Food Lion 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

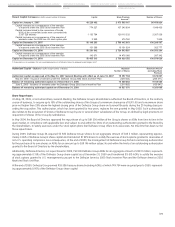

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

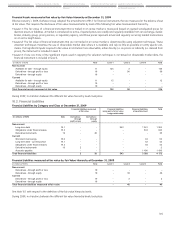

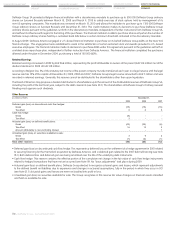

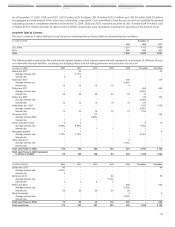

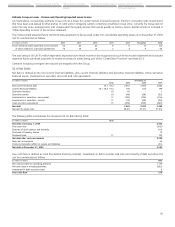

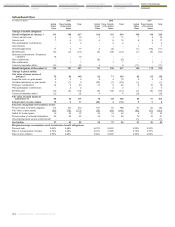

18.2. Short-term Borrowings

Short-term Borrowings by Currency

(in millions of EUR) December 31,

2009 2008 2007

U.S. dollar 35 - 38

Euro 28 152 3

Total 63 152 41

The carrying amounts of short-term borrowings approximate their fair values.

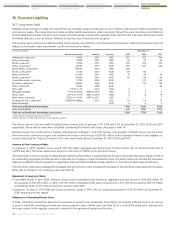

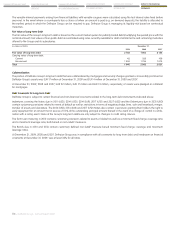

U.S. Entities

In December 2009, Delhaize America, LLC entered into an unsecured revolving credit agreement (“The Credit Agreement”), which provides

the entity with a three-year USD 500 million (EUR 347 million), unsecured, committed revolving credit facility, including a USD 100 million (EUR

69 million) sub-limit for the issuance of letters of credit, and a USD 35 million (EUR 24 million) sub-limit for swingline loans. The aggregate

maximum principal amount available under the Credit Agreement may be increased to an aggregate amount not exceeding USD 650 mil-

lion (EUR 451 million). Funds are available under the Credit Agreement for general corporate purposes. The Credit Agreement will mature on

December 1, 2012. The credit facility is guaranteed under the cross guarantee agreement between Delhaize Group and Delhaize America,

LLC. This agreement is a second amendment and restatement of the credit agreement entered into in 2005 and subsequently amended and

restated in 2007.

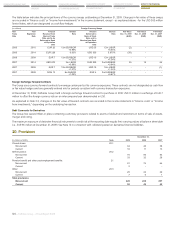

Delhaize America, LLC had outstanding borrowings under the 2009 credit agreement of USD 50 million (EUR 35 million) as of December 31,

2009, no outstanding borrowings as of December 31, 2008 and USD 50 million (EUR 34 million) in outstanding borrowings as of December

31, 2007.

Under the credit facilities that were in place at the various reporting dates, Delhaize America, LLC had average daily borrowings of USD 3 million

(EUR 2 million) during 2009, USD 25 million (EUR 18 million) during 2008 and USD 36 million (EUR 26 million) during 2007. No credit agreements

amounts were used to fund letters of credit during 2009 and approximately USD 1 million (EUR 1 million), of the 2005 Credit Agreement was

used to fund letters of credit during 2008 and 2007. In addition to the Credit Agreement, Delhaize America, LLC had approximately USD 37

million (EUR 26 million), USD 77 million (EUR 55 million) and USD 73 million (EUR 50 million) outstanding to fund letters of credit as of December

31, 2009, 2008 and 2007 respectively.

Further, Delhaize America, LLC has periodic short-term borrowings under uncommitted credit facilities that are available at the lenders’ discre-

tion and which amounted to USD 30 million (EUR 21 million) at December 31, 2009. As of December 31, 2009 and 2008, Delhaize America, LLC

had no borrowings outstanding under such arrangements. There was USD 6 million (EUR 4 million) outstanding under these arrangements at

December 31, 2007.

European and Asian Entities

At December 31, 2009, 2008 and 2007 the Group’s European and Asian entities together had credit facilities (committed and uncommitted) of

EUR 542 million (of which EUR 275 million of committed credit facilities), EUR 621 million and EUR 561 million, respectively, under which Delhaize

Group can borrow amounts for less than one year (“Short-term Bank Borrowings”) or more than one year (“Medium-term Bank Borrowings”).

The Short-term Bank Borrowings and the Medium-term Bank Borrowings generally bear interest at the inter-bank offering rate at the borrowing

date plus a pre-set margin, or based on market quotes from banks. In Europe and Asia, Delhaize Group had EUR 28 million in outstanding

short-term bank borrowings at December 31, 2009 compared to EUR 152 million in outstanding short-term bank borrowings at December

31, 2008 and EUR 3 million borrowings outstanding at December 31, 2007, respectively, with an average interest rate of 3.83%, 4.37% and

5.05%, respectively. During 2009, the Group’s European and Asian average borrowings were EUR 151 million at a daily average interest rate

of 2.79%.

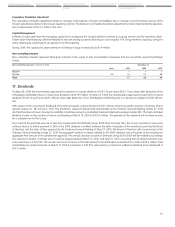

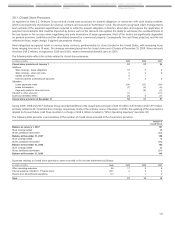

Debt Covenants for Short-term Borrowings

The three-year USD 500 million syndicated revolving credit facility and the EUR 275 million committed European bilateral credit facilities require

maintenance of various financial and non-financial covenants. The agreements contain customary provisions related to events of default and

affirmative and negative covenants applicable to Delhaize Group. The negative covenants contain restrictions in terms of negative pledge, liens,

indebtedness of subsidiaries, sale of assets, merger and dividend, as well as minimum fixed charge coverage ratios, maximum leverage ratios

and maximum equity variation ratios based on non-GAAP measures.

At December 31, 2009, 2008 and 2007, Delhaize Group was in compliance with all covenants conditions for Short-term Borrowings, and head-

room on financial covenants at December 31, 2009, was at least 20% for all ratios.