Logitech 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in net foreign currency exchange gains in fiscal year 2006 primarily resulted from a one-time

gain of $3 million related to an exchange of the Company’s Euro currency for U.S. dollars. The Company does

not speculate in currency positions, but is alert to opportunities to maximize its foreign exchange gains. The

Company also impaired an investment and recorded a gain on the sale of another investment.

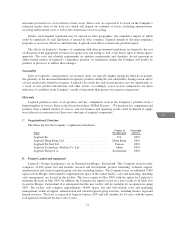

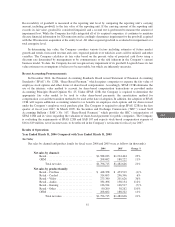

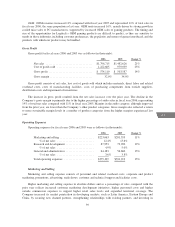

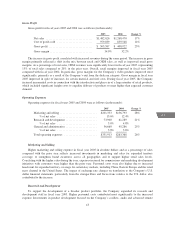

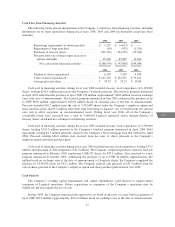

Provision for Income Taxes

The provision for income taxes and effective tax rate for fiscal years 2006 and 2005 were as follows (in

thousands):

2006 2005

Provision for income taxes .................. $28,749 $26,340

Effective income tax rate ................... 13.7% 15.0%

The provision for income taxes consists of income and withholding taxes. The decrease in effective tax rate

is primarily due to changes in the geographic mix of income.

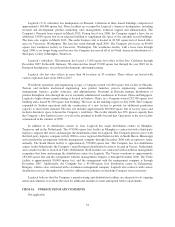

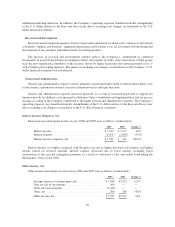

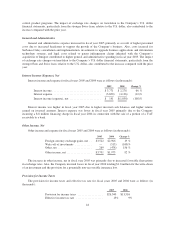

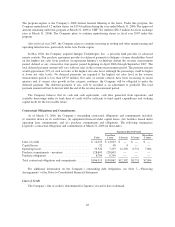

Year Ended March 31, 2005 Compared with Year Ended March 31, 2004

Net Sales

Net sales by channel and product family for fiscal years 2005 and 2004 were as follows (in thousands):

2005 2004 Change %

Net sales by channel:

Retail ................................ $1,294,404 $1,020,290 27 %

OEM ................................ 188,222 248,180 (24)%

Total net sales ..................... $1,482,626 $1,268,470 17 %

Net sales by product family:

Retail – Cordless ....................... $ 453,519 $ 341,082 33 %

Retail – Corded ........................ 296,346 294,829 1 %

Retail – Video ......................... 201,626 166,418 21 %

Retail – Audio ......................... 158,134 118,641 33 %

Retail – Gaming ....................... 146,517 82,872 77 %

Retail – Other ......................... 38,262 16,448 133%

OEM ................................ 188,222 248,180 (24)%

Total net sales ..................... $1,482,626 $1,268,470 17 %

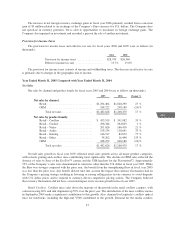

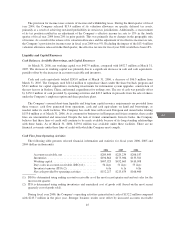

Overall sales growth in fiscal year 2005 reflected retail sales growth across all major product categories,

with console gaming and cordless mice contributing most significantly. The decline in OEM sales reflected the

absence of sales to Sony of the EyeToyTM camera and the USB headsets for the Playstation®2. Approximately

53% of the Company’s sales were denominated in currencies other than the U.S. dollar in fiscal year 2005. While

the Euro was stronger compared with the prior year, the benefit from the strengthening Euro in fiscal year 2005

was less than the prior year. Any benefit did not take into account the impact that currency fluctuations had on

the Company’s pricing strategy resulting in lowering or raising selling prices in one currency to avoid disparity

with U.S. dollar prices and to respond to currency-driven competitive pricing actions. The Company believed

that currency fluctuations did not have a material impact on its revenue growth in fiscal year 2005.

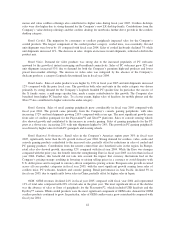

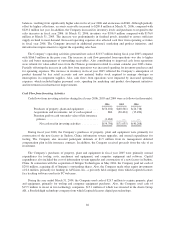

Retail Cordless. Cordless mice sales drove the majority of the growth in the retail cordless category, with

sales increasing 69% and unit shipments up 59% over the prior year. The introduction of the laser cordless mouse

in September 2004 made a significant contribution to this growth. Also, demand for Logitech’s cordless optical

mice for notebooks, including the high-end V500 contributed to the growth. Demand for the media cordless

41

CG

LISA