Food Lion 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

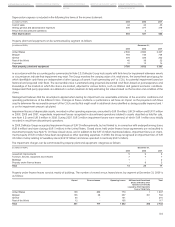

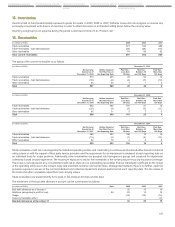

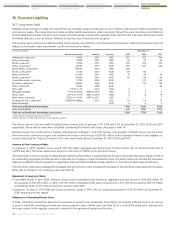

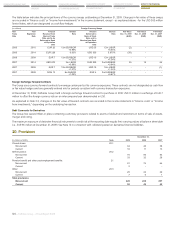

As of December 31, 2009, 2008 and 2007, USD 12 million (EUR 9 million), USD 18 million (EUR 13 million) and USD 30 million (EUR 20 million)

in aggregate principal amount of the notes was outstanding, respectively. Cash committed to fund the escrow and not available for general

corporate purposes is considered restricted. At December 31, 2009, 2008 and 2007, restricted securities of USD 15 million (EUR 10 million), USD

21 million (EUR 15 million) and USD 32 million (EUR 22 million), respectively, were recorded in investment in securities on the balance sheet.

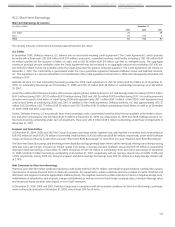

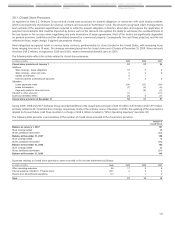

Long-term Debt by Currency

The main currencies in which Delhaize Group’s long-term (excluding finance leases) debt are denominated are as follows:

(in millions of EUR) December 31,

2009 2008 2007

U.S. dollar 1 281 1 112 1 060

Euro 665 980 961

Total 1 946 2 092 2 021

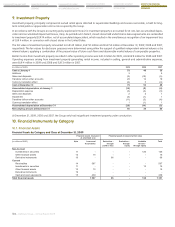

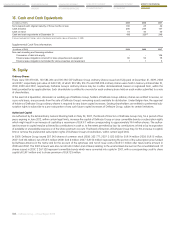

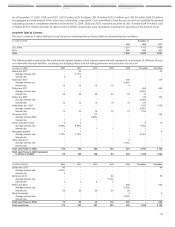

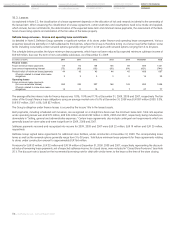

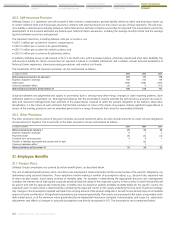

The following table summarizes the contractually agreed (undiscounted) interest payments and repayments of principals of Delhaize Group’s

non-derivative financial liabilities, excluding any hedging effects and not taking premiums and discounts into account:

(in millions of USD) 2010 2011 2012 2013 2014 Thereafter Fair Value

Notes due 2011 - 50 - - - - 53

Average interest rate - 8.13% - - - - -

Interest due 4 2 - - - - -

Notes due 2014 - - - - 300 - 318

Average interest rate - - - - 5.88% - -

Interest due 18 18 18 18 9 - -

Notes due 2017 - - - - - 450 489

Average interest rate - - - - - 6.50% -

Interest due 29 29 29 29 29 73 -

Notes due 2027 - - - - - 126 136

Average interest rate - - - - - 8.05% -

Interest due 10 10 10 10 10 127 -

Debentures due 2031 - - - - - 805 1 029

Average interest rate - - - - - 9.00% -

Interest due 72 72 72 72 72 1 195 -

Term loan 2012 - - 113 - - - 105

Average Interest Rate - - 0.88% - - - -

Interest due 1 1 1 - - - -

Senior and other notes 2 2 - - - 9 14

Average interest rate 6.58% 6.58% - - - 7.06% -

Interest due 1 1 1 1 1 1 -

Mortgages payable 1 1 - - - 1 4

Average interest rate 7.75% 7.75% - - - 8.25% -

Interest due - - - - - - -

Other debt 2014 - - - - 6 - 7

Average interest rate - - - - 7.00% - -

Interest due - - - - - - -

Total cash flows in USD 138 186 244 130 427 2 787 2 155

Total cash flows in USD translated

in millions of EUR 96 129 169 90 296 1 935 1 496

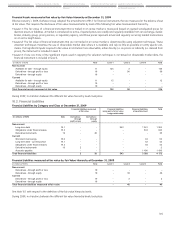

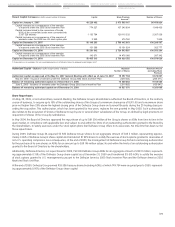

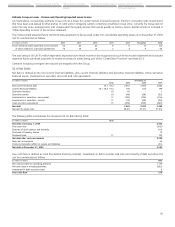

(in millions of EUR) 2010 2011 2012 2013 2014 Thereafter Fair Value

Bonds due 2010 40 - - - - - 40

Average interest rate 3.90% - - - - - -

Interest due 2 - - - - - -

Bond due 2013 - - - 80 - - 86

Average interest rate - - - 5.10% - - -

Interest due 4 4 4 4 - - -

Notes due 2014 - - - - 500 - 534

Average interest rate - - - - 5.63% - -

Interest due 28 28 28 28 28 - -

Bank borrowings - - - - 2 - 2

Average interest rate - - - - 2.00% - -

Interest due - - - - - - -

Total cash flows in EUR 74 32 32 112 530 - 662

Total cash flows 170 161 201 202 826 1 935 2 158