Logitech 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

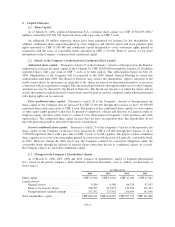

During the same periods, changes made to the Company’s authorized and conditional share capital were as

follows:

As of March 31,

2006 2005 2004 2003

Authorized share capital ........................ CHF10,000 CHF10,000 CHF10,000 CHF10,000

First conditional share capital ................... CHF15,165 CHF15,165 CHF15,165 CHF15,165

Second conditional share capital ................. CHF 2,725 CHF 2,725 CHF 2,725 CHF 2,725

For information on changes in Logitech’s consolidated shareholders’ equity during fiscal years 2006, 2005

and 2004, refer to the Consolidated Statement of Changes in Shareholders’ Equity on page F-6.

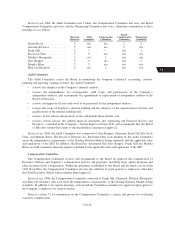

During fiscal years 2006, 2005 and 2004, the Company repurchased shares under buyback programs

authorized by the Board of Directors as follows (in thousands):

Date of

Announcement

Approved

Buyback

Amount

Equivalent

USD

Amount(1)

Expiration

Date

Amount Repurchased During Year Ended March 31,(2)

Program to date 2006 2005 2004

Shares Amount Shares Amount Shares Amount Shares Amount

June 2005 ....... CHF300,000 $235,000 June 2008 4,201 $174,613 4,201 $174,613 — $ — — $ —

April 2004 ...... CHF250,000 $200,000 June 2006 7,487 $201,264 1,937 $ 66,739 5,550 $134,525 — $ —

October 2003 .... CHF 40,000 $ 32,090 March 2004 1,330 $ 32,090 — $ — — $ — 1,330 $32,090

(1) Represents the approved buyback amount in U.S. dollars, calculated based on exchange rates on the announcement dates.

(2) Represents the amount in U.S. dollars, calculated based on exchange rates on the repurchase dates.

2.4 Share Categories

Registered Shares. Logitech International S.A. has only one category of shares – registered shares with a

par value of CHF .5 per share. Each of the 95,803,310 issued registered shares carries the same rights. There are

no preferential rights. However, a shareholder must be entered in the share register of the Company to exercise

voting rights and the rights deriving thereof (such as the right to convene a general meeting of shareholders or the

right to put an item on the meeting’s agenda). Refer to section 6 for an outline of participation rights of the

Company’s shareholders. Refer to section 1.1 and “Logitech ADSs” below for information on Logitech’s ADR

program.

Each registered share entitles its owner to dividends declared, even if the owner is not registered in the share

register of the Company. Under Swiss law, the Company pays dividends upon approval by its shareholders. This

request for shareholder approval typically follows the recommendation of the Board. Although Logitech has paid

dividends in the past, the Board of Directors announced in 1997 its intention not to recommend payment of cash

dividends in the future in order to retain earnings for use in the operation and expansion of Logitech’s business.

Unless this right is restricted in compliance with Swiss law and the Company’s Articles of Incorporation,

shareholders have the right to subscribe by preference for newly issued shares. Refer to section 2.2 for a

description of the provisions of the Company’s Articles of Incorporation relating to the restriction of the

shareholders’ preferential subscription rights.

The Company has not issued non-voting shares (“bons de participation,” “Partizipationsscheine”).

Logitech ADSs. Through an arrangement with The Bank of New York, as depositary, Logitech American

Depository Shares, or ADSs, trade on the Nasdaq National Market. Each ADS represents one Logitech registered

share. The ADSs are issued by The Bank of New York pursuant to a Deposit Agreement, dated March 27, 1997,

as amended, between Logitech, The Bank of New York, as depositary, and owners and beneficial owners of

ADS. The Deposit Agreement governs the rights of holders of Logitech ADSs and has the effect of giving

CG-5

20-F

LISA