Food Lion 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

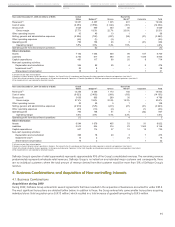

92 - Delhaize Group - Annual Report 2009

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

In the event of a modification of the terms of an equity-settled award, the minimum expense recognized is the expense as if the terms had

not been modified. An additional expense would be recognized for any modification, which increases the total fair value of the share-based

payment arrangement, or is otherwise beneficial to the employee as measured at the date of modification.

Where an equity-settled award is cancelled, it is treated as if it had vested on the date of cancellation, and any expense not yet recognized

for the award is recognized immediately. However, in case that a new award is substituted for the cancelled award, and designated as a

replacement award on the date that it is granted, the cancelled and new awards are treated as if they were a modification of the original

award.

Any proceeds received net of any directly attributable transaction costs are credited to share capital (nominal value) and share premium

when options are exercised. The dilutive effect of outstanding options is reflected as additional share dilution in the computation of diluted

earnings per share (see Note 31).

Revenue Recognition

Revenue is recognized to the extent that it is probable that the economic benefits will flow to the Group and the revenue can be reliably meas-

ured. Revenue is measured at the fair value of the consideration received, excluding discounts, rebates, and sales taxes or duty.

tSales of products to the Group’s retail customers are recognized at the point of sale and upon delivery of groceries to Internet or telephone

order customers. In addition, Delhaize Group generates revenue from sales to its wholesale customers, which are recognized upon delivery

to or pick-up by the wholesale customer.

As stated above, sales are recorded net of sales taxes, value-added taxes and discounts and incentives. These include discounts from

regular retail prices for specific items and “buy-one, get-one-free”-type incentives that are offered to retail customers through the Group’s

customer loyalty programs. Discounts provided by vendors, in the form of manufacturer’s coupons, are recorded as a receivable.

Revenue from the sale of gift cards and gift certificates is recognized when the gift card or gift certificate is redeemed by the retail customer.

The Group maintains various loyalty points programs whereby customers earn points for future purchases. These customer loyalty credits

are accounted for as a separate component of the sales transaction in which they are granted. A portion of the fair value of the considera-

tion received is allocated to the award credits and deferred. This is then recognized as revenue over the period that the award credits are

redeemed.

t5IF(SPVQHFOFSBUFTMJNJUFESFWFOVFTGSPNfranchise fees, which are recognized when the services are provided or franchise rights used.

t'PSDFSUBJOQSPEVDUTPSTFSWJDFTTVDIBTUIFTBMFPGMPUUFSZUJDLFUTUIJSEQBSUZQSFQBJEQIPOFDBSETFUD%FMIBJ[F(SPVQBDUTBTBOBHFOU

and consequently records the amount of commission income in its net sales.

tRental income from investment property is recognized in profit or loss on a straight-line basis over the term of the lease and included in

“Other operating income” (Note 27).

t Interest Income is recognized as interest accrues (using the effective interest method) and is included in “Income from investments” (Note

29.2).

t Dividend income is recognized when the Group’s right to receive the payment is established. The income is included in “Income from invest-

ments” (Note 29.2).

Cost of Sales

Cost of sales includes purchases of products sold and all costs associated with getting the products into the retail stores, including buy-

ing, warehousing and transportation costs. Finally, cost of sales includes appropriate vendor allowances (see also accounting policy for

“Inventories” above).

Selling, General and Administrative Expenses

Selling, general and administrative expenses include store operating expenses, costs incurred for activities which serve securing sales, admin-

istrative and advertising expenses.

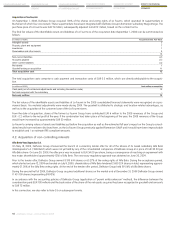

Segment Reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision maker (CODM),

who is responsible for allocating resources and assessing performance of the operating segments. At Delhaize Group the CODM has been

identified to be the Executive Committee.

See Note 2.2 for additional details on the impact the implementation of IFRS 8 had on Delhaize Group’s segment reporting.

2.4. Significant Use of Estimates, Assumptions and Judgment

The preparation of financial statements in conformity with IFRS requires Delhaize Group to make judgments, estimates and assumptions that

affect the application of accounting policies and the reported amounts of assets, liabilities and income and expenses, which inherently contain

some degree of uncertainty. These estimates are based on experience and assumptions Delhaize Group believes to be reasonable under the

circumstances. By definition, actual results could and will often differ from these estimates. In the past, the Group’s estimates generally have

not deviated significantly from actual results. Revisions to accounting estimates are recognized in the period in which the estimates are revised

and in any future periods affected.