Logitech 2006 Annual Report Download - page 96

Download and view the complete annual report

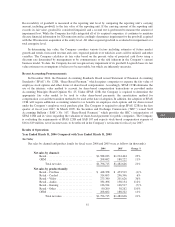

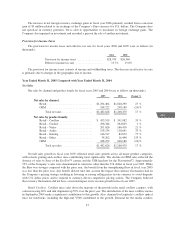

Please find page 96 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Logitech’s cordless and corded product families include the Company’s mice, trackballs, keyboards and

desktops; video is comprised of PC webcams; audio includes multimedia speakers and headset products for the

PC, and mobile entertainment and communication platforms; gaming includes console and PC peripherals; and

other is primarily comprised of the Company’s advanced remote control, as well as 3D input device offerings.

Net sales in fiscal year 2006 increased significantly from the prior year due to continued growth in demand

for the Company’s retail and OEM products. Retail sales growth was largely attributable to strong demand for

the audio product line and increased demand for video and remote control products. OEM sales also returned to

growth due to increased demand for mice. Approximately 50% of the Company’s sales were denominated in

currencies other than the U.S. dollar in fiscal year 2006.

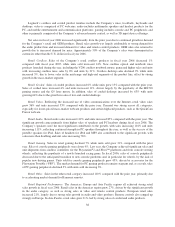

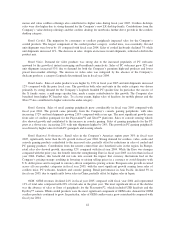

Retail Cordless. Sales of the Company’s retail cordless products in fiscal year 2006 decreased 1%

compared with fiscal year 2005, while units sold increased 14%. New cordless optical and notebook mice

products launched during the year, including the V200 cordless notebook mouse, generated higher sales and units

sold, increasing cordless mice sales by 8% and units by 21%. Cordless desktop sales declined 9% while units

increased 5%, due to lower sales in the mid-range and high-end segments of the product line, offset by strong

growth in the mass-market segment.

Retail Corded. Sales of corded products increased 6% while units grew 13% compared with the prior year.

Sales of corded mice increased 4% and units increased 11%, driven largely by the popularity of the MX518

gaming mouse and the G5 laser mouse. In addition, sales of corded desktops increased by 63% with units

growing 64% due to the growth in sales of low-end corded desktops.

Retail Video. Reflecting the increased use of video communications over the Internet, retail video sales

grew 36% and units increased 53% compared with the prior year. Demand was strong across all categories,

especially for lower-priced mass-market webcam products and certain high-end products, such as the QuickCam

Fusion webcam.

Retail Audio. Retail audio sales increased 112% and units increased 85% compared with the prior year. The

significant growth came primarily from higher sales of speakers and PC headsets during fiscal year 2006. The

Company’s speakers were the most significant contributors to the growth, with sales increasing 116% and units

increasing 111%, reflecting continued strength in PC speakers throughout the year, as well as the success of the

portable speakers for iPod. Sales of headsets for iPod and MP3 also contributed to the significant growth, with

sales more than doubling and unit sales increasing 76%.

Retail Gaming. Sales in retail gaming declined 7% while units sold grew 21% compared with the prior

year. Sales of console gaming peripherals were down 9%. Last year, the Company achieved significant sales and

unit shipments from cordless controllers for the Playstation®2 and Xbox™ platforms and from console steering

wheels, reflecting the popularity of a newly-launched racing game. In fiscal 2006, sales of console peripherals

decreased due to the anticipated transition to new console platforms and, in particular for wheels, by the lack of

popular new driving games. Units sold for console gaming peripherals grew 45%, driven by accessories for the

Playstation Portable (“PSP”). The market demand for PC gaming products remains stagnant and, as a result, sales

of PC gaming peripherals declined 3% with units sold decreasing 3%.

Retail Other. Sales in the other retail category increased 110% compared with the prior year, primarily due

to accelerating market demand for Harmony remotes.

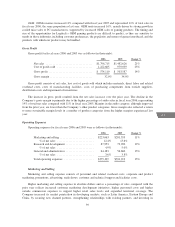

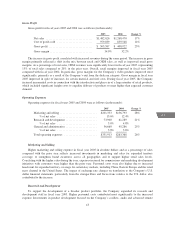

Retail Regional Performance. The Americas, Europe and Asia Pacific regions all achieved strong retail

sales growth in fiscal year 2006. Retail sales in the Americas region grew 27%, driven by the significant growth

in the audio category, as well as strong sales in video and remote control products. European retail sales

increased 21%, largely due to strong sales growth in audio and video products. Remote controls also ramped up

strongly in Europe. In Asia Pacific, retail sales grew 21%, led by strong sales of corded and audio products.

38