Memorex 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

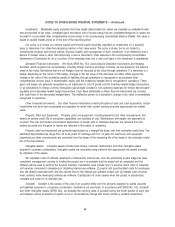

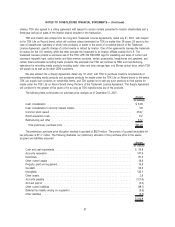

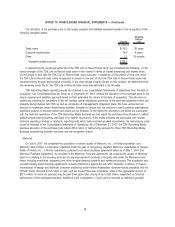

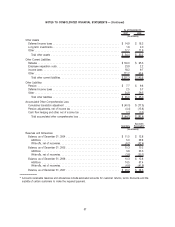

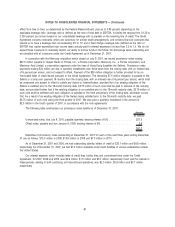

Our allocation of the purchase price to the assets acquired and liabilities assumed resulted in the recognition of the

following intangible assets:

Amount

Weighted

Average

Life

(In millions)

Trade name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $115.0 30 years

Customer relationships. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.0 6 years

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1 18 months

Intangible assets acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $132.1

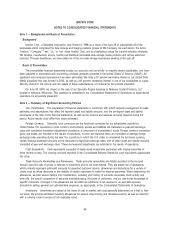

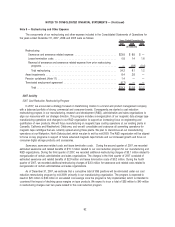

In determining the remaining useful life of the TDK Life on Record trade name, we considered the following: (1) the

overall strength of the TDK Life on Record trade name in the market in terms of market awareness and market share,

(2) the length of time that the TDK Life on Record trade name has been in existence, (3) the period of time over which

the TDK Life on Record trade name is expected to remain in use and (4) that the TDK Life on Record trade name has

remained strong through technological innovation in the data storage industry. Based on this analysis, we determined that

the remaining useful life for the TDK Life on Record trade name was estimated to be 30 years.

TDK Recording Media operating results are included in our Consolidated Statements of Operations from the date of

acquisition. Our Consolidated Balance Sheet as of December 31, 2007, reflects the allocation of the purchase price to the

assets acquired and liabilities assumed based on their estimated fair values at the date of acquisition. This allocation is

preliminary, pending the completion of the net working capital adjustment provisions of the purchase agreement which are

presently being finalized with TDK as well as completion of management’s integration plans. We have announced our

intention to implement certain restructuring activities. However, to ensure that we continue to meet customer expectations,

significant analysis is required before such plans can be finalized. To the extent the activities to be exited are associated

with the historical operations of the TDK Recording Media business we may adjust the purchase price allocation to reflect

additional restructuring liabilities (see Note 9 for further information). If the exited activities are associated with Imation

historical operating activities or related to reporting units which have recorded goodwill impairments, the restructuring costs

would be reflected in our Consolidated Statements of Operations. As of December 31, 2007, the TDK Recording Media

business allocation of the purchase price reflects $9.4 million of restructuring accruals for those TDK Recording Media

Business restructuring activities that have met the recognition criteria.

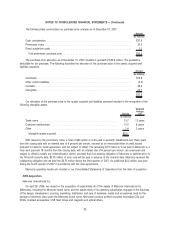

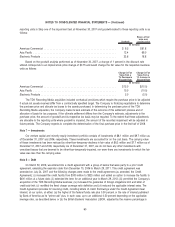

Memcorp

On July 9, 2007, we completed the acquisition of certain assets of Memcorp, Inc., a Florida corporation, and

Memcorp Asia Limited, a corporation organized under the laws of Hong Kong (together Memcorp, subsidiaries of Hopper

Radio of Florida, Inc., a Florida corporation), pursuant to an asset purchase agreement dated as of May 7, 2007 (the

Memcorp Purchase Agreement). As provided in the Memcorp Purchase Agreement, we acquired the assets of Memcorp

used in or relating to the sourcing and sale of consumer electronic products, principally sold under the Memorex brand

name, including inventories, equipment and other tangible personal property and intellectual property. The acquisition also

included existing brand licensing agreements, including Memcorp’s agreement with MTV Networks, a division of Viacom

International, to design and distribute consumer electronics under certain Nickelodeon character-based properties and the

NPower brand. We paid $31.8 million in cash, and we issued three-year promissory notes in the aggregated amount of

$37.5 million. An earn-out payment may be paid three years after closing of up to $20 million, dependent on financial

performance of the purchased business. Additional cash consideration, if paid, will be recorded as additional goodwill.

52

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)