Food Lion 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

Management further concluded that the reader of the Group’s financial statements would benefit from distinguishing operating from non-

operating - other business activities - and therefore decided to aggregate all remaining operating segments relating to operating activities

into the “Rest of the World” reportable segment, by this allowing singling out the corporate activities of the Group, which are disclosed as

“Corporate”.

This results in a geographical segmentation of the Group’s business, based on the location of customers and stores, which matches the way

Delhaize Group manages its operations and is consistent with previous segment reporting.

The Executive Committee reviews the performance of Delhaize Group’s segments against a number of measures, of which operating profit

represents the most important measure of profit or loss. The amount of each segment item reported is measured using the amounts reported

to the CODM, which equals consolidated IFRS financial information.

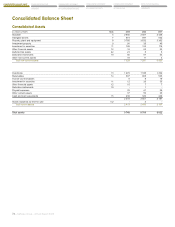

In the past, under IAS 14 guidance, Delhaize Group excluded from the business segments certain assets and liabilities (amongst others

financial assets and liabilities and derivatives) and re-allocated them to the “Corporate and Unallocated” segment. As the reporting to the

CODM does not include such re-allocations, segment assets and liabilities are now reported in line with internal reporting and total assets

as shown in the consolidated balance sheet equal total segment assets. Comparative information on segment assets and liabilities have

been re-presented.

As the information provided to the CODM and disclosed as segment information represents consolidated IFRS financial information, no

reconciling items need to be disclosed.

The new accounting guidance only impacts the presentation and disclosure of segments and has no impact on earnings per share. Revised

segment information is included in Note 3.

t3FWJTFE*"4Presentation of Financial Statements

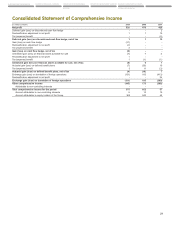

The revised standard introduces several (smaller) changes to IAS 1, with the most significant being the requirement to separate owner and

non-owner changes in equity and the introduction of the statement of comprehensive income, which contains all items of recognized income

and expense, either in one or two linked statements. The revised pronouncement had the following impact on Delhaize Group:

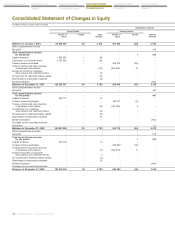

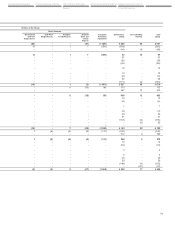

(a) IAS 1 no longer considers the “Statement of Recognized Income and Expense” (SoRIE) to be a Statement of Changes in Equity. Consequently,

Delhaize Group now presents its revised “Consolidated Statements of Changes in Equity,” which in the past had been included in the

notes, outside of the notes as a primary statement.

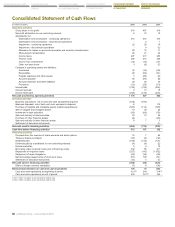

(b) Further, Delhaize Group re-labeled the SoRIE into “Statement of Comprehensive Income” and elected, in line with IAS 1, to show income

tax and reclassification adjustments to net income for the various line items on the face of the statement.

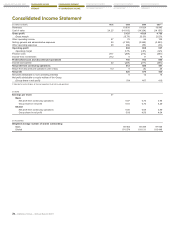

(c) Delhaize Group decided to continue presenting two linked statements (“Income Statement” and “Statement of Comprehensive Income”)

for detailing all items of recognized income and expense.

(d) The Group noted the suggested revised terminology for the term “Balance Sheet” (“Statement of Financial Position”), but elected to continue

using the term “Balance Sheet” for the time being.

As all changes relate to presentation only, the implementation of the revised IAS 1 has no impact on the financial performance of the Group.

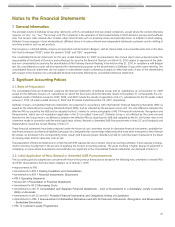

2.3. Summary of Significant Accounting Policies

The principle accounting policies applied in the preparation of these consolidated financial statements are described below. These policies

have been consistently applied to all financial years presented, except as explained in Note 2.2.

In the event of the presentation of discontinued operations, the comparative income statement is re-presented as if the operation presented as

discontinued operations during the period had been discontinued from the start of the comparative period (Note 5.3).

Principles of Consolidation

Subsidiaries are all entities - including special purpose entities - over which the Group has - directly or indirectly - the power to govern the

financial and operating policies, which is generally accompanying a shareholding of more than half of the voting rights. The existence and

effect of potential voting rights that would be exercisable or convertible at year-end, if any, are considered when assessing whether the Group

controls another entity. All subsidiaries are fully consolidated from the date of acquisition, being the date on which the Group obtains control,

and continue to be consolidated until the date such control ceases. For a list of all subsidiaries, see Note 36.

Joint ventures are entities over whose activities the Group has joint control, established by contractual agreement and requiring unanimous

consent for strategic, financial and operating decisions. Joint ventures are proportionally consolidated from the date joint control is established,

until such joint control ceases (Note 36).

The Group currently holds no investments in entities over which Delhaize Group has significant influence, but no control (associates).

The consolidated financial statements are prepared using uniform accounting policies for like transactions and other events in similar circum-

stances. Accounting policies of subsidiaries or joint ventures have been changed, where necessary, to ensure consistency with the policies

adopted by the Group.

All intragroup balances and transactions are eliminated in full when preparing the consolidated financial statements.