Dollar General 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes. The effective income tax rates for 2009, 2008, and the 2007 Successor and

Predecessor periods were an expense of 38.5%, an expense of 44.4%, a benefit of 26.9% and an

expense of 300.2%, respectively.

The 2009 income tax rate is greater than the expected U.S. statutory tax rate of 35% due primarily

to the inclusion of state income taxes in the total effective tax rate. The 2009 effective tax rate is less

than the 2008 rate due principally to the unfavorable impact that the non-deductible, merger-related

lawsuit settlement had on the 2008 rate. This reduction in the effective tax rate was partially offset by a

decrease in the tax rate benefit related to federal jobs credits. While the total amount of jobs credits

earned in 2009 was similar to the amount earned in 2008, the impact of this benefit on the effective tax

rate was reduced due to the 2009 increase in income before income taxes.

The 2008 income tax rate was greater than the expected U.S. statutory tax rate of 35% principally

due to the non-deductibility of the settlement and related expenses associated with the shareholder

lawsuit related to our 2007 merger.

The income tax rate for the Successor period ended February 1, 2008 is a benefit of 26.9%. This

benefit is less than the expected U.S. statutory rate of 35% due to the incurrence of state income taxes

in several of the group’s subsidiaries that file their state income tax returns on a separate entity basis

and the election to include, effective February 3, 2007, income tax related interest and penalties in the

amount reported as income tax expense.

The income tax rate for the Predecessor period ended July 6, 2007 is an expense of 300.2%. This

expense is higher than the expected U.S. statutory rate of 35% due principally to the non-deductibility

of certain acquisition related expenses.

Off Balance Sheet Arrangements

We lease three of our distribution centers. The entities involved in the ownership structure

underlying these leases meet the accounting definition of a Variable Interest Entity (‘‘VIE’’). One of

these distribution centers has been recorded as a financing obligation whereby its property and

equipment are reflected in our consolidated balance sheets. The land and buildings of the other two

distribution centers have been recorded as operating leases. We are not the primary beneficiary of

these VIEs and, accordingly, have not included these entities in our consolidated financial statements.

Other than the foregoing, we are not party to any off balance sheet arrangements.

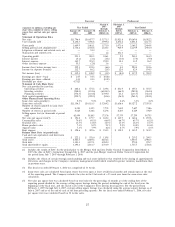

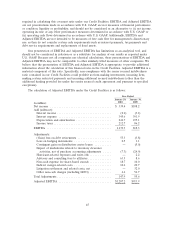

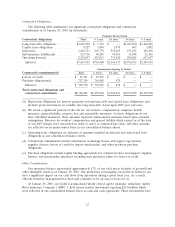

Unaudited Pro Forma Condensed Consolidated Financial Information

The following supplemental unaudited pro forma condensed consolidated statement of operations

data has been developed by applying pro forma adjustments to our historical consolidated statement of

operations. We were acquired on July 6, 2007 through a merger accounted for as a reverse acquisition.

Although we continued as the same legal entity after the merger, the accompanying unaudited pro

forma condensed consolidated financial information is presented for the Predecessor and Successor

relating to the periods preceding and succeeding the merger, respectively. As a result of the merger, we

applied purchase accounting standards and a new basis of accounting effective July 7, 2007. The

unaudited pro forma condensed consolidated statement of operations for the year ended February 1,

2008 gives effect to the merger as if it had occurred on February 3, 2007. Assumptions underlying the

pro forma adjustments are described in the accompanying notes, which should be read in conjunction

with this unaudited pro forma condensed consolidated financial statement.

The unaudited pro forma adjustments are based upon available information and certain

assumptions that we believe are reasonable under the circumstances. The unaudited pro forma

condensed consolidated financial information is presented for supplemental informational purposes

only, although we believe this information is useful in providing comparisons between years. The

37