Dollar General 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Merger (Continued)

Merger as a subsidiary of Buck. The Company’s results of operations after July 6, 2007 include the

effects of the Merger.

The aggregate purchase price was approximately $7.1 billion, including direct costs of the Merger,

and was funded primarily through debt financings as described more fully below in Note 7 and cash

equity contributions from KKR, GS Capital Partners VI Fund, L.P. and affiliated funds (affiliates of

Goldman, Sachs & Co.), and other equity co-investors (collectively, the ‘‘Investors’’ of approximately

$2.8 billion (316.2 million shares of new common stock, $0.875 par value per share, valued at $8.75 per

share). Also in connection with the Merger, certain of the Company’s management employees invested

in and were issued new shares, representing less than 1% of the outstanding shares, in the Company.

Pursuant to the terms of the Merger Agreement, the former holders of the Predecessor’s common

stock, par value $0.50 per share, received $22.00 per share, or approximately $6.9 billion, and all such

shares were acquired as a result of the Merger.

As discussed in Note 1, the Merger was accounted for as a reverse acquisition in accordance with

applicable purchase accounting provisions. Because of this accounting treatment, the Company’s assets

and liabilities have properly been accounted for at their estimated fair values as of the Merger date.

The aggregate purchase price has been allocated to the tangible and intangible assets acquired and

liabilities assumed based upon an assessment of their relative fair values as of the Merger date.

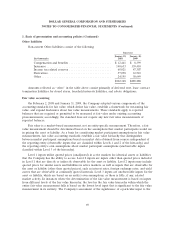

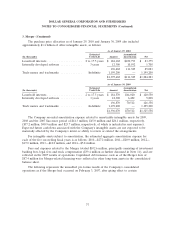

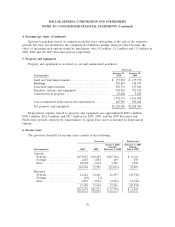

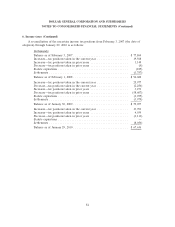

The allocation of the purchase price is as follows (in thousands):

Cash and cash equivalents .................................. $ 349,615

Short-term investments .................................... 30,906

Merchandise inventories ................................... 1,368,130

Income taxes receivable .................................... 40,199

Deferred income taxes .................................... 57,176

Prepaid expenses and other current assets ...................... 63,204

Property and equipment, net ................................ 1,301,119

Goodwill .............................................. 4,338,589

Intangible assets ......................................... 1,396,612

Other assets, net ......................................... 66,537

Current portion of long-term obligations ....................... (7,088)

Accounts payable ........................................ (585,518)

Accrued expenses and other ................................ (306,394)

Income taxes payable ..................................... (84)

Long-term obligations ..................................... (267,927)

Deferred income taxes .................................... (540,675)

Other liabilities .......................................... (208,710)

Total purchase price assigned ................................ $7,095,691

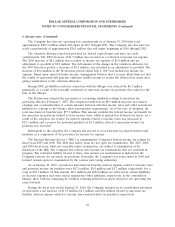

The purchase price allocation included approximately $4.34 billion of goodwill, none of which is

expected to be deductible for tax purposes. The goodwill balance at January 30, 2009 decreased

$6.3 million from the balance at February 1, 2008 due to an adjustment to income tax contingencies as

further discussed in Note 6.

76