Food Lion 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

Information about significant areas of estimation uncertainty and critical judgments in applying accounting policies that have the most signifi-

cant effect on the amounts in the consolidated financial statements is included in, but not limited to, the following notes:

t/PUF*EFOUJGJDBUJPOBOEBHHSFHBUJPOPGPQFSBUJOHTFHNFOUT

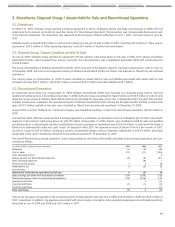

t/PUFT%JTQPTBM(SPVQ$MBTTJGJFEBT)FMEGPS4BMFBOE%JTDPOUJOVFE0QFSBUJPOT

t/PUFT"TTFTTJOHBTTFUTGPSJNQBJSNFOUBOEGBJSWBMVFTPGGJOBODJBMJOTUSVNFOUT

t/PUFT"DDPVOUJOHGPSWFOEPSBMMPXBODFT

t/PUF$MBTTJGJDBUJPOPGMFBTFT

t/PUF1SPWJTJPOT

t/PUF&NQMPZFF#FOFGJUT

t/PUF*ODPNF5BYFT

2.5. Standards and Interpretations Issued but not yet Effective

The following standards, amendments to or revisions of existing standards or interpretations have been published and are mandatory for the

Group’s accounting periods beginning on January 1, 2010 or later periods, but Delhaize Group has not early adopted them:

tImprovements to IFRS (applicable for annual periods beginning on or after January 1, 2010): In April 2009, the IASB issued the second final

omnibus annual improvements standard, containing 15 changes to 12 IASB pronouncements. Except as described in Note 2.2, Delhaize

Group has not adopted any of the remaining amendments and clarifications, but has reviewed them and concluded that they would have

no impact on the consolidated financial statements.

t"NFOENFOUTUP*'34 Group Cash-settled Share-based Payment Transactions (applicable for annual periods beginning on or after

January 1, 2010): The amendment clarifies the scope of IFRS 2 Share-based Payment and incorporates IFRIC 8 Scope of IFRS 2 and IFRIC

11 Group and Treasury Share Transactions into IFRS 2, which subsequently have both been withdrawn. The amendment further clarifies

when a share-based payment needs to be considered as an equity settled and when as cash settled share based payment. Delhaize Group

reviewed the revised requirements and concluded that based on its current stock option plans, the amendment will have no impact on its

consolidated financial statements.

t3FWJTFE*'34Business Combinations (applicable to business combinations for which the acquisition date is on or after the beginning of the

first annual reporting period beginning on or after July 1, 2009): While the revised IFRS 3 continues to apply the purchase accounting method,

now referred to as acquisition method, it introduces a number of changes in the accounting for business combinations that will impact the

amount of goodwill recognized, the reported results in the period of the acquisition and future results. Delhaize Group will apply the revised

IFRS 3 prospectively for business combinations taking place after January 1, 2010.

t3FWJTFE*"4Related Party Disclosures (applicable for annual periods beginning on or after January 1, 2011): The revised IAS 24 clarifies

and simplifies the definition of a related party, without reconsidering the fundamental approach to related party disclosures. The revised

standard also provides some relief for government-related entities (as defined in the revised standard) to disclose details of all transactions

with other government-related entities (as well as with the government itself). The Group is currently in the process of carefully assessing if

the revised guidance has any impact on Delhaize Group’s related party disclosure as included at present in Note 32.

t"NFOENFOU UP *"4 Consolidated and Separate Financial Statements (applicable for annual periods beginning on or after July 1,

2009): The revised IAS 27 requires that changes in the ownership interest of a subsidiary (without loss of control) is accounted as an equity

transaction and will therefore not result in goodwill or gains any longer. Furthermore, the amended standard changes the accounting for

losses incurred by the subsidiary as well as the loss of control of a subsidiary. Delhaize Group will apply the revised standard prospectively

to transactions with non-controlling interests from January 1, 2010 and will have to change prospectively its current accounting policy in this

respect, as the Group is currently applying the so-called “parent entity extension” method.

t"NFOENFOUTUP*"4Classification of Rights Issues (applicable for annual periods beginning on or after February 1, 2010): In October

2009, the IASB amended IAS 32 in that way that foreign currency rights issues are now required to be treated as equity transactions, provided

the offer is made pro-rata to all existing owners of the same class of the entity’s own non-derivative equity instruments. Delhaize Group is

currently analyzing the revised guidance and is in the process of reviewing past capital transactions in order to assess the potential impact

the amendment might have on its consolidated financial statements, if any.

t"NFOENFOUTUP*"4Eligible Hedged Items (applicable for annual periods beginning on or after July 1, 2009): The amendment addresses

the designation of a one-sided risk in a hedged item, and the designation of inflation as a hedged risk or portion in particular situations. The

Group has investigated the amendments and concluded that they will have no impact on the financial position or performance of the Group,

as the Group has not entered into any such transactions.

t*'34Financial Instruments (applicable for annual periods beginning on or after January 1, 2013): On November 12, 2009, the IASB published

the first part of IFRS 9, the accounting standard that will eventually replace IAS 39 Financial Instruments: Recognition and Measurement.

The revised guidance included in IFRS 9 relates to classification and measurement of financial assets alone and applies a “business model”

and “characteristics of the financial asset” test to assess if, after initial recognition at fair value, a financial asset is subsequently measured

at amortized cost or at fair value. Debt instruments may be subsequently measured at amortized cost if the asset is held within a business

model whose objective is to hold the assets to collect the contractual cash flows and the contractual terms of the financial asset give rise, on

specified dates, to cash flows that are solely payments of principal and interest on the principal outstanding. All other debt instruments are

subsequently measured at fair value. All financial assets that are equity investments are measured at fair value either through OCI or profit or

loss. This is an irrevocable choice the entity makes by instrument unless the equity investments are held for trading, in which case, they must