Food Lion 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

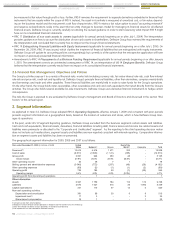

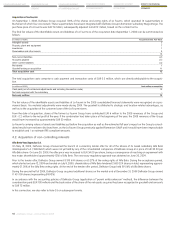

Delhaize Group has determined that acquired and used trade names have an indefinite useful life and are not amortized, but are tested annu-

ally for impairment and whenever events or circumstances indicate that impairment may have occurred. Trade names are tested for impair-

ment by comparing their recoverable amount, being their value in use, with their carrying amount. The value in use is estimated using revenue

projections of each operating entity (see Note 6) and applying an estimated royalty rate of 0.45% and 0.70% for Food Lion and Hannaford,

respectively. No impairment loss of trade names was recorded or reversed in 2009, 2008 or 2007.

See Note 8 for a description of the impairment test for assets with finite lives. During 2009, Delhaize Group impaired various software solutions

that related to projects that the Group abandoned during the year.

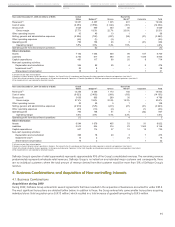

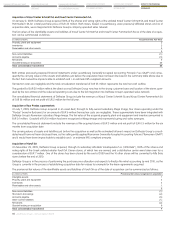

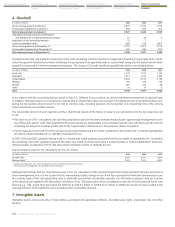

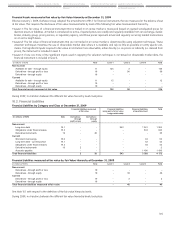

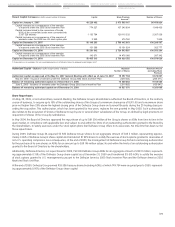

(in millions of EUR) Trade Developed Purchased Favorable Other Total

Names Software Software Lease Rights

Cost at January 1, 2009 374 123 152 217 52 918

Additions - 35 25 - - 60

Sales and disposals - (2) (3) (10) - (15)

Acquisitions through business combinations - - - 1 - 1

Transfers to/from other accounts - (3) 5 - (1) 1

Currency translation effect (12) (2) (4) (7) (2) (27)

Cost at December 31, 2009 362 151 175 201 49 938

Accumulated amortization at January 1, 2009 - (56) (80) (124) (22) (282)

Accumulated impairment at January 1, 2009 (34) - - (5) - (39)

Amortization expense - (17) (26) (13) (3) (59)

Impairment loss - (3) (2) - - (5)

Sales and disposals - - 2 10 - 12

Transfers to/from other accounts - - (1) - - (1)

Currency translation effect 1 2 2 4 1 10

Accumulated amortization at December 31, 2009 - (71) (103) (123) (24) (321)

Accumulated impairment at December 31, 2009 (33) (3) (2) (5) - (43)

Net carrying amount at December 31, 2009 329 77 70 73 25 574

Cost at January 1, 2008 354 86 120 224 46 830

Additions - 36 22 - 5 63

Sales and disposals - - (3) (22) - (25)

Acquisitions through business combinations - - - 4 1 5

Transfers to/from other accounts - (3) 7 - (3) 1

Currency translation effect 20 4 6 11 3 44

Cost at December 31, 2008 374 123 152 217 52 918

Accumulated amortization at January 1, 2008 - (42) (57) (124) (18) (241)

Accumulated impairment at January 1, 2008 (32) - - (5) - (37)

Amortization expense - (12) (22) (15) (3) (52)

Sales and disposals - - 3 22 - 25

Currency translation effect (2) (2) (4) (7) (1) (16)

Accumulated amortization at December 31, 2008 - (56) (80) (124) (22) (282)

Accumulated impairment at December 31, 2008 (34) - - (5) - (39)

Net carrying amount at December 31, 2008 340 67 72 88 30 597

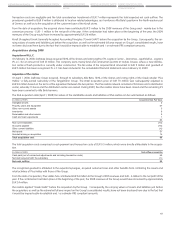

Cost at January 1, 2007 396 75 96 272 45 884

Additions - 20 30 1 8 59

Sales and disposals - - - (21) (2) (23)

Transfers to/from other accounts - (2) 3 (1) - -

Currency translation effect (42) (7) (9) (27) (5) (90)

Cost at December 31, 2007 354 86 120 224 46 830

Accumulated amortization at January 1, 2007 - (35) (43) (141) (19) (238)

Accumulated impairment at January 1, 2007 (36) - - (5) - (41)

Amortization expense - (10) (19) (20) (3) (52)

Sales and disposals - - - 21 2 23

Transfers to/from other accounts - - - 1 - 1

Currency translation effect 4 3 5 15 2 29

Accumulated amortization at December 31, 2007 - (42) (57) (124) (18) (241)

Accumulated impairment at December 31, 2007 (32) - - (5) - (37)

Net carrying amount at December 31, 2007 322 44 63 95 28 552

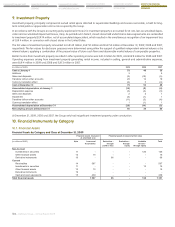

Trade name assets are allocated to the following cash generating units and reportable segment:

(in millions of EUR) December 31,

2009 2008 2007

Food Lion 179 185 175

Hannaford 150 155 147

United States 329 340 322

Amortization expenses are mainly charged to selling, general and administrative expenses.