Logitech 2006 Annual Report Download - page 38

Download and view the complete annual report

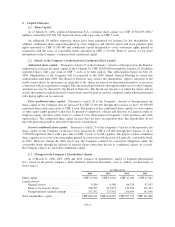

Please find page 38 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.holders of ADSs the same economic and voting interest in Logitech as if they were a holder of Logitech

registered shares. However, because The Bank of New York actually owns the Logitech registered shares

underlying the Logitech ADSs, ADS holders must rely on The Bank of New York to exercise the rights of a

shareholder by instructing the depositary in writing the manner in which they wish to vote or exercise their rights

as shareholders. The depositary, subject to Swiss laws and the Company’s Articles of Incorporation, is required

to vote or exercise such rights as instructed. Each ADS entitles its owner to dividends declared, if any, in respect

of Logitech registered shares underlying the ADSs, subject to the terms of the Deposit Agreement. Any cash

dividends by Logitech to its shareholders paid in Swiss francs will be converted by the depositary to U.S. dollars

and paid by the depositary to holders of ADSs, net of conversion expenses, and in accordance with the Deposit

Agreement. As of March 31, 2006, according to the records of The Bank of New York, approximately

17,132,636 ADSs were outstanding in the United States.

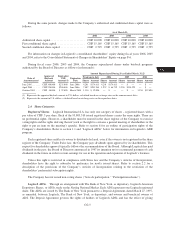

2.5 Bonus Certificates

The Company has not issued certificates or equity securities that provide financial rights in consideration for

services rendered or claims waived (referred to as “bonus certificates,” “bons de jouissance,” or

“Genussscheine”).

2.6 Limitations on Transferability and Nominee Registration

The Company maintains a share register that lists the names of the registered owners and beneficiaries of

the shares. Registration in the Company’s share register occurs upon request and is not subject to any condition.

Shareholders can be entered into the share register with voting rights even if they are holding their shares for the

account of a third party (nominee registration).

Refer to section 6.1 for the conditions of exercise of the shareholders’ voting rights.

2.7 Conversion and Option Rights

Conversion Rights. In June 2001, Logitech issued through its wholly owned subsidiary Logitech (Jersey)

Ltd. CHF 170.0 million ($95.6 million based on exchange rates at date of issuance) aggregate principal amount

of its 1% convertible bonds. The convertible bonds were issued in denominations of CHF 5,000 at par value, with

interest at 1.00% payable annually, and final redemption in June 2006 at 105%, representing a yield to maturity

of 1.96%. On August 31, 2005, the Company exercised its right to call the convertible bonds for early

redemption in accordance with the terms of the bonds. As of November 11, 2005, all outstanding bonds had been

presented for conversion into 5,448,693 Logitech registered shares at the conversion price of CHF 31.20 per

share ($23.72 based on exchange rates at November 11, 2005). The conversion was satisfied through delivery of

treasury shares.

Logitech has not issued any other bonds.

Warrants. Logitech has not issued warrants on its shares.

Employee Stock Options and Stock Purchase Plans. Logitech believes equity compensation is an

important part of attracting and retaining high-caliber employees and of aligning the interests of management and

the directors of the Company with the interests of the shareholders. Accordingly, Logitech maintains stock

purchase and stock option plans for its employees.

Under the 1996 Stock Plan, the Company may grant to employees and directors, options to purchase

registered shares or ADSs, restricted shares, stock appreciation rights, and stock units, which are bookkeeping

entries representing the equivalent of shares. A total of 38,000,000 registered shares and/or ADSs may be issued

under this plan. Options generally vest over four years and remain outstanding for periods not to exceed ten

years. Options may be granted only at exercise prices of at least 100% of the fair market value of the registered

CG-6