Food Lion 2009 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150 - Delhaize Group - Annual Report 2009

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

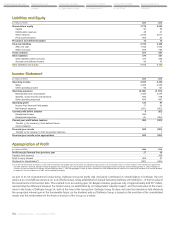

Liabilities and Equity

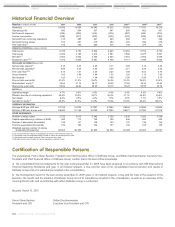

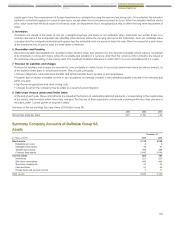

(in millions of EUR) 2009 2008

Shareholders’ equity 3 778 2 935

Capital 50 50

Distributable reserves 38 41

Other reserves 2 835 2 817

Profit carried forward 855 27

Provisions and deferred taxation 14 13

Financial liabilities 2 150 2 429

After one year 1 942 1 644

Within one year 208 785

Trade creditors 621 607

Other liabilities 379 351

Other liabilities within one year 337 308

Accruals and deferred income 42 43

Total liabilities and equity 6 942 6 335

Income Statement

(in millions of EUR) 2009 2008

Operating income 4 580 4 406

Sales 4 488 4 285

Other operating income 92 121

Operating expenses (4 460) (4 319)

Merchandise and consumables 3 396 3 274

Salaries, social security and pensions 605 578

Other operating expenses 459 467

Operating profit 120 87

Income from financial fixed assets 17 43

Net financial expense (131) (182)

Current profit before taxation 6 (52)

Exceptional income 986 1

Exceptional expenses (3) (104)

Current year profit before taxation 989 (155)

Transfer (-) to/ release (+) from deferred taxes - -

Current taxation - -

Financial year results 989 (155)

Transfer (-) to/ release (+) from tax-exempt reserves - 1

Financial year results to be appropriated 989 (154)

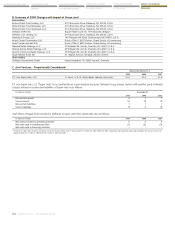

Appropriation of Profit

(in millions of EUR) 2009 2008

Profit brought forward from previous year 27 30

Transfer from reserves - 300

Profit to carry forward 855 27

Dividends to shareholders(1) (161) (149)

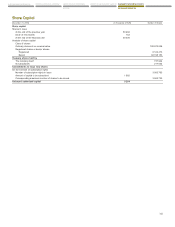

(1) As a result of the exercise of warrants issued under the Delhaize Group 2002 Stock Incentive Plan, the Company might have to issue new ordinary shares, to which coupon no. 48 entitling to the payment of

the 2009 dividend is attached, between the date of adoption of the annual accounts by the Board of Directors and the date of their approval by the Ordinary General Meeting of May 27, 2010. The Board of

Directors will communicate at the Ordinary General Meeting of May 27, 2010 the aggregate number of shares entitled to the 2009 dividend and will submit to this meeting the final amount of the total dividend

for approval. The annual accounts of 2009 will be modified accordingly.

As part of its US organizational restructuring, Delhaize Group SA partly sold and partly contributed its shareholdings in Delhaize The Lion

America LLC and Delhaize America LLC to its wholly owned, newly established US-based subsidiary Delhaize US Holding Inc., at the fair value of

the investments at transaction date. This resulted in an accounting gain, for Belgian statutory purposes only, of approximately EUR 977 million,

representing the difference between the market value, as established by an independent valuation expert, and the book value of the invest-

ment in the books of Delhaize Group SA, both at the time of the transaction. Delhaize Group SA does not have the intention to fully distribute

the recognized internal gain in the foreseeable future, as the dividend policy of Delhaize Group is based on the evolution of the consolidated

results and the reinforcement of the finance structure of the Group as a whole.