Dollar General 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

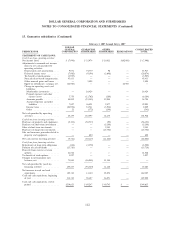

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Related party transactions (Continued)

Goldman, Sachs & Co. is a counterparty to an amortizing interest rate swap with a notional

amount of $396.7 million and $433.3 million as of January 29, 2010 and January 30, 2009, respectively,

entered into in connection with the Term Loan Facility. The Company paid Goldman, Sachs & Co.

approximately $17.9 million and $9.5 million in 2009 and 2008, respectively, and Goldman, Sachs & Co.

paid the Company $0.8 million in the 2007 Successor period pursuant to the interest rate swap as

further discussed in Note 8.

The Company entered into a sponsor advisory agreement, dated July 6, 2007, with KKR and

Goldman, Sachs & Co. pursuant to which those entities provided management and advisory services to

the Company. Under the terms of the sponsor advisory agreement, among other things, the Company

was obliged to pay to those entities an aggregate, initial management fee of $5.0 million annually.

Upon the completion of the Company’s initial public offering discussed in Note 2, pursuant to the

advisory agreement, the Company paid a fee of $63.6 million from cash generated from operations to

KKR and Goldman, Sachs & Co., which amount included a transaction fee equal to 1%, or

$4.8 million, of the gross primary proceeds from the offering accounted for as a cost of raising equity

and a corresponding reduction to Additional paid-in capital; and approximately $58.8 million in

connection with its termination, which is included in SG&A expenses for 2009. Including the

transaction and termination fees discussed above, the total management fees and other expenses

incurred for the years ended January 29, 2010 and January 30, 2009 and the Successor period ended

February 1, 2008 totaled $68.0 million, $6.6 million and $2.9 million, respectively. In addition, on

July 6, 2007, the Company entered into a separate indemnification agreement with the parties to the

sponsor advisory agreement, pursuant to which the Company agreed to provide customary

indemnification to such parties and their affiliates.

From time to time, the Company uses Capstone Consulting, LLC, a team of executives who work

exclusively with KKR portfolio companies providing certain consulting services. The Chief Executive

Officer of Capstone served on the Company’s Board of Directors until March 2009. Although neither

KKR nor any entity affiliated with KKR owns any of the equity of Capstone, prior to January 1, 2007

KKR had provided financing to Capstone. The aggregate fees incurred for Capstone services for the

Successor periods ended January 29, 2010, January 30, 2009 and February 1, 2008 totaled $0.2 million,

$3.0 million and $1.9 million, respectively.

The Company purchased certain of its Senior Notes and Senior Subordinated Notes held by

Goldman Sachs & Co. in the amount of $25.0 million in the 2007 Successor period as further discussed

in Note 7, and paid commissions of less than $0.1 million in connection therewith.

The Company entered into an underwriting agreement with KKR Capital Markets (an affiliate of

KKR), Goldman, Sachs & Co., Citigroup Global Markets Inc., and several other entities to serve as

underwriters in connection with its initial public offering in November 2009. The Company provided

underwriting discounts of approximately $27.4 million pursuant to the underwriting agreement,

approximately $6.0 million of which was provided to each of (a) KKR Capital Markets; (b) Goldman,

Sachs & Co.; and (c) Citigroup Global Markets Inc. The Company paid approximately $3.3 million in

expenses related to the initial public offering (excluding underwriting discounts and commissions),

including the offering-related expenses of the selling shareholder which the Company was required to

pay under the terms of an existing registration rights agreement.

102