Dollar General 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

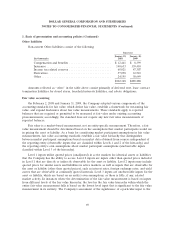

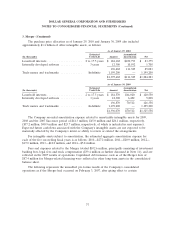

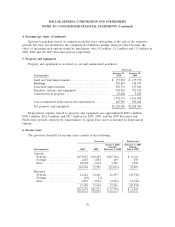

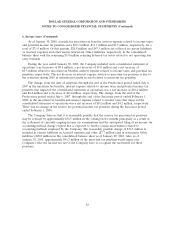

3. Merger (Continued)

adjustments, including the depreciation and amortization of the assets acquired based on their

estimated fair values and changes in interest expense resulting from changes in consolidated debt:

Year Ended

February 1,

(In thousands) 2008

Revenue ............................................... $9,495,246

Net loss ............................................... (57,939)

The pro forma information does not purport to be indicative of what the Company’s results of

operations would have been if the acquisition had in fact occurred at the beginning of the period

presented, and is not intended to be a projection of the Company’s future results of operations.

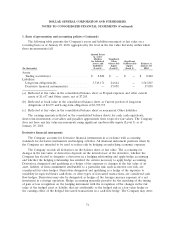

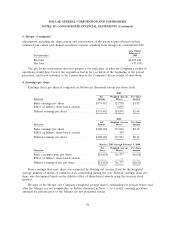

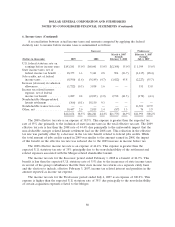

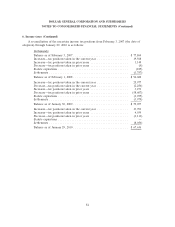

4. Earnings per share

Earnings (loss) per share is computed as follows (in thousands except per share data):

2009

Net Weighted Average Per Share

Successor Income Shares Amount

Basic earnings per share ................ $339,442 322,778 $1.05

Effect of dilutive share-based awards ....... 2,058

Diluted earnings per share ............... $339,442 324,836 $1.04

2008

Net Weighted Average Per Share

Successor Income Shares Amount

Basic earnings per share ................ $108,182 317,024 $0.34

Effect of dilutive share-based awards ....... 479

Diluted earnings per share ............... $108,182 317,503 $0.34

March 6, 2007 through February 1, 2008

Net Weighted Average Per Share

Successor Loss Shares Amount

Basic earnings (loss) per share ............. $(4,818) 316,777 $(0.02)

Effect of dilutive share-based awards ........ —

Diluted earnings (loss) per share ........... $(4,818) 316,777 $(0.02)

Basic earnings (loss) per share was computed by dividing net income (loss) by the weighted

average number of shares of common stock outstanding during the year. Diluted earnings (loss) per

share was determined based on the dilutive effect of share-based awards using the treasury stock

method.

Because of the Merger, the Company’s weighted average shares outstanding for periods before and

after the Merger are not comparable, as further discussed in Note 1. As a result, earnings per share

amounts for periods prior to the Merger are not presented herein.

78