Dollar General 2009 Annual Report Download - page 68

Download and view the complete annual report

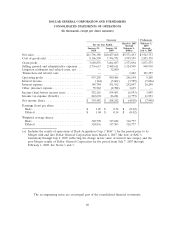

Please find page 68 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Effective December 31, 2008, we entered into a $475.0 million interest rate swap in order to

mitigate an additional portion of the variable rate interest exposure under the Credit Facilities. This

swap is scheduled to mature on January 31, 2013. Under the terms of this agreement we swapped one

month LIBOR rates for fixed interest rates, resulting in the payment of a fixed rate of 5.06% on a

notional amount of $475.0 million through April 2010, $400.0 million from May 2010 to October 2011,

and $300.0 million to maturity.

A change in interest rates on variable rate debt impacts our pre-tax earnings and cash flows;

whereas a change in interest rates on fixed rate debt impacts the economic fair value of debt but not

our pre-tax earnings and cash flows. Our interest rate swaps qualify for hedge accounting as cash flow

hedges. Therefore, changes in market fluctuations related to the effective portion of these cash flow

hedges do not impact our pre-tax earnings until the accrued interest is recognized on the derivatives

and the associated hedged debt. Based on our variable rate borrowing levels and interest rate swaps

outstanding during 2009 and 2008, the annualized effect of a one percentage point change in variable

interest rates would have resulted in a pretax reduction of our earnings and cash flows of

approximately $5.6 million in 2009 and $6.2 million in 2008.

The conditions and uncertainties in the global credit markets have substantially increased the

credit risk of other counterparties to our swap agreements. In the event such counterparties fail to

perform under our swap agreements and we are unable to enter into new swap agreements on terms

favorable to us, our ability to effectively manage our interest rate risk may be materially impaired. We

attempt to manage counterparty credit risk by periodically evaluating the financial position and

creditworthiness of such counterparties, monitoring the amount for which we are at risk with each

counterparty, and where possible, dispersing the risk among multiple counterparties. There can be no

assurance that we will manage or mitigate our counterparty credit risk effectively.

57