Logitech 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

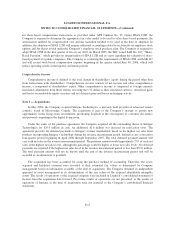

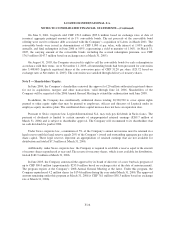

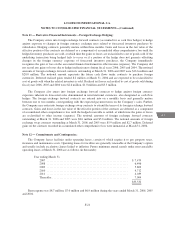

On June 8, 2001, Logitech sold CHF 170.0 million ($95.6 million based on exchange rates at date of

issuance) aggregate principal amount of its 1% convertible bonds. The net proceeds of the convertible bond

offering were used to refinance debt associated with the Company’s acquisition of Labtec in March 2001. The

convertible bonds were issued in denominations of CHF 5,000 at par value, with interest at 1.00% payable

annually, and final redemption in June 2006 at 105%, representing a yield to maturity of 1.96%. At March 31,

2005, the carrying amount of the convertible bonds, including the accrued redemption premium, was CHF

176.5 million ($147.7 million based on exchange rates at March 31, 2005).

On August 31, 2005, the Company exercised its right to call the convertible bonds for early redemption in

accordance with their terms. As of November 11, 2005, all outstanding bonds had been presented for conversion

into 5,448,693 Logitech registered shares at the conversion price of CHF 31.20 per share ($23.72 based on

exchange rates at November 11, 2005). The conversion was satisfied through delivery of treasury shares.

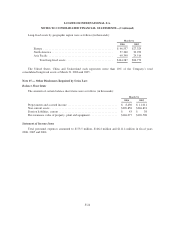

Note 8 — Shareholders’ Equity:

In June 2004, the Company’s shareholders renewed the approval of 20 million authorized registered shares

for use in acquisitions, mergers and other transactions, valid through June 24, 2006. Shareholders of the

Company will be requested at the 2006 Annual General Meeting to extend this authorization until June 2008.

In addition, the Company has conditionally authorized shares totaling 30,330,930 to cover option rights

granted or other equity rights that may be granted to employees, officers and directors of Logitech under its

employee equity incentive plans. The conditional share capital increase does not have an expiration date.

Pursuant to Swiss corporate law, Logitech International S.A. may only pay dividends in Swiss francs. The

payment of dividends is limited to certain amounts of unappropriated retained earnings ($269.7 million at

March 31, 2006) and is subject to shareholder approval. The Company will recommend to its shareholders that

no cash dividends be paid in 2006.

Under Swiss corporate law, a minimum of 5% of the Company’s annual net income must be retained in a

legal reserve until this legal reserve equals 20% of the Company’s issued and outstanding aggregate par value per

share capital. These legal reserves represent an appropriation of retained earnings that are not available for

distribution and totaled $7.3 million at March 31, 2006.

Additionally, under Swiss corporate law, the Company is required to establish a reserve equal to the amount

of treasury shares repurchased at year-end. The reserve for treasury shares, which is not available for distribution,

totaled $182.9 million at March 31, 2006.

In June 2005, the Company announced the approval by its board of directors of a new buyback program of

up to CHF 300.0 million (approximately $235.0 million based on exchange rates at the date of announcement).

The program expires at the Company’s 2008 Annual General Meeting at the latest. Under this program, the

Company repurchased 4.2 million shares for $174.6 million during the year ended March 31, 2006. The approved

amount remaining under this program at March 31, 2006 is CHF 76.1 million ($58.3 million based on exchange

rate at March 31, 2006).

F-16