Dollar General 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued)

For the year ended January 29, 2010, the fair value method of accounting for share-based awards

resulted in share-based compensation expense (a component of SG&A expenses) and a corresponding

reduction in net income before income taxes in the amount of $22.2 million ($13.6 million net of tax)

of which $11.7 million ($7.1 million net of tax) was related to stock options, $7.2 million ($4.4 million

net of tax) was related to equity appreciation rights and $3.3 million ($2.0 million net of tax) was

related to restricted stock as discussed in more detail below. Of these amounts, $6.9 million of the

expense for equity appreciation rights and $2.5 million of the expense for restricted stock was

attributable to the vesting of certain awards in conjunction with the Company’s initial public offering

discussed in Note 2.

For the year ended January 30, 2009, the Company recorded share-based compensation expense

and a corresponding reduction in net income before income taxes in the amount of $10.0 million

($6.1 million net of tax) of which $8.9 million ($5.4 million net of tax) was related to stock options and

$1.1 million ($0.7 million net of tax) was related to restricted stock.

The 2007 Successor statement of operations reflects share-based compensation expense and a

corresponding reduction of pre-tax income in the amount of $3.8 million ($2.4 million net of tax). The

Company recognized $45.4 million of share-based compensation expense in the 2007 Predecessor

statement of operations ($28.5 million net of tax), including $6.0 million of compensation expense prior

to the Merger included in SG&A expenses comprised of $2.3 million for stock options and $3.7 million

for restricted stock and restricted stock units. The remaining $39.4 million of such expense related

directly to the Merger is reflected in Transaction and related costs in the consolidated statement of

operations for the Predecessor period ended July 6, 2007, for the accelerated vesting of stock options

($18.7 million) and restricted stock and restricted stock units ($20.7 million).

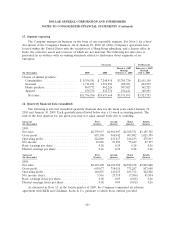

The fair value of each option grant is separately estimated by applying the Black-Scholes-Merton

option pricing valuation model. The weighted average for key assumptions used in determining the fair

value of options granted in the years ended January 29, 2010 and January 30, 2009, the Successor

period ended February 1, 2008, and the Predecessor period ended July 6, 2007, and a summary of the

methodology applied to develop each assumption, are as follows:

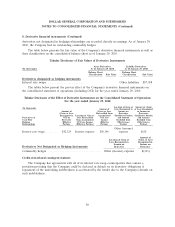

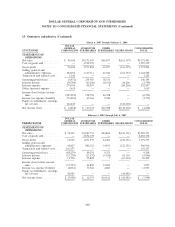

Successor Predecessor

January 29, January 30, February 1, July 6,

2010 2009 2008 2007

Expected dividend yield ....................... 0% 0% 0% 0.91%

Expected stock price volatility ................... 41.2% 40.2% 41.9% 18.5%

Weighted average risk-free interest rate ............ 2.8% 2.8% 4.6% 4.5%

Expected term of options (years) ................ 7.4 7.4 7.5 5.7

Expected dividend yield—This is an estimate of the expected dividend yield on the Company’s

stock. Prior to the Merger this estimate was based on historical dividend payment trends. Subsequent to

the Merger, the Company is subject to limitations on the payment of dividends under its Credit

Facilities as further discussed in Note 7. An increase in the dividend yield will decrease compensation

expense.

Expected stock price volatility—This is a measure of the amount by which the price of the

Company’s common stock has fluctuated or is expected to fluctuate. Prior to the Merger, the Company

used actual historical changes in the market price of the Company’s common stock and implied

98