Logitech 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

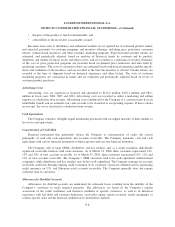

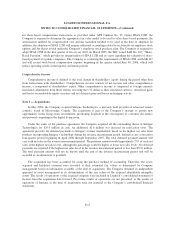

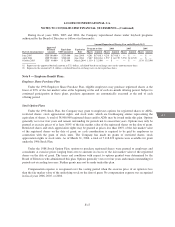

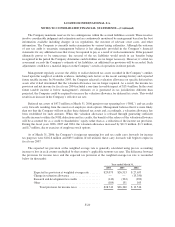

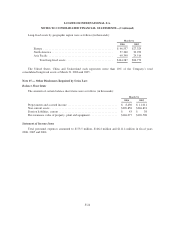

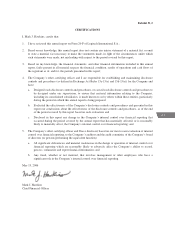

A summary of activity under the stock option plans is as follows (exercise prices are weighted averages):

Year ended March 31,

2006 2005 2004

Number

Exercise

Price Number

Exercise

Price Number

Exercise

Price

Outstanding, beginning of

year ..................... 12,948,662 $16 14,328,196 $13 15,474,272 $11

Granted .................... 1,725,735 $38 2,593,460 $24 2,499,760 $17

Exercised .................. (3,238,116) $13 (3,657,356) $11 (3,155,288) $ 8

Cancelled or expired .......... (632,309) $20 (315,638) $18 (490,548) $17

Outstanding, end of year ....... 10,803,972 $19 12,948,662 $16 14,328,196 $13

Exercisable, end of year ....... 5,254,909 $14 5,561,180 $13 6,583,468 $10

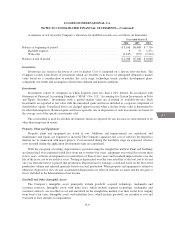

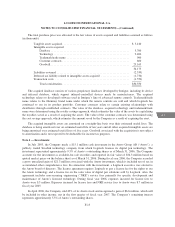

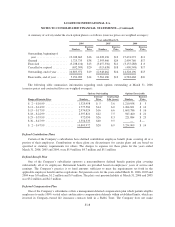

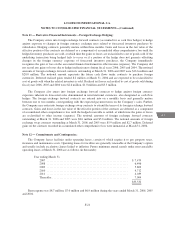

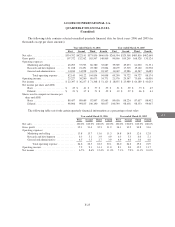

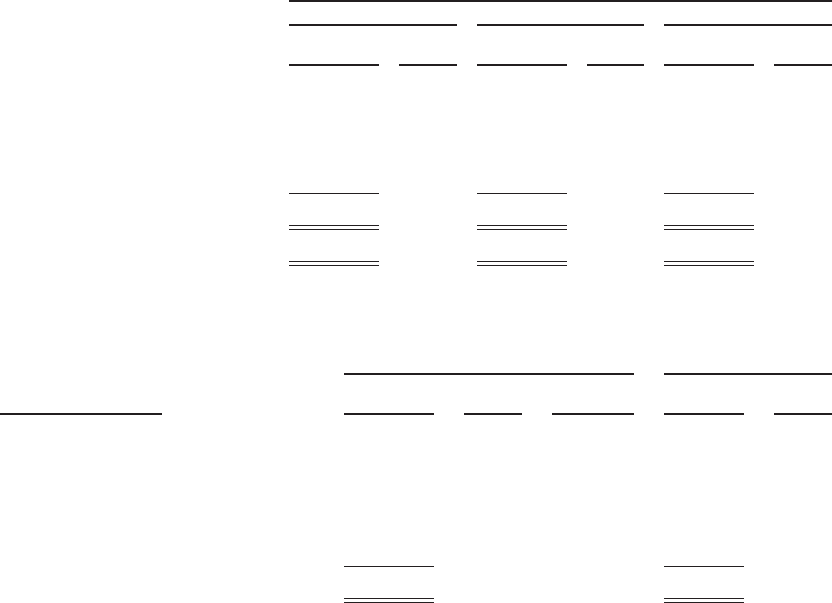

The following table summarizes information regarding stock options outstanding at March 31, 2006

(exercise prices and contractual lives are weighted averages):

Options Outstanding Options Exercisable

Range of Exercise Price Number

Exercise

Price

Contractual

Life (years) Number

Exercise

Price

$ 2–$10.99 ................... 1,325,958 $ 5 3.6 1,210,958 $ 5

$11–$14.99 ................... 1,777,584 $14 6.0 1,264,821 $ 14

$15–$17.99 ................... 2,974,024 $16 6.6 1,609,786 $ 16

$18–$22.99 ................... 2,397,821 $22 7.5 947,460 $ 21

$23–$35.99 ................... 972,050 $26 8.3 221,884 $ 25

$36–$47.99 ................... 1,356,535 $40 9.5 — $ —

$ 2–$47.99 ................... 10,803,972 $20 6.9 5,254,909 $ 14

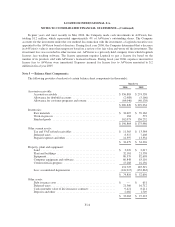

Defined Contribution Plans

Certain of the Company’s subsidiaries have defined contribution employee benefit plans covering all or a

portion of their employees. Contributions to these plans are discretionary for certain plans and are based on

specified or statutory requirements for others. The charges to expense for these plans for the years ended

March 31, 2006, 2005 and 2004, were $5.9 million, $4.7 million and $5.1 million.

Defined Benefit Plan

One of the Company’s subsidiaries sponsors a noncontributory defined benefit pension plan covering

substantially all of its employees. Retirement benefits are provided based on employees’ years of service and

earnings. The Company’s practice is to fund amounts sufficient to meet the requirements set forth in the

applicable employee benefit and tax regulations. Net pension costs for the years ended March 31, 2006, 2005 and

2004 were $.8 million, $1.2 million and $.9 million. The plan’s net pension liability at March 31, 2006 and 2005

was $3.2 million and $2.5 million.

Deferred Compensation Plan

One of the Company’s subsidiaries offers a management deferred compensation plan which permits eligible

employees to make 100%-vested salary and incentive compensation deferrals within established limits, which are

invested in Company-owned life insurance contracts held in a Rabbi Trust. The Company does not make

F-18