Logitech 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

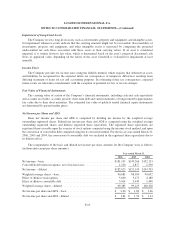

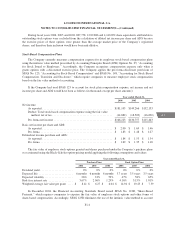

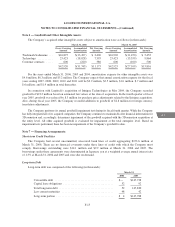

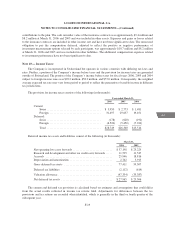

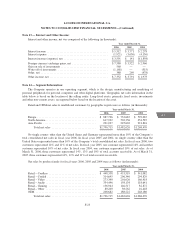

The total purchase price was allocated to the fair values of assets acquired and liabilities assumed as follows

(in thousands):

Tangible assets acquired ............................................... $ 3,410

Intangible assets acquired:

Database ....................................................... 5,700

Technology ..................................................... 2,400

Trademark/trade name ............................................ 900

Customer contracts ............................................... 600

Goodwill ....................................................... 23,163

36,173

Liabilities assumed ................................................... (2,339)

Deferred tax liability related to intangible assets acquired .................... (1,734)

Transaction costs .................................................... (1,550)

Total consideration ............................................... $30,550

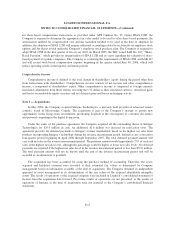

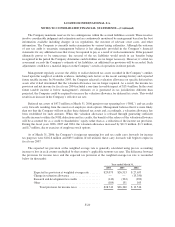

The acquired database consists of various proprietary databases developed by Intrigue, including its device

and infrared database, which support infrared-controlled devices made by manufacturers. The acquired

technology relates to developed software used in Intrigue’s line of advanced remote controls. Trademark/trade

name relates to the Harmony brand name under which the remote controls are sold and which Logitech has

continued to use in its product portfolio. Customer contracts relate to certain existing relationships with

distributors through established contracts. The value of the database, acquired technology and trademark/trade

name were determined using the royalty savings approach, which estimates the value of the assets by capitalizing

the royalties saved as a result of acquiring the assets. The value of the customer contracts was determined using

the cost savings approach, which estimates the amount saved by the Company as a result of acquiring the asset.

The acquired intangible assets are amortized on a straight-line basis over their estimated useful lives. The

database is being amortized over an estimated useful life of ten years and all other acquired intangible assets are

being amortized over estimated useful lives of five years. Goodwill associated with the acquisition is not subject

to amortization and is not expected to be deductible for income tax purposes.

Note 4 — Investments:

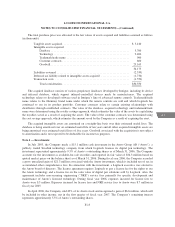

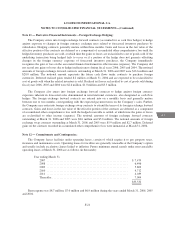

In July 2003, the Company made a $15.1 million cash investment in the Anoto Group AB (“Anoto”), a

publicly traded Swedish technology company from which Logitech licenses its digital pen technology. The

investment represented approximately 9.5% of Anoto’s outstanding shares as of March 31, 2006. The Company

accounts for the investment as available-for-sale securities and reported its fair value of $36.3 million based on

quoted market prices on the balance sheet as of March 31, 2006. During fiscal year 2006, the Company recorded

a gross unrealized gain of $21.3 million associated with the Anoto investment, which is included net of tax in

accumulated other comprehensive loss. In connection with the investment, a Logitech executive was elected to

the Anoto board of directors. The license agreement requires Logitech to pay a license fee for the rights to use

the Anoto technology and a license fee on the sales value of digital pen solutions sold by Logitech. Also, the

agreement includes non-recurring engineering (“NRE”) service fees primarily for specific development and

maintenance of Anoto’s licensed technology. During fiscal year 2006, expenses incurred for license fees to

Anoto were $.5 million. Expenses incurred for license fees and NRE service fees to Anoto were $.7 million in

fiscal year 2005.

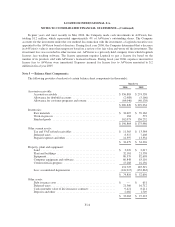

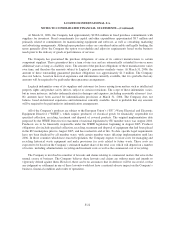

In April 2006, the Company sold 42% of its Anoto stock and recognized a gain of $6.6 million, which will

be included in other income, net in the first quarter of fiscal year 2007. The Company’s remaining interest

represents approximately 5.5% of Anoto’s outstanding shares.

F-13

CG

LISA