Logitech 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

A. Major Shareholders

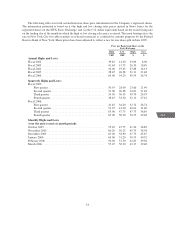

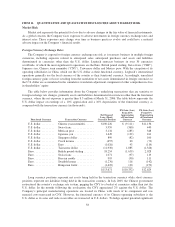

The following table sets forth certain beneficial ownership information as of March 31, 2006 of each

shareholder known by the Company to beneficially own 5% or more of the Company’s registered shares or

ADSs. The Company does not believe it is directly or indirectly owned or controlled by any corporation or by

any foreign government. The voting rights of Logitech shares held by major shareholders are the same as the

voting rights of shares held by all other shareholders. The Company is unaware of any arrangement that might

result in a change in its control.

Name of Beneficial Owner

Shares Beneficially

Owned(1) Percentage(2)

DanielBorel .................................... 6,120,000 6.4%

(1) Beneficial ownership is determined in accordance with rules of the SEC that deem shares to be beneficially

owned by any person who has voting or investment power with respect to such shares. The beneficial

owners have furnished this information. Unless otherwise indicated below, the persons named in the table

have sole voting and sole investment power with respect to all shares shown as beneficially owned, subject

to community property laws where applicable. Registered shares subject to options that are currently

exercisable or exercisable within 60 days after March 31, 2006 are deemed to be issued and beneficially

owned by the person holding such options for the purpose of computing the percentage ownership of such

person but are not treated as issued for the purpose of computing the percentage ownership of any other

person.

(2) Percentage ownership is calculated based on 95,803,310 registered shares issued as of March 31, 2006.

Based on a SEC filing by FMR Corp. on February 14, 2006, FMR Corp. was the beneficial holder under

applicable US securities laws of 7,098,170 Logitech shares and/or ADSs, representing approximately 7.4% of the

Company’s aggregate voting rights, as of December 31, 2005. FMR Corp. is the parent company of Fidelity

Investments, a U.S.-based mutual fund company, and its beneficial ownership is as a result of holdings through

one or more of its funds. On March 21, 2006 FMR Corp. notified the Company that its shareholdings had fallen

to 4.96% of the Company’s aggregate voting rights on March 15, 2006.

Refer also to Item 9C “Markets on which our Shares Trade” for information regarding the number of ADSs

held in the United States.

B. Related Party Transactions

In connection with the Company’s investment in the Anoto Group AB, a Logitech executive was elected to

the Anoto board of directors. Anoto is a publicly traded Swedish high technology company from which Logitech

licenses digital pen technology. The license agreement requires Logitech to pay a license fee for the rights to use

the Anoto technology and a license fee on the sales value of digital pen solutions sold by Logitech. Also, the

agreement includes non-recurring engineering (“NRE”) service fees primarily for specific development and

maintenance of Anoto’s licensed technology. During fiscal year 2006, expenses incurred for license fees to

Anoto were $.5 million. Expenses incurred for license fees and NRE service fees to Anoto were $.7 million in

fiscal year 2005.

Also, in connection with the Company’s investment in A4Vision, Inc. a Logitech executive was appointed

to the A4Vision board of directors. A4Vision is a privately held company from which Logitech licenses face

tracking software. The license agreement requires Logitech to pay a license fee based on the number of its

products sold with A4Vision’s licensed software. During fiscal year 2006, expenses incurred for license fees to

A4Vision were immaterial. Expenses incurred for license fees to A4Vision amounted to $.2 million in fiscal year

2005.

51

CG

LISA