Logitech 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

control product programs. The impact of exchange rate changes on translation to the Company’s U.S. dollar

financial statements, particularly from the stronger Swiss franc relative to the U.S. dollar, also contributed to the

increase compared with the prior year.

General and Administrative

General and administrative expense increased in fiscal year 2005 primarily as a result of higher personnel

costs due to increased headcount to support the growth of the Company’s business. Also, costs incurred for

Sarbanes-Oxley consultation and implementation, investments to upgrade business applications and information

technology systems, and legal costs related to patent infringement claims inherited with the Company’s

acquisition of Intrigue contributed to higher general and administrative spending in fiscal year 2005. The impact

of exchange rate changes on translation to the Company’s U.S. dollar financial statements, particularly from the

stronger Euro and Swiss franc relative to the U.S. dollar, also contributed to the increase compared with the prior

year.

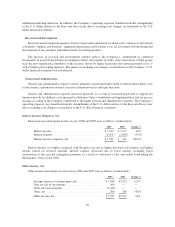

Interest Income (Expense), Net

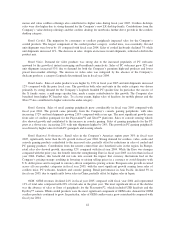

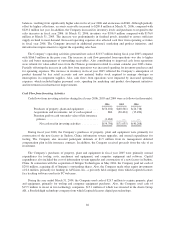

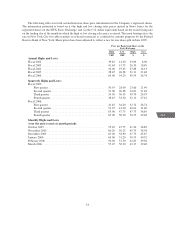

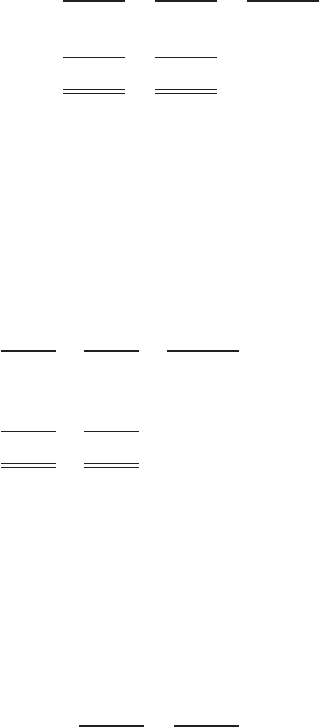

Interest income and expense for fiscal years 2005 and 2004 were as follows (in thousands):

2005 2004 Change %

Interest income .................................. $3,771 $2,278 66%

Interest expense ................................. (3,630) (4,136) (12)%

Interest income (expense), net ...................... $ 141 $(1,858) (108)%

Interest income was higher in fiscal year 2005 due to higher invested cash balances and higher returns

earned on invested amounts. Interest expense was lower in fiscal year 2005 primarily due to the Company

incurring a $.8 million financing charge in fiscal year 2004 in connection with the sale of a portion of a VAT

receivable to a bank.

Other Income, Net

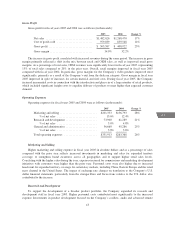

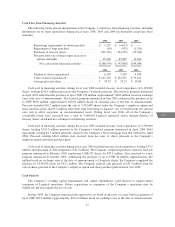

Other income and expense for fiscal years 2005 and 2004 were as follows (in thousands):

2005 2004 Change %

Foreign currency exchange gains, net . . $3,522 $2,966 19 %

Write-off of investments ............ — (515) (100)%

Other,net ........................ 269 (478) 156 %

Otherincome,net.................. $3,791 $1,973 92%

The increase in other income, net in fiscal year 2005 was primarily due to increased favorable fluctuations

in exchange rates. Also, the Company incurred losses in fiscal year 2004 totaling $1.0 million for the write-down

of an investment and the provision for a potentially non-recoverable insurance loss.

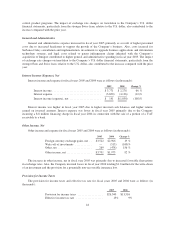

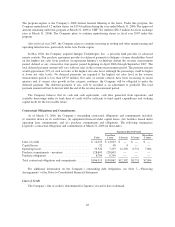

Provision for Income Taxes

The provision for income taxes and effective tax rate for fiscal years 2005 and 2004 were as follows (in

thousands):

2005 2004

Provision for income taxes .................. $26,340 $13,516

Effective income tax rate ................... 15% 9%

44