Logitech 2006 Annual Report Download - page 158

Download and view the complete annual report

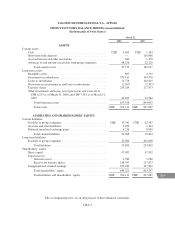

Please find page 158 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LOGITECH INTERNATIONAL S.A., APPLES

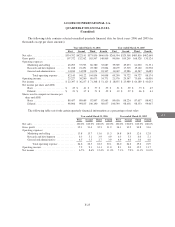

NOTES TO SWISS STATUTORY FINANCIAL STATEMENTS—(Continued)

In June 2005, the Board of Directors authorized the repurchase of up to CHF 300,000,000 of the Holding

Company’s registered shares/ADSs. This program expires at the Company’s 2008 Annual General Meeting. At

March 31, 2006, the Company had repurchased 4,200,500 registered shares for approximately CHF 223,760,000.

Treasury shares are recorded as a long-term asset at the lower of cost or market value. The disposal of

treasury shares during the period was to the Company’s directors and employees under the Holding Company’s

share option and share purchase plans as well as for the conversion of one subsidiary’s convertible debt. The gain

or loss on the disposal of repurchased treasury shares is recorded in the statement of income.

Note 5 — Authorized and Conditional Share Capital Increases:

Share split

In June 2005, the Company’s shareholders approved a two-for-one share split whereby one share with a par

value of CHF 1 was converted into two shares with a par value of CHF 0.50 per share. All references to the

number of shares have been adjusted to reflect the effect of the share split undertaken by the Holding Company.

Authorized capital

In June 2004, the Company’s shareholders renewed their approval of 20,000,000 authorized registered

shares for use in acquisitions, mergers and other similar transactions, valid through the period ending June 2006.

Conditional capital

In June 1996 and June 1995, the Company’s shareholders approved the availability of 16,000,000 and

12,000,000 conditional registered shares. In June 2002, the shareholders approved the continued availability of

the aforementioned amounts and approved an additional 12,000,000 conditional registered shares. The remaining

number of conditional registered shares at March 31, 2006 was 30,330,930, which are available for issuance

upon the exercise of employee stock options and the issuance of shares under the Company’s employee share

purchase plans. During fiscal years 2006 and 2005, no shares were issued from the aforementioned amounts of

conditional shares available. In fiscal years 2006 and 2005, all stock options and purchase plan commitments

were satisfied from treasury shares held by the Holding Company.

In addition to the aforementioned, the shareholders in June 2001 approved the creation of an additional

5,450,000 conditional registered shares to cover the conversion rights associated with the issue of a convertible

bond by Logitech Jersey Ltd, a subsidiary of the Holding Company. As at March 31, 2006, none of the

aforementioned conditional registered shares had been issued.

Note 6 — Significant Shareholders:

The Holding Company’s share capital consists of registered shares. To the knowledge of the Holding

Company, the only beneficial owner holding more than 5% of the voting rights of the Holding Company at

March 31, 2006 is Mr. Daniel Borel, a founder of the Company and its Chairman of the Board, who holds

6,120,000 shares or approximately 6.38%.

LISA-6