Memorex 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

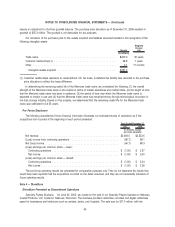

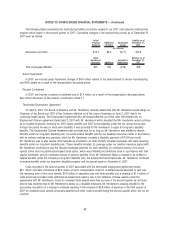

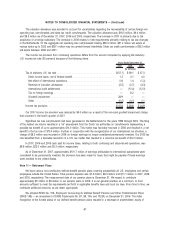

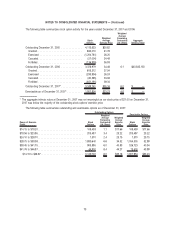

TDK Recording Media Restructuring Costs

During the third and fourth quarter of 2007, we recorded severance and other charges of $11.7 million, as we

reorganized in conjunction with the TDK Recording Media acquisition and integration. We recorded $9.4 million of these

amounts as adjustments to goodwill in accordance with EITF 95-3, Recognition of Liabilities in Connection with a Purchase

Business Combination (EITF 95-3). The remaining $2.3 million of restructuring costs related to Imation operations and

were reflected in our Consolidated Statements of Operations as restructuring and other expense. The following tables

summarize the restructuring activity related to the TDK Recording Media restructuring program.

Initial

Program

Amounts

Cumulative

Usage

Liability as of

December 31,

2007

(In millions)

Severance and other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $11.7 $(2.3) $9.4

Initial

Headcount

Amounts

Cumulative

Reductions

Balance as of

December 31,

2007

Total employees affected . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 172 (97) 75

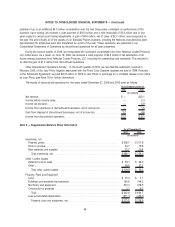

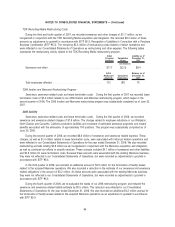

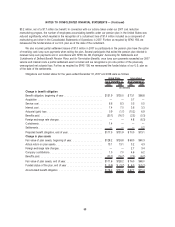

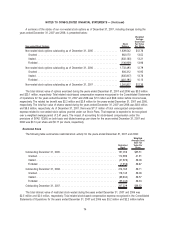

2006 Imation and Memorex Restructuring Program

Severance, severance related costs and lease termination costs. During the first quarter of 2007 we recorded lease

termination costs of $0.4 million related to our 2006 Imation and Memorex restructuring program, which began in the

second quarter of 2006. The 2006 Imation and Memorex restructuring program was substantially completed as of June 30,

2007.

2006 Activity

Severance, severance related costs and lease termination costs. During the first quarter of 2006, we recorded

severance and severance related charges of $1.8 million. The charges related to employee reductions in our Wahpeton,

North Dakota and Camarillo, California production facilities and consisted of estimated severance payments and related

benefits associated with the elimination of approximately 100 positions. This program was substantially completed as of

June 30, 2006.

During the second quarter of 2006, we recorded $6.8 million of severance and severance related expense. These

charges, as well as $1.4 million related to lease termination costs, were associated with historical Imation operations and

were reflected in our Consolidated Statements of Operations for the year ended December 31, 2006. We also recorded

restructuring accruals totaling $4.9 million as we reorganized in conjunction with the Memorex acquisition and integration,

as well as continued our efforts to simplify structure. These accruals included $4.1 million of severance and other liabilities

and $0.8 million for lease termination costs. Because these amounts were associated with the existing Memorex business,

they were not reflected in our Consolidated Statements of Operations, but were recorded as adjustments to goodwill in

accordance with EITF 95-3.

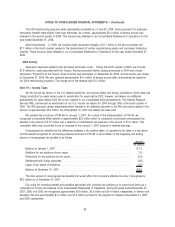

In the third quarter of 2006, we recorded an additional accrual of $2.5 million for the termination of facility leases

related to the acquired Memorex operations. We also recorded a reduction in the estimate of our severance and severance

related obligations in the amount of $0.2 million. As these amounts were associated with the existing Memorex business,

they were not reflected in our Consolidated Statements of Operations, but were recorded as adjustments to goodwill in

accordance with EITF 95-3.

During the fourth quarter of 2006, we re-evaluated the needs of our 2006 restructuring program and reduced the

severance and severance related liability estimate by $0.5 million. This reduction was reflected in our Consolidated

Statements of Operations for the year ended December 31, 2006. We also recorded an additional $0.2 million accrual for

the termination of facility leases related to the acquired Memorex operations as an adjustment to goodwill in accordance

with EITF 95-3.

64

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)