Food Lion 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

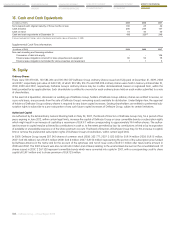

106 - Delhaize Group - Annual Report 2009

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

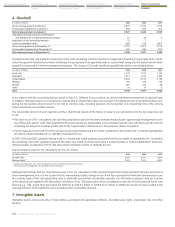

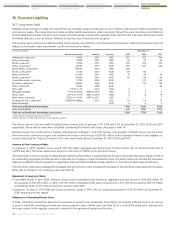

11. Investments in Securities

Investments in securities represent mainly investments in debt securities which are either held as available for sale or with the intention and

ability to hold to maturity. During 2008, the Group sold a more than an insignificant amount of its financial assets classified as held-to-maturity

and, therefore, reclassified any remaining investments initially classified as held-to-maturity assets to available-for-sale at that point in time.

Securities are included in non-current assets, except for securities with maturities less than 12 months from the balance sheet date, which are

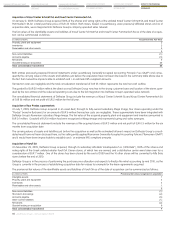

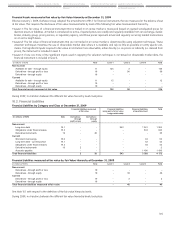

classified as current assets. The carrying amounts of the investments in securities are as follows:

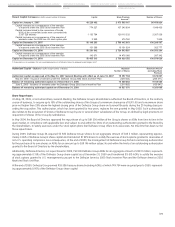

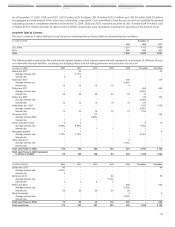

(in millions of EUR) December 31,

2009 2008 2007

Available Held to Total Available Held to Total Available Held to Total

for Sale Maturity for Sale Maturity for Sale Maturity

Non-current 126 - 126 123 - 123 68 48 116

Current 12 - 12 28 - 28 28 8 36

Total 138 - 138 151 - 151 96 56 152

Delhaize Group’s available for sale investments are mainly listed debt securities and fair values were predominantly determined by reference

to current bid prices in an active market (see Notes 2.3 and 10.1). The fair values of investments in securities classified as held-to-maturity at

December 31, 2007 were EUR 153 million.

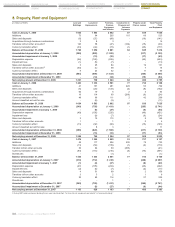

As referred to in Note 2.3, the Group assesses at each reporting date whether there is objective evidence that an investment or a group of

investments is impaired. In 2008, as a consequence of the credit crisis, an impairment charge of EUR 1 million was recognized in the income

statement. In 2009 and 2007, none of the investments in securities were either past due or impaired. The credit quality of the Group’s invest-

ments in securities can be assessed by reference to external credit ratings (Standard & Poor’s), which can be summarized for 2009 as fol-

lows:

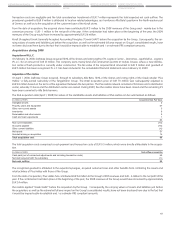

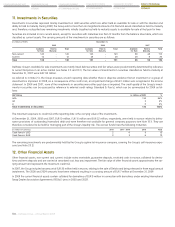

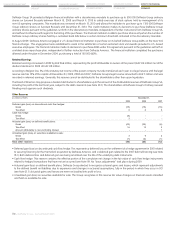

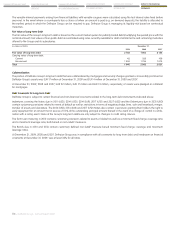

S&P Rating in millions of EUR %

AAA 130 94%

AA 2 2%

A 6 4%

Total Investments in Securities 138 100%

The maximum exposure to credit risk at the reporting date is the carrying value of the investments.

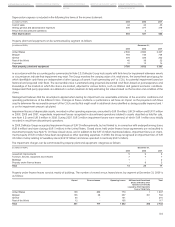

At December 31, 2009, 2008 and 2007, EUR 10 million, EUR 15 million and EUR 22 million, respectively, were held in escrow related to defea-

sance provisions of outstanding Hannaford debt and were therefore not available for general company purposes (see Note 18.1). They are

therefore considered to be held for managing part of the Group’s liquidity risk. The escrow funds have the following maturities:

(in millions of currency) 2010 2011 - 2015 2016 Total

Cash flows in USD 2 4 9 15

Cash flows in EUR 2 2 6 10

The remaining investments are predominately held by the Group’s captive (re)-insurance company, covering the Group’s self-insurance expo-

sure (see Note 20.2).

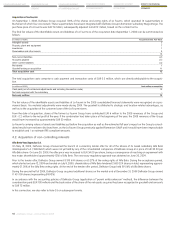

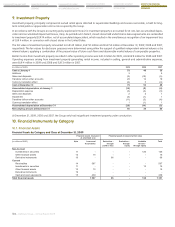

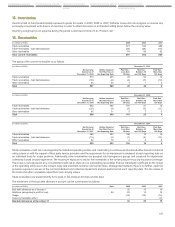

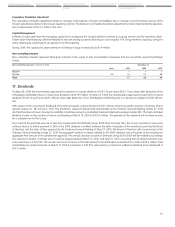

12. Other Financial Assets

Other financial assets, non-current and current, include notes receivable, guarantee deposits, restricted cash in escrow, collateral for deriva-

tives and term deposits and are carried at amortized cost, less any impairment. The fair value of other financial assets approximates the car-

rying amount and represents the maximum credit risk.

In 2007, the Group included an amount of EUR 20 million held in escrow, relating to the sale of Delvita and being released in three equal annual

instalments. The 2008 and 2009 amounts have been released resulting in a carrying amount of EUR 7 million at December 31, 2009.

In 2009 the current financial assets contain collateral for derivatives of EUR 8 million in connection with derivatives under existing International

Swap Dealer Association Agreements (“ISDAs”) (zero in 2008 and 2007).