Logitech 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

This Annual Report on Form 20-F to shareholders contains forward-looking statements that involve risks

and uncertainties. The Company’s actual results could differ materially from those anticipated in these

statements as a result of certain factors, including those set forth above in Item 3D “Risk Factors,” and below in

Item 11 “Quantitative and Qualitative Disclosure about Market Risk.”

Overview

Logitech is a leading global technology company and earns revenues and profits from the sale of personal

peripherals that serve as the primary physical interface between people and their personal computers and other

digital platforms. For the PC, the Company’s products include mice, trackballs, keyboards, gaming controllers,

multimedia speakers, headsets and webcams. For digital music devices, the Company’s products include

speakers and headphones. For gaming consoles, the Company offers a range of controllers, audio products and

other accessories. In addition, Logitech offers wireless music solutions for the home and advanced remote

controls for home entertainment systems. Logitech also offers digital writing solutions, 3D control devices, and

headphones for mobile phones. The Company sells its products to both original equipment manufacturers

(“OEMs”) and to a network of distributors and resellers (“retail”).

The Company’s markets are extremely competitive. Some of our competitors are well established with

substantial resources, others are less established and compete at lower price points. These markets are

characterized by aggressive promotional and pricing practices, short product life cycles, rapidly changing

technology and evolving customer demands. In order to remain competitive, continued investment in product

research and development is critical to driving innovation with new and improved products and technologies.

Logitech is committed to meeting customer needs for personal peripheral devices and believes innovation and

product quality are important elements to gaining market acceptance and strengthening market leadership. The

Company has historically targeted peripherals for the PC platform, a market that is dynamically changing as a

result of consumer trends toward notebooks. Logitech remains focused on strengthening its market leadership in

the PC market with the introduction of products that support the continued growth of the notebook market

segment. The Company has also expanded into peripherals for other platforms, including video game consoles,

mobile phones, home entertainment systems and most recently, mobile entertainment and digital music systems.

Over the last several years, Logitech has laid a foundation for long-term growth, expanding and improving

its supply chain operations, investing in product development and marketing, delivering innovative new products

and pursuing new market opportunities beyond the PC platform. During this time, the Company has significantly

broadened its product offerings and the markets in which it sells them. Although most of this expansion has been

organic, the Company’s business has also grown as a result of a limited number of acquisitions that have

expanded the Company’s business into new product categories.

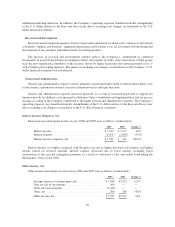

In fiscal year 2006, revenues increased 21% to $1.8 billion and net income increased 21% to $181.1 million

reflecting the results of the Company’s continued investment in new product categories and diversification of the

existing product portfolio. Audio and video retail sales were the key growth categories contributing to the

Company’s fiscal 2006 financial performance and are expected to continue driving growth in the near term. Sales

of advanced remote controls have contributed to the increased revenue and present growth potential for the

future.

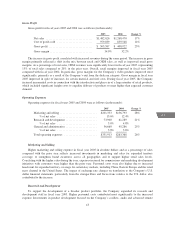

The Company’s focus in fiscal year 2007 is to capture the growth opportunities in the business and improve

profitability. Audio, video and advanced remote controls will continue to be the key growth drivers. Cordless

desktops and mice are also expected to return the cordless category to solid growth as a result of focused product

and marketing initiatives. New products to be launched later in fiscal year 2007, particularly in the speaker and

cordless categories, are expected to carry higher margins than the products replaced as a result of the Company’s

product development efforts. Further, Logitech is investing in business applications and information technology

upgrades. These investments are necessary to position Logitech for future growth by improving operational and

33

CG

LISA