Food Lion 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

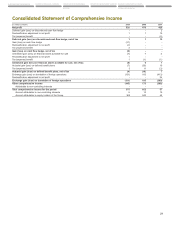

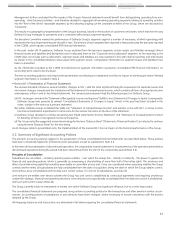

Non-monetary items that are measured at historical cost in a foreign currency are translated using the exchange rates as at the dates of

the initial transaction. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rate at the date

when the fair value is determined and gains or losses are included in the income statement except for differences arising on the retranslation

of non-monetary items in respect of which gains and losses are recognized directly in equity. For such non-monetary items, any exchange

component of that gain or loss is also recognized directly in equity.

tForeign group entities: The results and balance sheets of all Group entities that have a functional currency different from the Group’s pres-

entation currency are translated into the presentation currency as follows:

(a) the balance sheets of foreign subsidiaries are converted to euros at the year-end exchange rate (closing exchange rate);

(b) goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity

and translated at the closing rate; and

(c) the income statements are translated at the average daily exchange rate (i.e., the yearly average of exchange rates on

each working day).

The differences arising from the use of the average daily exchange rate for the income statement and the closing exchange rate for the

balance sheet are recorded in the “Cumulative translation adjustment” being part of “Other Comprehensive Income” (OCI). On disposal of a

foreign operation, the component of OCI relating to that particular foreign operation is recognized in the income statement (as a “reclassifica-

tion adjustment”).

None of the Group entities has the currency of a hyper-inflationary economy nor does Delhaize Group hedge net investments in foreign opera-

tions.

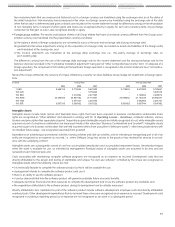

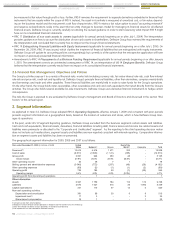

(in EUR) Closing Rate Average Daily Rate

2009 2008 2007 2009 2008 2007

1 USD 0.694155 0.718546 0.679302 0.716949 0.679902 0.729661

100 CZK - - 3.755445 - - 3.601579

100 SKK - 3.319392 2.977697 - 3.198802 2.960814

100 RON 23.605505 24.860162 27.718491 23.585462 27.154728 29.982331

100 THB - 2.071037 2.283105 - 2.062906 2.261727

100 IDR 0.007339 0.006562 0.007232 0.006923 0.007044 0.007982

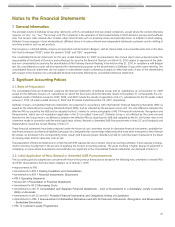

Intangible Assets

Intangible assets include trade names and favorable lease rights that have been acquired in business combinations (unfavorable lease

rights are recognized as “Other liabilities” and released in analogy with SIC 15 Operating Leases - Incentives), computer software, various

licenses and prescription files separately acquired. Separately acquired intangible assets are initially recognized at cost, while intangible assets

acquired as part of a business combination are measured initially at fair value (see “Business Combinations and Goodwill”). Intangible assets

acquired as part of a business combination that are held to prevent others from using them (“defensive assets”) - often being trade names with

no intended future usage - are recognized separately from goodwill.

Expenditures on advertising or promotional activities, training activities and start-up activities, and on relocating or reorganizing part or all of an

entity are recognized as an expense as incurred, i.e., when Delhaize Group has access to the goods or has received the services in accord-

ance with the underlying contract.

Intangible assets are subsequently carried at cost less accumulated amortization and accumulated impairment losses. Amortization begins

when the asset is available for use, as intended by management. Residual values of intangible assets are assumed to be zero and are

reviewed at each financial year-end.

Costs associated with maintaining computer software programs are recognized as an expense as incurred. Development costs that are

directly attributable to the design and testing of identifiable and unique “for-own-use software” controlled by the Group are recognized as

intangible assets when the following criteria are met:

tJUJTUFDIOJDBMMZGFBTJCMFUPDPNQMFUFUIFTPGUXBSFQSPEVDUTPUIBUJUXJMMCFBWBJMBCMFGPSVTF

tNBOBHFNFOUJOUFOETUPDPNQMFUFUIFTPGUXBSFQSPEVDUBOEVTFJU

tUIFSFJTBOBCJMJUZUPVTFUIFTPGUXBSFQSPEVDU

tJUDBOCFEFNPOTUSBUFEIPXUIFTPGUXBSFQSPEVDUXJMMHFOFSBUFQSPCBCMFGVUVSFFDPOPNJDCFOFGJUT

tBEFRVBUFUFDIOJDBMGJOBODJBMBOEPUIFSSFTPVSDFTUPDPNQMFUFUIFEFWFMPQNFOUBOEUPVTFUIFTPGUXBSFQSPEVDUBSFBWBJMBCMFBOE

tUIFFYQFOEJUVSFBUUSJCVUBCMFUPUIFTPGUXBSFQSPEVDUEVSJOHJUTEFWFMPQNFOUDBOCFSFMJBCMZNFBTVSFE

Directly attributable costs capitalized as part of the software product include software development employee costs and directly attributable

overhead costs. Other development expenditures that do not meet these criteria are recognized as an expense as incurred. Development costs

recognized in a previous reporting period as an expense are not recognized as an asset in a subsequent period.