Logitech 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

appreciation of the CNY, the Company has transferred a portion of its cash investments to CNY accounts. At

March 31, 2006, net assets held in CNY totaled $100.2 million. While the revaluation continues to limit the CNY

to float within a narrow percentage band each day, the Company believes that the change to a more flexible

system based on a basket of foreign currencies could lead to a further, gradual rise in the CNY’s value.

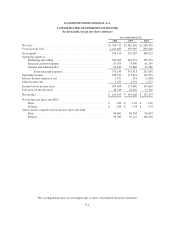

From time to time, the Company enters into foreign exchange forward contracts to hedge against exposure

to changes in foreign currency exchange rates related to forecasted inventory purchases by subsidiaries. These

forward contracts are denominated in the same currency as the underlying transactions. The Company does not

use derivative financial instruments for trading or speculative purposes. As of March 31, 2006, the notional

amounts of foreign exchange forward contracts outstanding for forecasted inventory purchases were

$13.6 million. These forward contracts generally mature within three months. Deferred realized gains totaled

$.2 million at March 31, 2006 and are expected to be reclassified to cost of goods sold when the related inventory

is sold. If the U.S. dollar had appreciated by 10% as compared with the hedged foreign currency, an unrealized

gain of $1.3 million in the foreign exchange forward contract portfolio would have occurred. If the U.S. dollar

had depreciated by 10% as compared with the hedged foreign currency, a $1.4 million unrealized loss in the

foreign exchange forward contract portfolio would have occurred.

Interest Rates

Changes in interest rates could impact the Company’s anticipated interest income on its cash equivalents

and interest expense on variable rate short-term debt. The Company analyzed its interest rate exposures to assess

the impact of hypothetical changes in interest rates. Based on the results of these analyses, a 100 basis point

decrease or increase in interest rates from the March 31, 2006 and March 31, 2005 period end rates would not

have a material effect on the Company’s results of operations or cash flows.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Not applicable.

59

CG

LISA