Memorex 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with the Memcorp acquisition which closed on July 9, 2007, we issued promissory notes totaling

$37.5 million payable to Hopper Radio of Florida, Inc., a Florida corporation, Memcorp, Inc., a Florida corporation, and

Memcorp Asia Limited, a corporation organized under the laws of Hong Kong (together, the Sellers). Promissory note

payments totaling $30 million are due in quarterly installments over three years from the closing date, with an interest rate

of 6 percent per annum, and not subject to offset. Payment of the $30 million obligation is further provided for by an

irrevocable letter of credit issued pursuant to the Credit Agreement. The remaining $7.5 million obligation is payable to the

Sellers in a lump sum payment 18 months from the closing date, with an interest rate of 6 percent per annum, which shall

be unsecured and subject to offset to satisfy any claims to indemnification; provided that if an existing obligation of the

Sellers is satisfied prior to the 18-month maturity date, $3.75 million of such note shall be paid in advance of the maturity

date, and provided further that if the existing obligation is not satisfied prior to the 18-month maturity date, $3.75 million of

such note shall be withheld until such obligation is satisfied or the third anniversary of the closing date, whichever occurs

first. As a result of an existing obligation of the Sellers being satisfied prior to the 18-month maturity date, we paid

$3.75 million of such note during the third quarter of 2007. We also paid a quarterly installment in the amount of

$2.5 million in the fourth quarter of 2007, in accordance with the note agreements.

In addition, certain international subsidiaries have borrowing arrangements locally outside of the Credit Agreement

discussed above. As of December 31, 2007 and 2006, there were no borrowings outstanding under such arrangements.

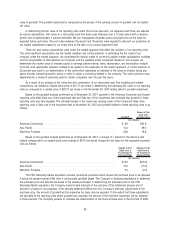

In 1997, our Board of Directors authorized the repurchase of up to six million shares of our common stock and in

1999 increased the authorization to a total of 10 million shares. On August 4, 2004, our Board of Directors increased the

authorization for repurchase of common stock, expanding the then remaining share repurchase authorization of 1.8 million

shares as of June 30, 2004, to a total of six million shares. On April 17, 2007, our Board of Directors authorized the

repurchase of 5.0 million shares of common stock. The previous share repurchase program, which had a remaining share

repurchase authorization of 2.4 million shares, was cancelled and replaced with the new authorization. During 2007, 2006

and 2005, we repurchased 3.8 million shares, 0.9 million shares and 0.5 million shares, respectively. As of December 31,

2007, we had repurchased 3.8 million shares under the latest authorization and held, in total, 4.5 million shares of treasury

stock acquired at an average price of $25.27 per share. Authorization for repurchases of an additional 1.2 million shares

remains outstanding as of December 31, 2007. On January 28, 2008, the Board of Directors authorized a share

repurchase program increasing the total outstanding authorization to 3.0 million shares of common stock. The Company’s

previous authorization was cancelled with the new authorization.

We paid cash dividends of $0.62 per share or $23.2 million during 2007, $0.54 per share or $18.8 million during

2006, and $0.46 per share or $15.7 million during 2005. Any future dividends are at the discretion of and subject to the

approval of Imation’s Board of Directors.

We contributed $5.6 million to our defined benefit pension plans during 2007. Based on this funding, as well as the

market performance on plan assets, we ended 2007 with an aggregate noncurrent pension liability of $7.7 million and

aggregated noncurrent pension assets of $7.8 million, an improvement from the noncurrent pension liability of $9.8 million

and aggregated noncurrent pension assets of $1.0 million at the end of 2006. We expect pension contributions to be in the

range of $5 million to $6 million in 2008, depending on asset performance and interest rates.

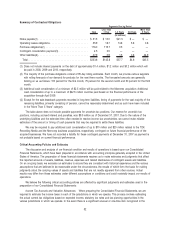

Our liquidity needs for 2008 include the following: capital expenditures in the range of $15 million to $20 million,

restructuring payments of approximately $25 million, scheduled debt repayment of $10 million, pension funding in the range

of $5 million to $6 million, operating lease payments of approximately $17 million (see Note 15 to the Consolidated

Financial Statements for further information) and any amounts associated with litigation or the repurchase of common

stock under the authorization discussed above or any dividends that may be paid upon approval of the Board of Directors.

We expect that cash and cash equivalents, together with cash flow from operations and availability of borrowings under

our current and future sources of financing, will provide liquidity sufficient to meet these needs and for our operations.

Off-Balance Sheet Arrangements

Other than the operating lease commitments discussed in Note 15 to the Consolidated Financial Statements, we are

not using off-balance sheet arrangements, including special purpose entities, nor do we have any contractual obligations,

excluding our promissory notes, or commercial commitments with terms greater than one year that would significantly

impact our liquidity.

31