Food Lion 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

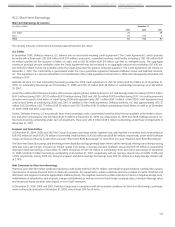

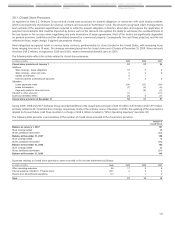

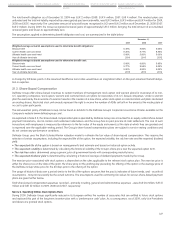

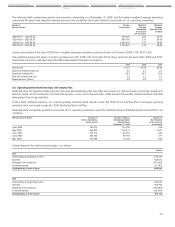

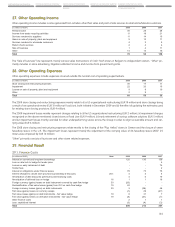

(in millions of EUR) 2009 2008 2007

United Plans Outside Total United Plans Outside Total United Plans Outside Total

States of the United States of the United States of the United

Plans States Plans States Plans States

Components of pension cost:

Amounts recognized in the income

statement:

Current service cost 8 4 12 7 4 11 7 5 12

Interest cost 7 6 13 6 6 12 6 5 11

Expected return on plan assets (6) (3) (9) (6) (4) (10) (6) (3) (9)

Amortization of past service cost - - - 1 - 1 - - -

Curtailment gain recognized - - - (8) - (8) - - -

Settlement loss recognized - 1 1 - 1 1 - 1 1

Total pension cost recognized in the

income statement 9 8 17 - 7 7 7 8 15

Amounts recognized in OCI:

Actuarial (gains)/losses immediately

recognized 2 7 9 30 (1) 29 - (10) (10)

Effect of changes in exchange rates 1 - 1 - - - - - -

Cumulative amount of actuarial gains

and losses recognized 31 12 43 28 5 33 (2) 6 4

Weighted average assumptions

used to determine pension cost:

Discount rate 6.01% 5.55% 6.00% 5.32% 5.75% 4.34%

Expected long-term rate of return on plan

assets during year 7.75% 4.40% 7.75% 4.90% 7.75% 4.15%

Rate of compensation increase 4.67% 3.38% 4.76% 3.37% 4.60% 3.36%

Rate of price inflation 3.50% 2.09% 3.50% 2.08% 3.50% 2.07%

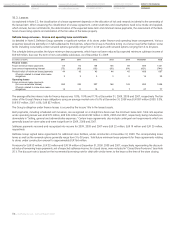

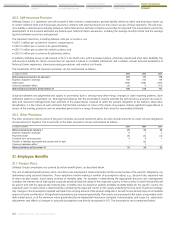

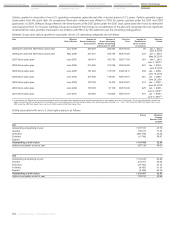

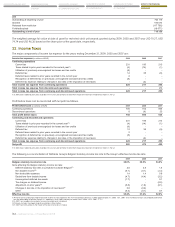

(in millions of EUR) 2009 2008 2007

United Plans Outside Total United Plans Outside Total United Plans Outside Total

States of the United States of the United States of the United

Plans States Plans States Plans States

Historical Information

Defined benefit obligation 136 121 257 111 106 217 104 110 214

Plan Assets 99 78 177 79 69 148 82 71 153

Surplus 37 43 80 32 37 69 21 39 60

Experience (gains) and losses:

Related to plan assets (9) 1 (8) 28 1 29 1 - 1

Percentage of plan assets -9.15% 0.93% -4.52% 35.61% 0.87% 19.38% 0.30% -0.14% 0.13%

Related to plan liabilities - 1 1 2 1 3 1 - 1

Percentage of plan liabilities -0.04% 0.49% 0.39% 1.83% 1.13% 1.51% 0.63% 0.09% 0.37%

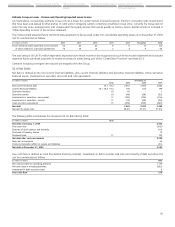

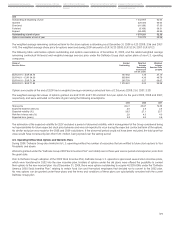

(in millions of EUR) 2006 2005

United Plans Outside Total United Plans Outside Total

States of the United States of the United

Plans States Plans States

Historical Information

Defined benefit obligation 109 116 225 121 114 235

Plan Assets 85 65 150 82 60 142

Surplus 24 51 75 39 54 93

Experience (gains) and losses:

Related to plan assets (4) 1 (3) 1 1 2

Percentage of plan assets -5.10% 0.44% -2.73% 0.68% 1.01% 0.85%

Related to plan liabilities (3) 1 (2) 1 12 13

Percentage of plan liabilities -2.48% 0.84% -0.76% 0.45% 10.22% 5.18%