to minority interest holders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.9

Common stock issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216.7

Direct acquisition costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.2

Restructuring and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.2

Total preliminary purchase price. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $314.9

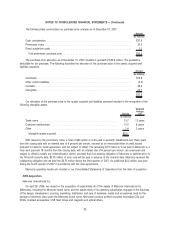

The preliminary purchase price allocation resulted in goodwill of $55.9 million. The portion of goodwill deductible for

tax purposes is $11.7 million. The following illustrates our preliminary allocation of the purchase price to the assets

acquired and liabilities assumed:

Amount

(In millions)

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25.8

Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147.9

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91.5

Other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.8

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.3

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55.9

Intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 132.1

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.8

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (121.6)

Accrued payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.2)

Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (39.1)

Deferred tax liability arising on acquisition. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.8)

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9.5)

$ 314.9

51

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)