Food Lion 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

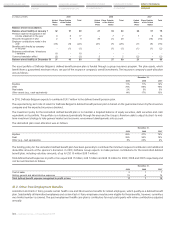

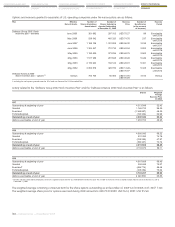

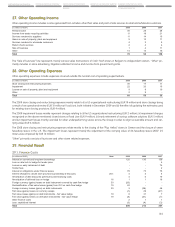

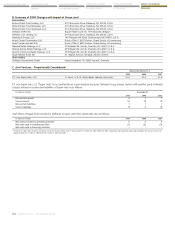

27. Other Operating Income

Other operating income includes income generated from activities other than sales and point of sale services to retail and wholesale customers.

(in millions of EUR) 2009 2008 2007

Rental income 30 28 28

Income from waste recycling activities 11 18 21

Services rendered to suppliers 11 14 15

Gains on sale of property, plant and equipment 5 12 11

Services rendered to wholesale customers 4 3 2

Return check services 2 4 4

Sale of business 1 4 11

Other 14 13 16

Total 78 96 108

The “Sale of business” line represents mainly various sales transactions of Cash Fresh stores in Belgium to independent owners. “Other” pri-

marily includes in-store advertising, litigation settlement income and income from government grants.

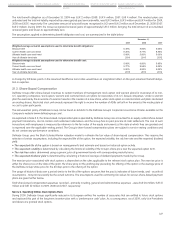

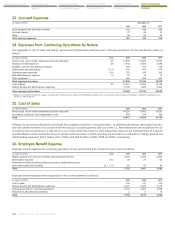

28. Other Operating Expenses

Other operating expenses include expenses incurred outside the normal cost of operating supermarkets.

(in millions of EUR) 2009 2008 2007

Store closing and restructuring expenses 36 17 11

Impairment 22 20 15

Losses on sale of property, plant and equipment 9 8 10

Other 2 5 -

Total 69 50 36

The 2009 store closing and restructuring expenses mainly relate to (i) a US organizational restructuring (EUR 19 million) and store closings being

a result of an operational review (EUR 10 million at Food Lion), both initiated in December 2009 and (ii) the effect of updating the estimates used

for existing store closing provisions (EUR 4 million).

The 2009 impairment losses mainly represent charges relating to (i) the US organizational restructuring (EUR 2 million), (ii) impairment charges

recognized on the above mentioned closed stores at Food Lion (EUR 9 million), (iii) early retirement of various software solutions (EUR 5 million)

and (iv) impairment losses mainly recorded for other underperforming stores across the Group in order to align recoverable amount and car-

rying value (EUR 6 million).

The 2008 store closing and restructuring expenses relate mainly to the closing of five “Plus Hellas” stores in Greece and the closure of seven

Sweetbay stores in the U.S. The impairment losses represent mainly the adjustment of the carrying value of 26 Sweetbay stores (2007: 25

stores were impaired by EUR 14 million).

“Other” primarily consists of hurricane and other storm related expenses.

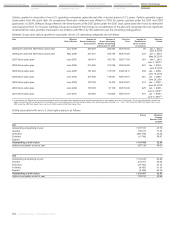

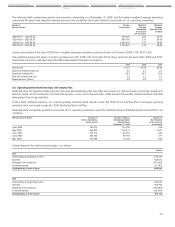

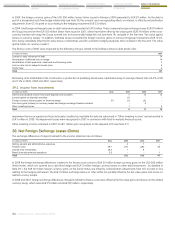

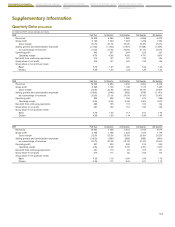

29. Financial Result

29.1. Finance Costs

(in millions of EUR) Note 2009 2008 2007

Interest on current and long-term borrowings 120 130 159

Loss on rate lock to hedge for tender price - - 4

Losses on early retirement of debt - - 74

Tender fees - - 2

Interest on obligations under finance leases 76 73 76

Interest charged to closed store provisions (unwinding of discount) 20.1 4 3 4

Amortization of debt discounts (premiums) and financing costs 4 6 15

Amortization of deferred loss on hedge 16 1 1 16

Foreign currency (gains) losses on debt instrument covered by cash flow hedge 30 (20) - -

Reclassification of fair value losses (gains) from OCI on cash flow hedge 19 22 - -

Foreign currency losses (gains) on debt instruments 30 3 (26) 46

Fair value (gains) losses on currency swaps (1) 29 (47)

Fair value losses (gains) on debt instruments - fair value hedge 19 8 31 7

Fair value (gains) losses on derivative instruments - fair value hedge 19 (8) (31) (7)

Other finance costs 2 1 1

Less: capitalized interest (3) (4) (3)

Total 208 213 347