Food Lion 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

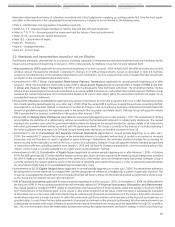

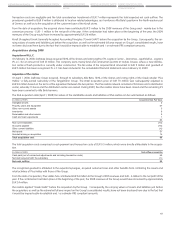

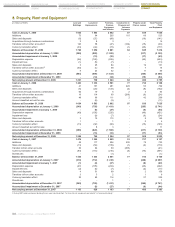

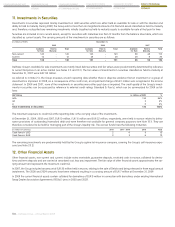

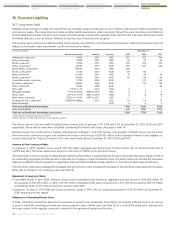

Depreciation expense is included in the following line items of the income statement:

(in millions of EUR) 2009 2008 2007

Cost of sales 44 42 43

Selling, general and administrative expenses 409 377 379

Result from discontinued operations - 2 -

Total depreciation 453 421 422

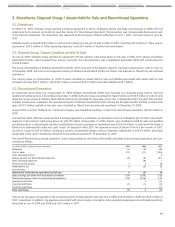

Property, plant and equipment can be summarized by segment as follows:

(in millions of EUR) December 31,

2009 2008 2007

United States 2 596 2 696 2 407

Belgium 764 746 738

Greece 370 339 202

Rest of the World 45 38 22

Corporate 10 13 14

Total property, plant and equipment 3 785 3 832 3 383

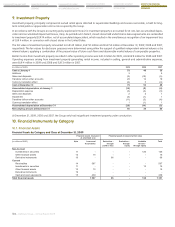

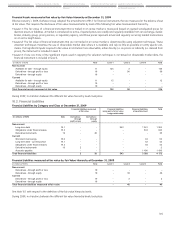

In accordance with the accounting policy summarized in Note 2.3, Delhaize Group tests assets with finite lives for impairment whenever events

or circumstances indicate that impairment may exist. The Group monitors the carrying value of its retail stores, the lowest level asset group for

which identifiable cash flows are independent of other (groups of) assets (“cash generating unit” or CGU), for potential impairment based on

historical and projected cash flows. The recoverable value is estimated using projected discounted cash flows based on past experience and

knowledge of the markets in which the stores are located, adjusted for various factors, such as inflation and general economic conditions.

Independent third-party appraisals are obtained in certain situations to help estimating fair values based on the location and condition of the

stores.

Management believes that the assumptions applied when testing for impairment are reasonable estimates of the economic conditions and

operating performance of the different CGUs. Changes in these conditions or performance will have an impact on the projected cash flows

used to determine the recoverable amount of the CGUs and by that might result in additional stores identified as being possibly impaired and /

or on the impairment amount calculated.

Impairment losses of depreciable assets, recorded in other operating expenses, amounted to EUR 13 million, EUR 24 million and EUR 17 million

in 2009, 2008 and 2007, respectively. Impairment losses recognized in discontinued operations (related to assets classified as held for sale,

see Note 5.3) were EUR 5 million in 2008. During 2007, EUR 3 million impairment losses were reversed, of which EUR 1 million was initially

recorded in result from discontinued operations.

In 2009, Delhaize Group recognized impairment losses of EUR 13 million primarily, but not limited to, in connection with underperforming stores

(EUR 6 million) and store closings (EUR 5 million) in the United States. Closed stores held under finance lease agreements are reclassified to

investment property (see Note 9). On these closed stores, and in addition to the EUR 13 million mentioned above, impairment losses on invest-

ment property of EUR 4 million have been recognized as other operating expenses. In 2008, the Group recognized an impairment loss of EUR

24 million mainly relating to Sweetbay stores (EUR 19 million) and stores operated in Germany (EUR 5 million).

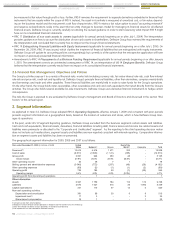

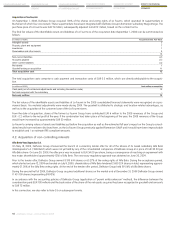

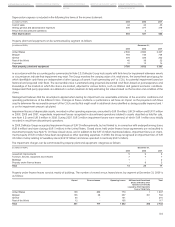

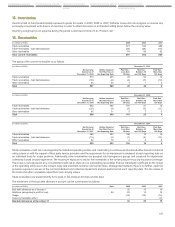

The impairment charges can be summarized by property, plant and equipment categories as follows:

(in millions of EUR) December 31,

2009 2008 2007

Leasehold improvements 5 9 6

Furniture, fixtures, equipment and vehicles 7 7 7

Buildings 1 - 2

Property under finance leases - 8 2

Total 13 24 17

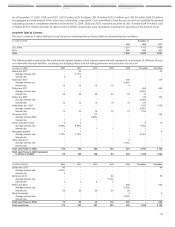

Property under finance leases consists mainly of buildings. The number of owned versus leased stores by segment at December 31, 2009 is

as follows:

Owned Finance Leases Operating Leases Affiliated and Franchised Total

Stores Owned by their

Operators or Directly

Leased by their Operators

from a Third Party

United States 138 689 779 1 1 607

Belgium 136 28 237 391 792

Greece 55 - 161 - 216

Rest of the World 12 - 105 - 117

Total 341 717 1 282 392 2 732