Logitech 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

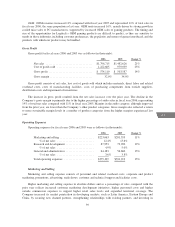

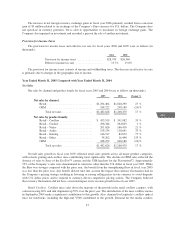

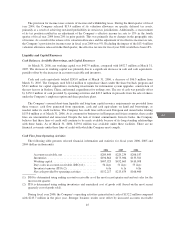

Gross Profit

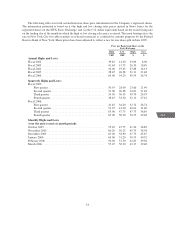

Gross profit for fiscal years 2005 and 2004 was as follows (in thousands):

2005 2004 Change %

Net sales ................................. $1,482,626 $1,268,470 17%

Cost of goods sold ......................... 979,039 859,548 14%

Grossprofit ............................... $ 503,587 $ 408,922 23%

Grossmargin.............................. 34.0% 32.2%

The increase in gross profit correlated with increased revenues during the same period. The increase in gross

margin primarily reflected a shift in the mix between retail and OEM sales, as well as improved retail gross

margins. As a percentage of total sales, OEM revenues were significantly lower in fiscal year 2005, representing

13% of total sales compared to 20% in the prior year. Overall, retail margins improved in fiscal year 2005

compared with fiscal year 2004. In particular, gross margins for the Company’s video products improved most

significantly, primarily as a result of the Company’s exit from the dualcam category. Gross margin in fiscal year

2005 improved in spite of increases for certain material and fuel costs. During fiscal year 2005, the Company

incurred incremental costs in connection with the introduction and phase-in of a large number of retail products,

which included significant freight costs to expedite delivery of products to meet higher than expected customer

demand.

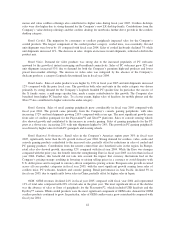

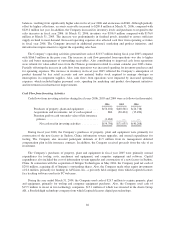

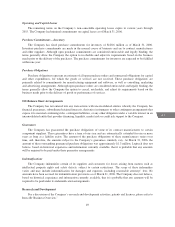

Operating Expenses

Operating expenses for fiscal years 2005 and 2004 were as follows (in thousands):

2005 2004 Change %

Marketing and selling .......................... $201,353 $156,793 28%

% of net sales ............................ 13.6% 12.4%

Research and development ...................... 73,900 61,289 21%

% of net sales ............................ 5.0% 4.8%

General and administrative ...................... 56,660 45,286 25%

% of net sales ............................ 3.8% 3.6%

Total operating expenses ....................... $331,913 $263,368 26%

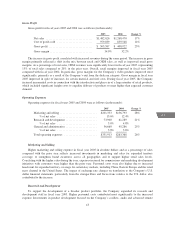

Marketing and Selling

Higher marketing and selling expense in fiscal year 2005 in absolute dollars and as a percentage of sales

compared with the prior year reflects increased investments in marketing and sales for expanded territory

coverage, to strengthen brand awareness across all geographies and to support higher retail sales levels.

Correlating with the higher sales during the year, expenses incurred for commissions and marketing development

initiatives with customers were higher than the prior year. Personnel costs were also higher due to increased

headcount for expanded territory coverage for certain key markets, including China, Eastern Europe and the retail

mass channel in the United States. The impact of exchange rate changes on translation to the Company’s U.S.

dollar financial statements, particularly from the stronger Euro and Swiss franc relative to the U.S. dollar, also

contributed to the increase.

Research and Development

To support the development of a broader product portfolio, the Company expanded its research and

development staff in fiscal year 2005. Higher personnel costs contributed most significantly to the increased

expense. Investments in product development focused on the Company’s cordless, audio and advanced remote

43

CG

LISA