Logitech 2006 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

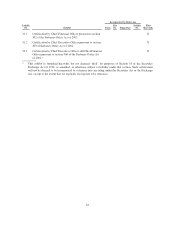

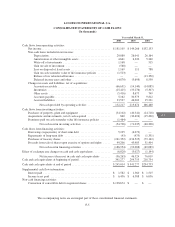

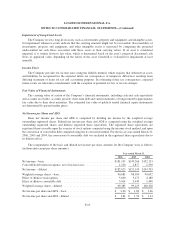

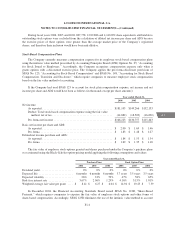

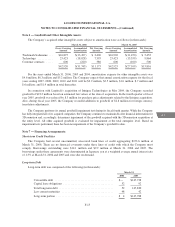

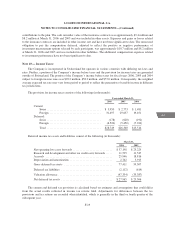

A summary of activity in the Company’s allowance for doubtful accounts was as follows (in thousands):

Year ended March 31,

2006 2005 2004

Balance at beginning of period .......................................... $5,166 $6,068 $7,716

Baddebtexpense ................................................. 9 55 1,271

Write-offs ....................................................... (2,187) (957) (2,919)

Balance at end of period ............................................... $2,988 $5,166 $6,068

Inventories

Inventories are stated at the lower of cost or market. Cost is computed on a first-in, first-out basis. The

Company records write-downs of inventories which are obsolete or in excess of anticipated demand or market

value based on a consideration of product life cycle stage, technology trends, product development plans,

component cost trends and assumptions about future demand and market conditions.

Investments

Investments consist of companies in which Logitech owns less than a 20% interest. In accordance with

Statement of Financial Accounting Standards (“SFAS”) No. 115, “Accounting for Certain Investments in Debt

and Equity Securities,” investments with a quoted market value are classified as available-for-sale. Such

investments are reported at fair value with the unrealized gains and losses included as a separate component of

shareholders’ equity. Unrealized losses are charged against income when a decline in fair value is determined to

be other than temporary. Realized gains and losses upon the sale or disposition of such investments are based on

the average cost of the specific investments sold.

The cost method is used for all other investments which are adjusted for any decrease in value deemed to be

other than temporary in nature.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Additions and improvements are capitalized, and

maintenance and repairs are expensed as incurred. The Company capitalizes the cost of software developed for

internal use in connection with major projects. Costs incurred during the feasibility stage are expensed, whereas

costs incurred during the application development stage are capitalized.

With the exception of tooling, depreciation is provided using the straight-line method. Plant and buildings

are depreciated over estimated useful lives from ten to twenty-five years, equipment over useful lives from three

to five years, software development over useful lives of three to five years and leasehold improvements over the

life of the lease, not to exceed five years. Tooling is depreciated over the forecasted life of the tool, not to exceed

one year from the time it is placed into production. Depreciation for tooling is calculated based on the forecasted

production volume and adjusted quarterly based on actual production. When property and equipment is retired or

otherwise disposed of, the cost and accumulated depreciation are relieved from the accounts and the net gain or

loss is included in the determination of net income.

Goodwill and Other Intangible Assets

The Company’s intangible assets principally include goodwill, acquired technology, trademarks and

customer contracts. Intangible assets with finite lives, which include acquired technology, trademarks and

customer contracts, are recorded at cost and amortized on the straight-line method over their useful lives ranging

from four to ten years. Intangible assets with indefinite lives, which include goodwill, are recorded at cost and

evaluated at least annually for impairment.

F-9

CG

LISA