Food Lion 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 - Delhaize Group - Annual Report 2009

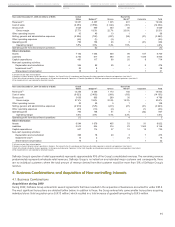

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

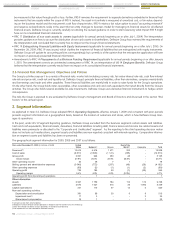

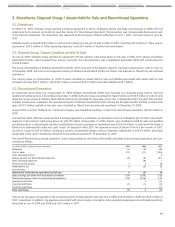

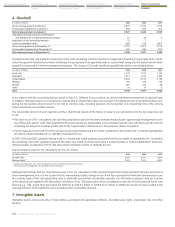

6. Goodwill

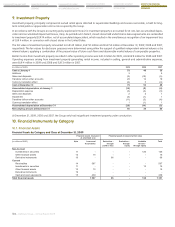

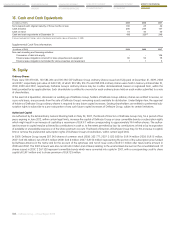

(in millions of EUR) 2009 2008 2007

Gross carrying amount at January 1 2 677 2 516 2 774

Accumulated impairment at January 1 (70) (70) (77)

Net carrying amount at January 1 2 607 2 446 2 697

Acquisitions through business combinations

and adjustments to initial purchase accounting 41 30 6

Acquisition of non-controlling interests 72 7 -

Currency translation effect (80) 124 (257)

Gross carrying amount at December 31 2 707 2 677 2 516

Accumulated impairment at December 31 (67) (70) (70)

Net carrying amount at December 31 2 640 2 607 2 446

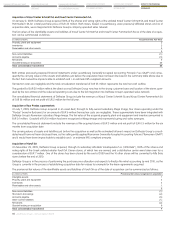

Goodwill is allocated and tested for impairment at the cash generating unit (CGU) level that is expected to benefit from synergies of the combi-

nation the goodwill resulted from, which at Delhaize Group represents an operating entity or country level, being also the lowest level at which

goodwill is monitored for internal management purpose. The Group’s CGUs with significant goodwill allocated to are detailed below:

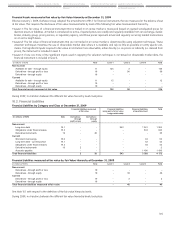

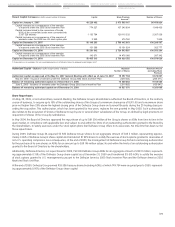

(in millions of EUR) 2009 2008 2007

Food Lion 1 172 1 213 1 147

Hannaford 1 071 1 103 1 043

United States 2 243 2 316 2 190

Belgium 180 160 160

Greece 201 120 94

Other 16 11 2

Total 2 640 2 607 2 446

In accordance with the accounting policies stated in Note 2.3, Delhaize Group conducts an annual impairment assessment for goodwill and,

in addition, whenever events or circumstances indicate that an impairment may have occurred. The impairment test of goodwill involves com-

paring the recoverable amount of each CGU with its carrying value, including goodwill, and recognition of an impairment loss if the carrying

value exceeds the recoverable amount.

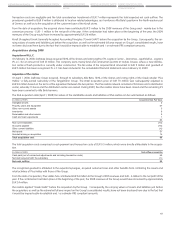

The recoverable amount of each operating entity is determined based on the higher of value in use calculations and the fair value less cost

to sell:

t5IFWBMVFJOVTFi7*6wDBMDVMBUJPOTVTFDBTIGMPXQSPKFDUJPOTCBTFEPOUIFMBUFTUBWBJMBCMFGJOBODJBMQMBOTBQQSPWFECZNBOBHFNFOUDPWFS-

ing a three-year period. Cash flows beyond the three-year period are extrapolated using estimated growth rates, with these growth rates not

exceeding the long-term average growth rate for the supermarket retail business in the particular market in question.

t5IFGBJSWBMVFMFTTDPTUUPTFMMi'7-$54wJTCBTFEPOFBSOJOHTNVMUJQMFTQBJEGPSTJNJMBSDPNQBOJFTJOUIFNBSLFUBOEPSNBSLFUDBQJUBMJ[BUJPO

for publicly traded subsidiaries (i.e. Alfa Beta Vassilopoulos S.A.).

In 2009, 2008 and 2007, goodwill relating to the U.S. entities was tested applying discounted cash flows models to estimate the VIU. Goodwill at

the remaining CGUs with significant goodwill allocation was tested for impairment using a market multiple or market capitalization approach,

where possible, to determine FVLCTS and discounted cash flows models to establish the VIU.

Key assumptions used for VIU calculations for the U.S. entities:

(in millions of EUR) 2009 2008 2007

Growth rate* 2.0% 2.0% 2.0%

Discount rate** 7.6% 7.3% 8.5%

* Weighted average growth rate used to extrapolate cash flows beyond the financial plans period.

** After-tax discount rate applied to corresponding cash flow projections.

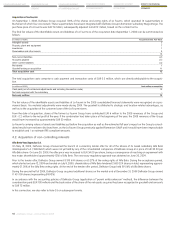

Management believes that the assumptions used in the VIU calculations of the goodwill impairment testing represent the best estimates of

future developments and is of the opinion that no reasonable possible change in any of the key assumptions mentioned above would cause

the carrying value of the cash generating units to materially exceed their recoverable amounts. For information purposes only, an increase

of the discount rate applied to the discounted cash flows of e.g., 100 basis points and a simultaneous reduction of total projected future cash

flows by e.g., 10%, would have decreased the total VIU by EUR 3.0 billion in 2009 (EUR 3.1 billion in 2008) and would not have resulted in the

carrying amounts of the significant CGUs exceeding their recoverable amounts.

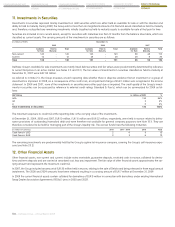

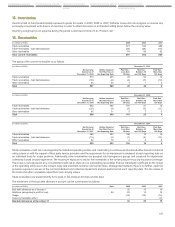

7. Intangible Assets

Intangible assets consist primarily of trade names, purchased and developed software, favorable lease rights, prescription files and other

licenses.