Dollar General 2009 Annual Report Download - page 67

Download and view the complete annual report

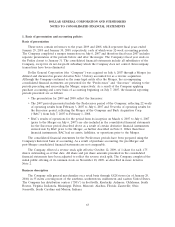

Please find page 67 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.that an entity should make about events or transactions that occurred after the balance sheet date. In

February 2010 minor modifications were made to this guidance. The future effects of the adoption of

these standards on our consolidated financial statements will be dependent upon the materiality of

future events which cannot be predicted.

We adopted the additional disclosure provisions of the ASC Derivatives and Hedging Topic during

the first quarter of 2009. These standards require entities to provide greater transparency through

additional disclosures about how and why an entity uses derivative instruments, how derivative

instruments and related hedged items are accounted for, and how derivative instruments and related

hedged items affect an entity’s financial position, results of operations, and cash flows. The adoption of

these standards is not expected to have a material effect on our consolidated financial statements in the

future.

We changed our accounting for fair value of our nonfinancial assets and liabilities in connection

with the adoption of certain provisions of the ASC Fair Value Measurements and Disclosures Topic

effective January 31, 2009. The effects of the adoption of these standards on our future consolidated

financial statements will be dependent upon the materiality of future events which cannot be predicted.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Financial Risk Management

We are exposed to market risk primarily from adverse changes in interest rates, and to a lesser

degree commodity prices. To minimize this risk, we may periodically use financial instruments, including

derivatives. As a matter of policy, we do not buy or sell financial instruments for speculative or trading

purposes and all derivative financial instrument transactions must be authorized and executed pursuant

to approval by the Board of Directors. All financial instrument positions taken by us are intended to be

used to reduce risk by hedging an underlying economic exposure. Because of high correlation between

the derivative financial instrument and the underlying exposure being hedged, fluctuations in the value

of the financial instruments are generally offset by reciprocal changes in the value of the underlying

economic exposure.

Interest Rate Risk

We manage our interest rate risk through the strategic use of fixed and variable interest rate debt

and, from time to time, derivative financial instruments. Our principal interest rate exposure relates to

outstanding amounts under our Credit Facilities. As of January 29, 2010, our Credit Facilities provide

for variable rate borrowings of up to $2.995 billion including availability of $1.031 billion under our

ABL Facility, subject to the borrowing base. In order to mitigate a portion of the variable rate interest

exposure under the Credit Facilities, we entered into interest rate swaps which became effective on

July 31, 2007. Pursuant to the swaps, we swapped three month LIBOR rates for fixed interest rates,

resulting in the payment of an all-in fixed rate of 7.68% on an original notional amount of $2.0 billion

originally scheduled to amortize on a quarterly basis until maturity at July 31, 2012.

In October 2008, a counterparty to one of our 2007 swap agreements defaulted. We terminated

this agreement and in November 2008 we subsequently cash settled the swap. As of January 29, 2010,

the notional amount under the remaining 2007 swaps is $793.3 million.

Effective February 28, 2008, we entered into a $350.0 million step-down interest rate swap in order

to mitigate an additional portion of the variable rate interest exposure under the Credit Facilities.

Under the terms of this agreement we swapped one month LIBOR rates for fixed interest rates,

resulting in the payment of a fixed rate of 5.58% on a notional amount of $350.0 million for the first

year and $150.0 million for the second year. This contract expired on February 28, 2010.

56