Logitech 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

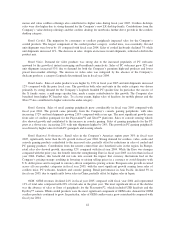

The Company also enters into cooperative marketing arrangements with most of its distribution and retail

customers allowing customers to receive a credit equal to a set percentage of their purchases of the Company’s

products for various marketing programs. The objective of these programs is to encourage advertising and

promotional events to increase sales of the Company’s products. Accruals for the estimated costs of these

marketing programs are recorded based on the contractual percentage of product purchased in the period the

Company recognizes revenue.

The Company regularly evaluates the adequacy of its accruals for customer programs and incentive

offerings. Future market conditions and product transitions may require the Company to take action to increase

such programs. In addition, when the variables used to estimate these costs change, or if actual costs differ

significantly from the estimates, the Company would be required to record incremental reductions to revenue or

increased operating expenses. If, at any future time, the Company becomes unable to reasonably estimate the cost

of customer programs and incentive offerings, recognition of revenue might be deferred until products are sold to

end-users, which would adversely impact revenue in the period of transition.

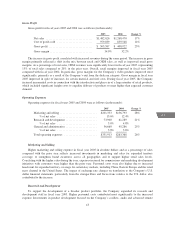

Allowance for Doubtful Accounts

The Company sells its products through a domestic and international network of distributors, retailers and

OEM customers. Logitech generally does not require any collateral from its customers. However, the Company

seeks to control its credit risk through ongoing credit evaluations of its customers’ financial condition and by

purchasing credit insurance on U.S. and European retail accounts receivable balances.

The Company regularly evaluates the collectibility of its accounts receivable and maintains allowances for

doubtful accounts. The allowances are based on management’s assessment of the collectibility of specific

customer accounts, including their credit worthiness and financial condition, as well as the Company’s historical

experience with bad debts and customer deductions, receivables aging, current economic trends and geographic

or country-specific risks.

As of March 31, 2006, three customers represented 14%, 13% and 10% of total accounts receivable. The

customers comprising the ten highest outstanding trade receivable balances accounted for approximately 60% of

total accounts receivable as of March 31, 2006. A deterioration of a significant customer’s financial condition

could cause actual write-offs to be materially different from the estimated allowance. If any of these customers’

receivable balances should be deemed uncollectible or if actual write-offs are higher than historical experience,

the Company would have to make adjustments to its allowance for doubtful accounts, which could result in an

increase in the Company’s operating expenses.

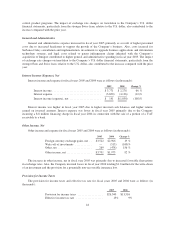

Inventory Valuation

The Company must order components for its products and build inventory in advance of customer orders.

Further, the Company’s industry is characterized by rapid technological change, short-term customer

commitments and rapid changes in demand.

The Company records inventories at the lower of cost or market value and records write-downs of

inventories which are obsolete or in excess of anticipated demand or market value. A review of inventory is

performed each period that considers factors including the marketability and product life cycle stage, product

development plans, component cost trends, demand forecasts and current sales levels. Inventory exposures are

identified by comparing inventory on hand and on order to forecasted sales over the next six, nine and twelve

month periods. Inventory on hand which is not expected to be sold or utilized based on review of forecasted sales

and utilization is considered excess, and the Company recognizes the write-off in cost of sales at the time of such

determination. At the time of loss recognition, a new, lower-cost basis for that inventory is established and

subsequent changes in facts and circumstances would not result in an increase in the cost basis. If there were an

abrupt and substantial decline in demand for Logitech’s products or an unanticipated change in technological or

customer requirements, the Company may be required to record additional write-downs which could adversely

affect gross margins in the period when the write-downs are recorded.

35

CG

LISA