Food Lion 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

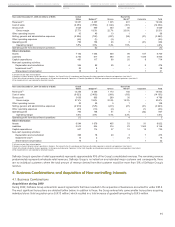

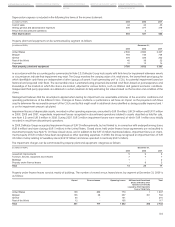

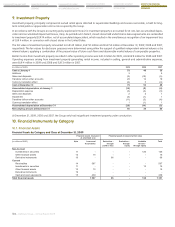

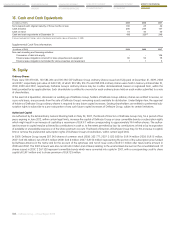

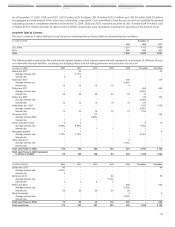

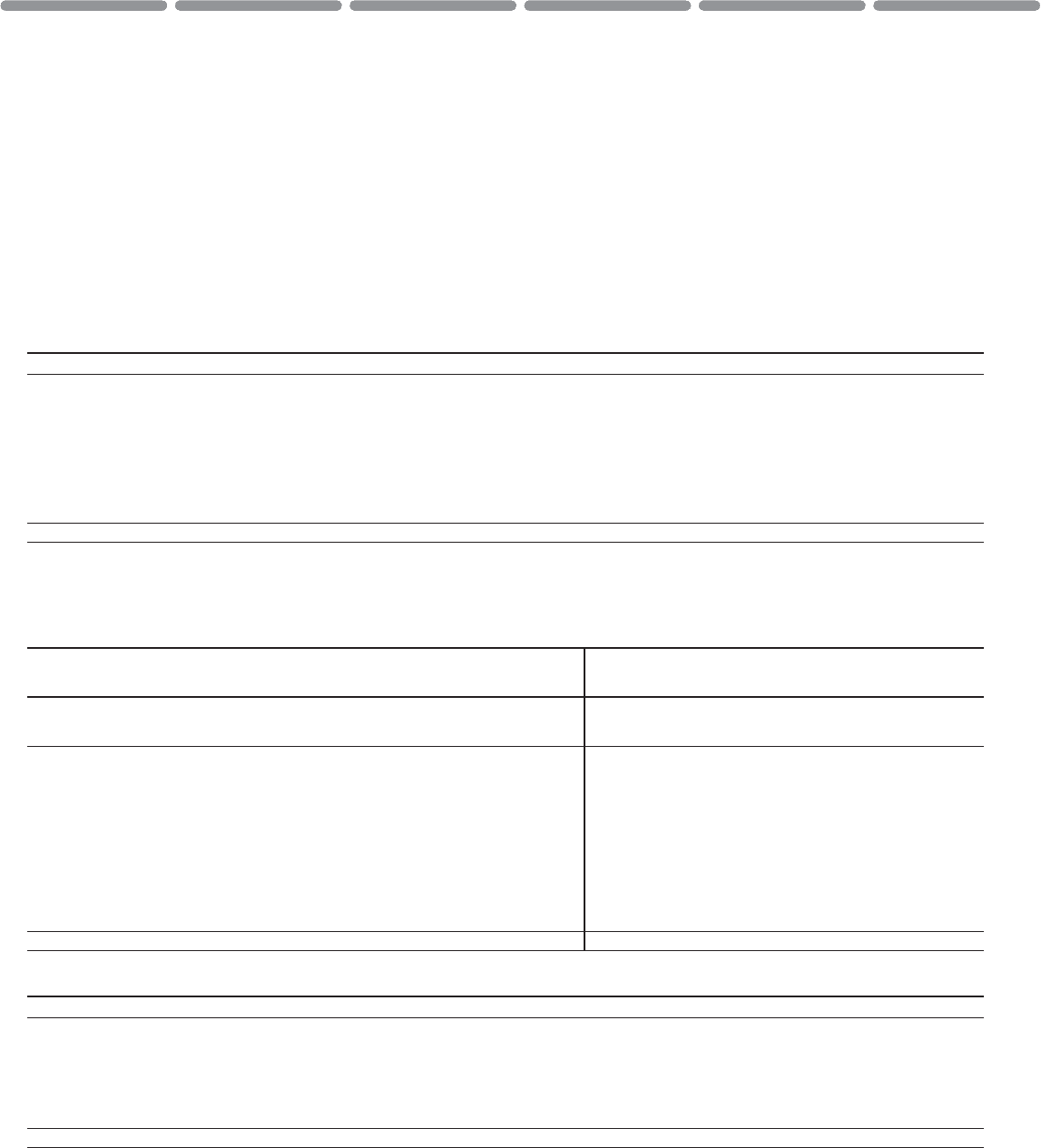

Financial Assets measured at fair value by Fair Value Hierarchy at December 31, 2009

Effective January 1, 2009, Delhaize Group adopted the amendment to IFRS 7 for financial instruments that are measured in the balance sheet

at fair value. This requires the disclosure of fair value measurements by level of the following fair value measurement hierarchy:

tLevel 1: The fair value of a financial instrument that is traded in an active market is measured based on quoted (unadjusted) prices for

identical assets or liabilities. A market is considered as active, if quoted prizes are readily and regularly available from an exchange, dealer,

broker, industry group, pricing service, or regulatory agency, and those prices represent actual and regularly occurring market transactions

on an arm’s length basis.

tLevel 2: The fair value of financial instruments that are not traded in an active market is determined by using valuation techniques. These

valuation techniques maximise the use of observable market date where it is available and rely as little as possible on entity specific esti-

mates. If all significant inputs required to fair value an instrument are observable, either directly (i.e. as prices) or indirectly (i.e. derived from

prices), the instrument is included in level 2.

tLevel 3: If one ore more of the significant inputs used in applying the valuation technique is not based on observable market date, the

financial instrument is included in level 3.

(in millions of EUR) Note Level 1 Level 2 Level 3 Total

Non-Current

Available for sale - through equity 11 124 2 - 126

Derivatives - through profit or loss 19 - 96 - 96

Derivatives - through equity 19 - - - -

Current

Available for sale - through equity 11 12 - - 12

Derivatives - through profit or loss 19 - - - -

Derivatives - through equity 19 - - - -

Total financial assets measured at fair value 136 98 - 234

During 2009, no transfers between the different fair value hierarchy levels took place.

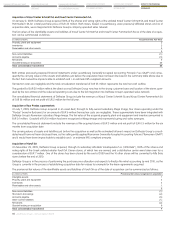

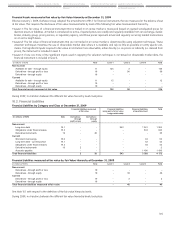

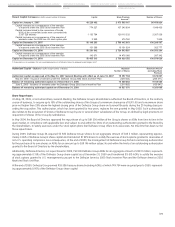

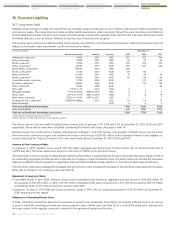

10.2. Financial Liabilities

Financial Liabilities by Category and Class at December 31, 2009

Financial liabilities measured Financial liabilities Financial liabilities Total

at fair value being part of a fair value at amortized cost

hedge relationship

(in millions of EUR) Note Derivatives - Derivatives -

through through

profit or loss equity

Non-current

Long-term debt 18.1 - - 543 1 361 1 904

Obligations under finance leases 18.3 - - - 643 643

Derivative instruments 19 - 38 - - 38

Current

Short-term borrowings 18.2 - - - 63 63

Long-term debt - current portion 18.1 - - - 42 42

Obligations under finance leases 18.3 - - - 44 44

Derivative instruments 19 2 - - - 2

Accounts payable - - - 1 436 1 436

Total financial liabilities 2 38 543 3 589 4 172

Financial Liabilities measured at fair value by Fair Value Hierarchy at December 31, 2009

(in millions of EUR) Note Level 1 Level 2 Level 3 Total

Non-current

Derivatives - through profit or loss 19 - - - -

Derivatives - through equity 19 - 38 - 38

Current

Derivatives - through profit or loss 19 - 2 - 2

Derivatives - through equity 19 - - - -

Total financial liabilities measured at fair value - 40 - 40

See Note 10.1 with respect to the definition of the fair value hierarchy levels.

During 2009, no transfers between the different fair value hierarchy levels took place.