Logitech 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

balances, resulting from significantly higher sales in fiscal year 2006 and an increase in DSO. Although partially

offset by higher collections, accounts receivable increased to $289.8 million at March 31, 2006, compared with

$229.2 million last year. In addition, the Company increased its inventory levels and purchases to respond to the

sales increases in fiscal year 2006. At March 31, 2006, inventory was $196.9 million compared with $176.0

million at March 31, 2005. The increase was predominantly in finished goods, intended to ensure sufficient

supply on hand to meet demand. Increased operating expenses also affected cash flow from operating activities

in fiscal year 2006. The Company invested in additional personnel, marketing and product initiatives, and

infrastructure improvements to support the expanding sales base.

The Company’s operating activities generated net cash of $213.7 million during fiscal year 2005 compared

with $166.5 million in the prior year. The increase in cash flow generated from operations was due to higher

sales and better management of outstanding receivables. Also contributing to improved cash from operations

were refunds for value-added taxes from the Chinese government related to certain calendar year 2003 claims.

Partially offsetting the increase in cash flow from operations was increased spending for inventory purchases and

for operating expenses. The increase in inventory in fiscal year 2005 reflected the Company’s anticipation of

product demand by key retail accounts and raw material buffer stock required to manage shortages or

interruptions in component supplies. Also, cash flows from operations were impacted by increased operating

expenses, which included higher personnel costs, spending for marketing and product development initiatives

and investments in infrastructure improvements.

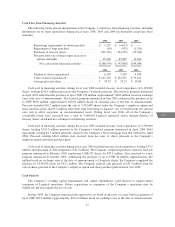

Cash Flow from Investing Activities

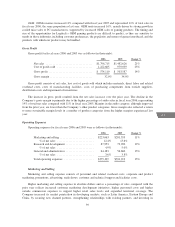

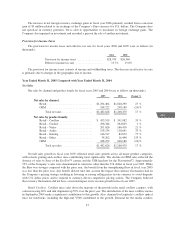

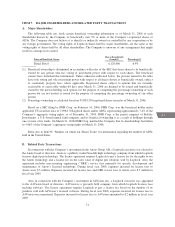

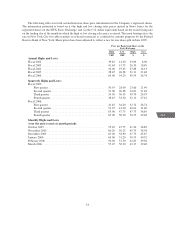

Cash flows from investing activities during fiscal years 2006, 2005 and 2004 were as follows (in thousands):

2006 2005 2004

Purchases of property, plant and equipment ......... $(54,102) $(40,541) $(24,718)

Acquisitions and investments, net of cash acquired .... 860 (30,494) (15,490)

Premium paid on cash surrender value of life insurance

policies .................................... (1,464) — —

Net cash used in investing activities ........... $(54,706) $(71,035) $(40,208)

During fiscal year 2006, the Company’s purchases of property, plant and equipment were primarily for

construction of the new factory in Suzhou, China, information system upgrades, and normal expenditures for

tooling. The Company also invested participant deferrals of $1.5 million from its management deferred

compensation plan in life insurance contracts. In addition, the Company received proceeds from the sale of an

investment.

The Company’s purchases of property, plant and equipment in fiscal year 2005 were primarily normal

expenditures for tooling costs, machinery and equipment, and computer equipment and software. Capital

expenditures also included the cost of information system upgrades and construction of a new factory in Suzhou,

China. In connection with the acquisition of Intrigue Technologies in May 2004, the Company paid net cash of

$29.8 million, acquiring all of Intrigue’s outstanding shares. Also, the Company made other equity investments

of $.6 million, primarily for funding in A4Vision, Inc., a privately held company from which Logitech licenses

face tracking software used in its PC webcams.

During the year ended March 31, 2004, the Company used cash of $24.7 million to acquire property, plant

and equipment, primarily for tooling and computer equipment purchases. Also, the Company used cash of

$15.5 million to invest in two technology companies, $15.1 million of which was invested in the Anoto Group

AB, a Swedish high technology company from which Logitech licenses digital pen technology.

46