Dollar General 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. Current and long-term obligations (Continued)

senior subordinated toggle notes due 2017 (the ‘‘Senior Subordinated Notes’’), which mature on

July 15, 2017, pursuant to an indenture, dated as of July 6, 2007 (the ‘‘senior subordinated indenture’’).

The Senior Notes and the Senior Subordinated Notes are collectively referred to herein as the ‘‘Notes’’.

The senior indenture and the senior subordinated indenture are collectively referred to herein as the

‘‘indentures’’.

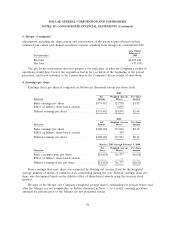

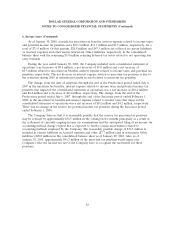

Interest on the Notes is payable on January 15 and July 15 of each year. Interest on the Senior

Notes is payable in cash. Cash interest on the Senior Subordinated Notes accrues at a rate of 11.875%

per annum. For certain interest periods, the Company may elect to pay interest on the Senior

Subordinated Notes by increasing the principal amount of the Senior Subordinated Notes or issuing

new senior subordinated notes (‘‘PIK interest’’) at a rate of 12.625% per annum. Through January 29,

2010, all interest on the Notes has been paid in cash.

The Notes are fully and unconditionally guaranteed by each of the existing and future direct or

indirect wholly owned domestic subsidiaries that guarantee the obligations under the Company’s Credit

Facilities.

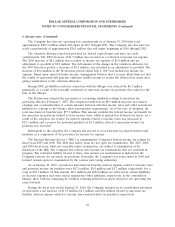

The Company may redeem some or all of the Notes at any time at redemption prices described or

set forth in the indentures. In addition, the holders of the Notes can require the Company to redeem

the Notes at 101% of the aggregate principal amount outstanding in the event of certain change in

control events. In connection with the Company’s November 2009 initial public offering, as further

discussed in Note 2, the Company repurchased $195.7 million of the Senior Notes and $205.2 million of

the Senior Subordinated Notes at redemption prices of 110.625% and 111.875%, respectively, plus

accrued and unpaid interest, resulting in a pretax loss totaling $50.6 million. In January 2009 and

January 2008, the Company repurchased $44.1 million and $25.0 million, respectively, of the Senior

Subordinated Notes, resulting in pretax gains of $3.8 million and $4.9 million, respectively. Pretax gains

and losses associated with the redemption of the Notes are reflected in Other (income) expense in the

consolidated statements of operations.

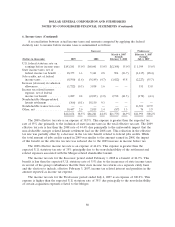

The indentures contain certain covenants, including, among other things, covenants that limit the

Company’s ability to incur additional indebtedness, create liens, sell assets, enter into transactions with

affiliates, or consolidate or dispose of all of its assets.

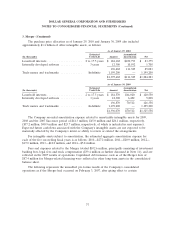

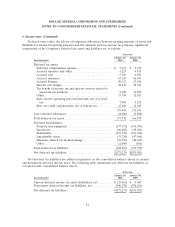

Scheduled debt maturities for the Company’s fiscal years listed below are as follows (in thousands):

2010—$3,572; 2011—$1,177; 2012—$802; 2013—$292; 2014—$1,963,815; thereafter—$1,448,417.

On July 6, 2007, immediately after the completion of the Merger, the Company completed a cash

tender offer to purchase any and all of its $200 million principal amount of 85⁄8% Notes due June 2010

(the ‘‘2010 Notes’’). Approximately 99% of the 2010 Notes were validly tendered and accepted for

payment. The tender offer included a consent payment equal to 3% of the par value of the 2010 Notes,

and such payments along with associated settlement costs totaling $6.2 million were paid and reflected

as Other (income) expense in the 2007 Successor period presented.

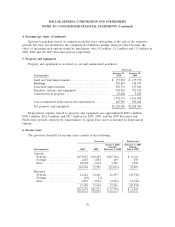

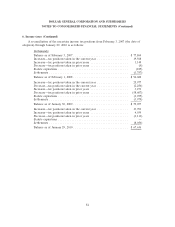

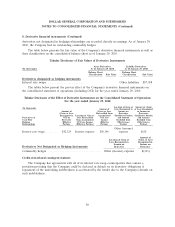

8. Derivative financial instruments

The Company is exposed to certain risks arising from both its business operations and economic

conditions. The Company principally manages its exposures to a wide variety of business and

operational risks through management of its core business activities. The Company manages economic

risks, including interest rate, liquidity, and credit risk, primarily by managing the amount, sources, and

87