Food Lion 2009 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146 - Delhaize Group - Annual Report 2009

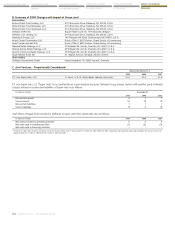

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

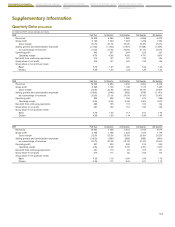

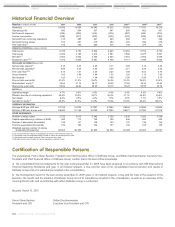

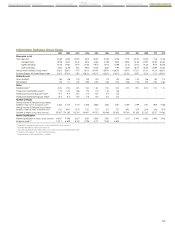

Historical Financial Overview

Results (in millions of EUR) 2009 2008 2007 2006 2005

(4)

2004

(4)

2003

(4)

Revenues 19 938 19 024 18 943 19 215 18 345 17 597 18 215

Operating profit 942 904 937 947 900 862 801

Net financial expenses (202) (202) (332) (276) (297) (305) (319)

Income tax expense (228) (217) (204) (245) (224) (200) (188)

Net profit from continuing operations 512 485 401 426 380 357 294

Net profit (Group share) 514 467 410 352 365 296 279

Free cash flow(1) 518 150 326 215 149 373 441

FINANCIAL POSITION (in millions of EUR)

Total assets 9 748 9 700 8 822 9 295 10 254 8 703 8 766

Total equity 4 409 4 195 3 676 3 561 3 596 2 875 2 801

Net debt(1) 2 063 2 402 2 244 2 635 2 943 2 608 3 028

Enterprise value(1)(3) 7 472 6 849 8 281 8 726 8 171 7 849 6 805

PER SHARE INFORMATION (in EUR)

Net earnings (basic)(2) 5.16 4.70 4.20 3.71 3.89 3.19 3.03

Net earnings (diluted)(2) 5.08 4.59 4.04 3.55 3.71 3.09 3.02

Free cash flow(1)(2) 5.19 1.51 3.35 2.27 1.59 4.03 4.79

Gross dividend 1.60 1.48 1.44 1.32 1.20 1.12 1.00

Net dividend 1.20 1.11 1.08 0.99 0.90 0.84 0.75

Pay-out ratio (net profit) 31.4% 31.9% 35.2% 36.4% 31.4% 35.5% 33.2%

Shareholders’ equity(3) 43.54 41.19 36.17 36.55 37.65 30.34 29.93

Share price (year-end) 53.62 44.20 60.20 63.15 55.20 55.95 40.78

RATIOS (%)

Operating margin 4.7% 4.8% 4.9% 4.9% 4.9% 4.9% 4.4%

Effective tax rate of continuing operations 30.8% 30.9% 33.7% 36.5% 37.1% 35.9% 39.0%

Net margin 2.6% 2.5% 2.2% 1.8% 2.0% 1.7% 1.5%

Net debt to equity(1) 46.8% 57.3% 61.0% 74.0% 81.8% 90.6% 108.1%

CURRENCY INFORMATION

Average EUR per USD rate 0.7169 0.6799 0.7297 0.7964 0.8038 0.8039 0.8840

EUR per USD rate at year-end 0.6942 0.7185 0.6793 0.7593 0.8477 0.7342 0.7918

OTHER INFORMATION

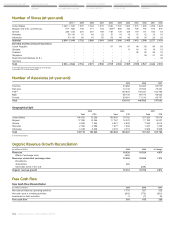

Number of sales outlets 2 732 2 673 2 545 2 705 2 636 2 565 2 559

Capital expenditures (in millions of EUR) 520 714 729 700 636 494 463

Number of associates (thousands) 138 141 138 143 137 138 142

Full-time equivalents (thousands) 104 106 104 107 102 102 105

Weighted average number of shares

outstanding (thousands) 99 803 99 385 97 666 94 939 93 934 92 663 92 097

(1) See “Financial Review” section for explanation of the non GAAP financial measures.

(2) Calculated using the weighted average number of shares outstanding over the year.

(3) Calculated using the total number of shares at the end of the year.

(4) Not adjusted for reclassification of German operations to discontinued.

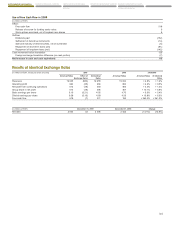

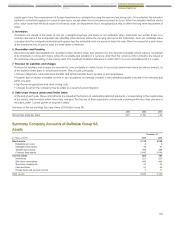

Certification of Responsible Persons

The undersigned, Pierre-Olivier Beckers, President and Chief Executive Officer of Delhaize Group, and Stéfan Descheemaeker, Executive Vice-

President and Chief Financial Officer of Delhaize Group, confirm that to the best of their knowledge:

a) the consolidated financial statements for the year ending December 31, 2009 have been prepared in accordance with IFRS (International

Financial Reporting Standards) and give, in all material respects, a true and fair view of the consolidated financial position and results of

Delhaize Group and of its subsidiaries included in the consolidation;

b) the management report for the year ending December 31, 2009 gives, in all material respects, a true and fair view of the evolution of the

business, the results and the situation of Delhaize Group and of its subsidiaries included in the consolidation, as well as an overview of the

most significant risks and uncertainties with which Delhaize Group is confronted.

Brussels, March 10, 2010

Pierre-Olivier Beckers Stéfan Descheemaeker

President and CEO Executive Vice-President and CFO