Memorex 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.a corresponding offset to the original intangible asset recorded in conjunction with the execution of the original Exabyte

distribution agreement.

Due to the decline in value of Exabyte common stock, we determined that other-than-temporary impairments in our

investment in Exabyte holdings existed in 2006. Consequently, we reduced the carrying value of our Exabyte holdings by

$4.2 million with a corresponding loss recorded in other expense in the Consolidated Statements of Operations. As of

December 31, 2006, our Exabyte stock holdings had been fully written off.

The Exabyte notes receivable consist of a $5.0 million note, bearing 10 percent interest beginning January 1, 2006,

with interest only payments through 2007 and quarterly principal and interest payments commencing on March 31, 2008

and continuing through December 31, 2009. The notes receivable also included a $2.0 million note bearing 10 percent

interest through December 15, 2006, at which time the principal amount was due.

On November 20, 2006, Tandberg completed the acquisition of substantially all of the Exabyte assets and the

Exabyte tape media distribution agreement was assigned to Tandberg. As a result of the acquisition, we restructured the

Exabyte notes receivable agreement. In connection with the notes restructuring agreement, we received $1.0 million of the

$2.0 million previously due December 15, 2006, and all interest accrued but not paid, on the outstanding notes receivable.

Tandberg replaced the $5.0 million note with a $4.0 million note (the Note). The Note bears interest at 10 percent

beginning November 20, 2007, payable quarterly with principal payments commencing on December 15, 2008 and

continuing through December 15, 2010. In addition, in conjunction with the note restructuring agreement, Tandberg

increased the margin we earn on distribution by two percentage points, effective January 1, 2007, until such time that we

recover the forgiven principal amount on both notes totaling $2.0 million. In connection with the restructuring of our notes

receivable and distribution agreements, we recorded a loss of $0.4 million during 2006, which represents lost interest

income on the notes receivable. During 2007 Tandberg experienced liquidity problems and short-term funding has been

provided by outside investors. The collection of the note receivable and realization of the intangible asset is dependent on

the continued success of our relationship with Tandberg and the liquidity of Tandberg. At December 31, 2007, we continue

to believe the recorded note is collectible. However, future events may impact this assessment.

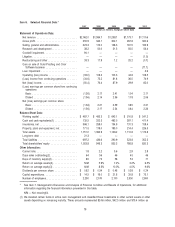

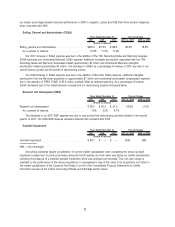

Intangible assets were $371.0 million as of December 31, 2007, compared with $230.2 million as of December 31,

2006. The increase in net intangible assets was attributed to identifiable intangible assets of $132.1 million arising from the

TDK Recording Media acquisition and $25.1 million arising from the Memcorp acquisition.

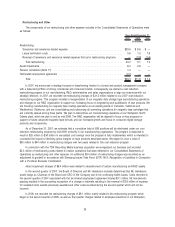

Accounts payable were $350.1 million as of December 31, 2007, compared with $227.3 million as of December 31,

2006. The increase in accounts payable was mainly attributed to the TDK Recording Media acquisition.

Other current liabilities were $257.3 million as of December 31, 2007, compared with $140.6 million as of

December 31, 2006. The increase in current liabilities was attributed to the liability for rebates, which increased

$38.7 million due mainly to the acquisition of the TDK Recording Media business, an increase in employee separation cost

liability of $21.7 million related to our restructuring activity, as well as several other increases associated with our recent

acquisitions of approximately $50 million in aggregate.

Liquidity and Capital Resources

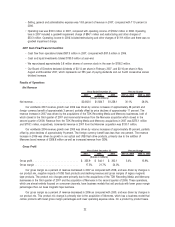

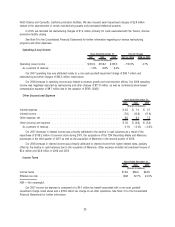

Cash provided by operating activities was $87.5 million in 2007. The major driver was a net loss of $50.4 million

offset by non-cash items totaling $154.8 million offset by working capital changes of $16.9 million. Non-cash items included

a goodwill impairment charge of $94.1 million, depreciation and amortization of $46.9 million and stock-based compensa-

tion of $10.2 million. Large cash outflows in 2007 included net income tax payments of $9.6 million, restructuring payments

of $13.1 million and pension funding of $5.6 million.

Cash provided by operating activities was $97.5 million in 2006. The major driver was net income as adjusted for

non-cash items totaling $139.6 million, offset by working capital changes of $42.1 million. Net income as adjusted for

significant non-cash items included net income of $76.4 million adjusted for depreciation and amortization of $38.4 million,

stock-based compensation of $11.0 million, deferred income taxes of $9.7 million and asset impairments of $7.2 million.

Significantly higher revenue drove working capital during the year, including increases in receivables and inventories, using

working capital of $37.6 million and $49.3 million, respectively, offset by an increase in accounts payable, providing working

capital of $30.5 million. Large cash outflows in 2006 included tax payments of $22.0 million, restructuring payments of

$13.2 million and pension funding of $13.2 million.

29