Food Lion 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

low-cost supermarket format with the opening of two Red Market stores

in Belgium and one in Romania. More will come in 2010.

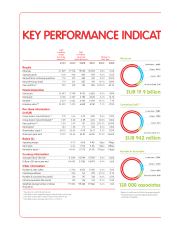

In 2009, our store network grew by 59 stores to 2 732 stores at year-

end. We also continued to seize opportunities in our markets and to

strengthen our market positions through acquisitions. In Greece, we

acquired a small chain of 11 supermarkets and a distribution center,

whereas in Bucharest, Romania, we added four supermarkets to the

network. Our efforts to obtain all the shares of Alfa Beta in Greece led

to the acquisition of an additional 24.7% of the minority shares. The

Balkans are an area that we have clearly marked for future accelerated

growth. During the year, we acted decisively to respond to the short-

term pressures of the global economy, taking steps to manage our

costs tightly and use the savings to fund price investments and sales

building initiatives. Through a sustainable combination of gross margin

improvements with thorough cost management, our Group was able

to maintain its operating margin at industry-high levels. The Group’s

operating profit increased by 4.2% at actual exchange rates.

Based on our solid 2009 performance, our clear strategy for the future

and our confidence in the Company’s strong banners, the Board of

Directors will propose to the Ordinary General Meeting on May 27, 2010

to increase the dividend by 8.1% to EUR 1.6, EUR 1.2 net of 25% Belgian

withholding tax.

Over its recent history, our Group has created a strong platform of

leading brands and market shares, best-in-class industry profitability

and a solid balance sheet. All of these together form a launching pad

that can now enable us to accelerate our growth and to capitalize on

these strengths. Our Group is ready to deal with the changed consumer

environment and competitive and economic challenges. That is why we

have rallied our operating companies around a ”New Game Plan,” a

comprehensive approach to achieve superior revenue and operating

profit growth.

Our ”New Game Plan” is developed around four breakthrough themes,

the first one being operating as one Group based on a common vision

and a common set of values around which we mobilize our associates.

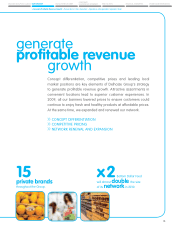

The plan aims at accelerating growth through a greater emphasis on

price competitiveness resulting in value leadership in all our markets. All

our operating companies are planning new and more aggressive pricing

strategies from the start of 2010 to further narrow the gap with each

market’s leading price competitor. We will further maximize sales within

our existing stores and continue to respond to consumers’ increasing

interest for health and wellness and corporate responsibility.

Our revenue growth will be further accelerated by additional drivers

including our low-cost supermarket formats, Bottom Dollar Food and Red

Market and our newer markets of Greece, Romania and Indonesia. In

these newer operations, our Group plans to triple the openings in these

newer operations to 250 new stores over the next three years. Already

in 2010, our Group plans to open 120 to 130 new stores and to remodel

approximately 100 stores. Our operating companies will continue to

focus on targeted acquisitions to reinforce our densities in existing and

adjacent markets. Next year, our Group plans approximately EUR 800

million in capital expenditures, a significant step-up compared to EUR

520 million in 2009. These investments will continue to focus on store

openings, renewals and innovation across all aspects of our operations.

Growth acceleration will be made possible by excellence in associate

development. We will continue to leverage our Group’s signature training

and career development programs. We are convinced that our Group’s

strong culture will further strengthen our 138 000 associates’ best-in-class

sense of engagement and commitment.

To fund this growth program, Delhaize Group will become even more

nimble as an organization. We plan to increase efficiencies through

executional excellence. The initiatives to accelerate growth will be funded

by cost savings. We have a respectable track record when it comes to

cost optimization, having achieved EUR 60 million in cost reductions in

2008 and EUR 100 million in 2009. Our plan is to reach EUR 300 million

in additional annual gross SG&A savings by 2012, largely the result of

efficiencies at regional or global levels. A case in point is the recently

announced transformation of our independent U.S. companies into

"Delhaize America," one integrated organization with shared services,

but unique go-to-market strategies. For our Group this is without any

doubt the most significant event at our U.S. operations since the buyout

of the minority shareholders in the U.S. in 2001. On the other side of the

Atlantic, Delhaize Belgium will continue its successful “

Excel 2008-2010”

plan to drive sales and increase efficiencies.

True to our heritage of being connected to the communities in which we

operate, our Group is committed to give back to society. All our operating

companies have programs that are a testimony to their local integration

and corporate responsibility. In 2009, we published our second

Corporate Responsibility report which again included an impressive list

of achievements in this domain.

To conclude, we want to thank you, our shareholders, for your confidence

and support. Although we cannot control the macro-economic

environment, we are in control of our business. Our ”New Game Plan”

will position Delhaize Group to come out of these difficult economic times

not only as the highly profitable food retailer it is already today, but also

as one of the fastest growing food retailers.

Count Jacobs de Hagen,

Chairman of the

Board of Directors

Pierre-Olivier Beckers,

President and

Chief Executive Officer

> Financial Highlights > Profile > Letter from the Chairman and the CEO > Overview of Operating Companies > Our New Game Plan > Our Vision and Values

…TO A NEW GAME

PLAN FOR YEARS TO

COME

› Operating as One Group

› Accelerating Growth

› Excelling in Associate Development

› Pursuing Executional Excellence

DELHAIZE GROUP AT A GLANCE OUR STRATEGY

OUR ACTIVITIES IN 2009 CORPORATE

GOVERNANCE STATEMENT RISK FACTORS FINANCIAL STATEMENTS

SHAREHOLDER INFORMATION