Dollar General 2009 Annual Report Download - page 74

Download and view the complete annual report

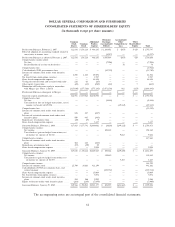

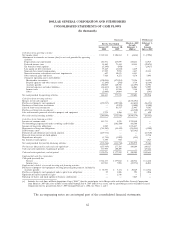

Please find page 74 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

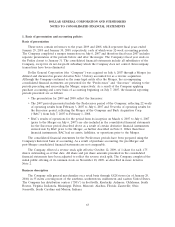

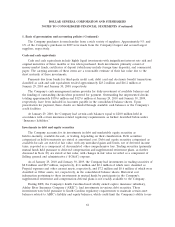

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies

Basis of presentation

These notes contain references to the years 2009 and 2008, which represent fiscal years ended

January 29, 2010 and January 30, 2009, respectively, each of which were 52-week accounting periods.

The Company completed a merger transaction on July 6, 2007 and therefore fiscal year 2007 includes

separate presentation of the periods before and after the merger. The Company’s fiscal year ends on

the Friday closest to January 31. The consolidated financial statements include all subsidiaries of the

Company, except for its not-for-profit subsidiary which the Company does not control. Intercompany

transactions have been eliminated.

Dollar General Corporation (the ‘‘Company’’) was acquired on July 6, 2007 through a Merger (as

defined and discussed in greater detail in Note 3 below) accounted for as a reverse acquisition.

Although the Company continued as the same legal entity after the Merger, the accompanying

consolidated financial statements are presented for the ‘‘Predecessor’’ and ‘‘Successor’’ relating to the

periods preceding and succeeding the Merger, respectively. As a result of the Company applying

purchase accounting and a new basis of accounting beginning on July 7, 2007, the financial reporting

periods presented are as follows:

• The presentation for 2009 and 2008 reflect the Successor.

• The 2007 periods presented include the Predecessor period of the Company, reflecting 22 weeks

of operating results from February 3, 2007 to July 6, 2007 and 30 weeks of operating results for

the Successor period, reflecting the Merger of the Company and Buck Acquisition Corp.

(‘‘BAC’’) from July 7, 2007 to February 1, 2008.

• BAC’s results of operations for the period from its inception on March 6, 2007 to July 6, 2007

(prior to the Merger on July 6, 2007) are also included in the consolidated financial statements

for the Successor period described above as a result of certain derivative financial instruments

entered into by BAC prior to the Merger, as further described in Note 8. Other than these

financial instruments, BAC had no assets, liabilities, or operations prior to the Merger.

The consolidated financial statements for the Predecessor periods have been prepared using the

Company’s historical basis of accounting. As a result of purchase accounting, the pre-Merger and

post-Merger consolidated financial statements are not comparable.

The Company effected a reverse stock split effective October 12, 2009, of 1 share for each 1.75

shares outstanding as of that date. All share and per share amounts presented in the consolidated

financial statements have been adjusted to reflect the reverse stock split. The Company completed the

initial public offering of its common stock on November 18, 2009, as described in more detail in

Note 2.

Business description

The Company sells general merchandise on a retail basis through 8,828 stores (as of January 29,

2010) in 35 states covering most of the southern, southwestern, midwestern and eastern United States.

The Company has distribution centers (‘‘DCs’’) in Scottsville, Kentucky; Ardmore, Oklahoma; South

Boston, Virginia; Indianola, Mississippi; Fulton, Missouri; Alachua, Florida; Zanesville, Ohio;

Jonesville, South Carolina and Marion, Indiana.

63