Dollar General 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Benefit plans (Continued)

A participant’s right to claim a distribution of his or her account balance is dependent on ERISA

guidelines and Internal Revenue Service regulations. All active employees are fully vested in all

contributions to the 401(k) plan. During 2009, 2008, and the 2007 Successor and Predecessor periods,

the Company expensed approximately $8.4 million, $8.0 million, $4.3 million and $3.0 million,

respectively, for matching contributions. The Merger did not significantly impact the comparability of

such expense amounts between periods.

The Company also has a nonqualified supplemental retirement plan (‘‘SERP’’) and compensation

deferral plan (‘‘CDP’’), known as the Dollar General Corporation CDP/SERP Plan, for a select group

of management and highly compensated employees. The supplemental retirement plan is a

noncontributory defined contribution plan with annual Company contributions ranging from 2% to 12%

of base pay plus bonus depending upon age plus years of service and job grade. Under the CDP,

participants may defer up to 65% of base pay and up to 100% of bonus pay. An employee may be

designated for participation in one or both of the plans, according to the eligibility requirements of the

plans. The Company matches base pay deferrals at a rate of 100% of base pay deferral, up to 5% of

annual salary, with annual salary offset by the amount of match-eligible salary in the 401(k) plan. All

participants are 100% vested in their CDP accounts. The Company incurred compensation expense for

these plans of approximately $1.9 million in 2009, $1.2 million in 2008, $0.3 million in the 2007

Successor period and $0.5 million in the 2007 Predecessor period.

The CDP/SERP Plan assets are invested at the option of the participant in an account that mirrors

the performance of a fund or funds selected by the Company’s Compensation Committee or its

delegate (the ‘‘Mutual Fund Options’’) or, prior to the Merger, in funds selected by the Company’s

Compensation Committee or its delegate and/or in an account that mirrored the performance of the

Company’s common stock (the ‘‘Common Stock Option’’). Effective August 2, 2008, the deemed fund

options under the CDP/SERP Plan were changed to mirror the same fund options offered under the

401(k) plan.

Vested amounts are payable at the time designated by the plan upon the participant’s termination

of employment or retirement, except that participants may elect to receive an in-service distribution or

an ‘‘unforeseeable emergency hardship’’ distribution of vested amounts credited to the CDP account.

Account balances deemed to be invested in the Mutual Fund Options are payable in cash and, prior to

the Merger, account balances deemed to be invested in the Common Stock Option were payable in

shares of Dollar General common stock and cash in lieu of fractional shares.

As a result of the Merger, the CDP/SERP Plan liabilities as of the Merger date were fully funded

into an irrevocable rabbi trust. All account balances deemed to be invested in the Common Stock

Option were liquidated at a value of $22.00 per share and the proceeds were transferred to an existing

Mutual Fund Option within the Plan.

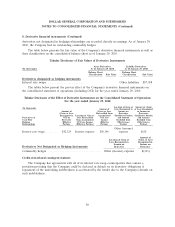

Asset balances in the Mutual Funds Options are stated at fair market value, which is based on

quoted market prices. The current portion of these balances is included in Prepaid expenses and other

current assets and the long term portion is included in Other assets, net in the consolidated balance

sheets. The deferred compensation liability related to the Mutual Funds Options is recorded at the fair

value of the investment options as chosen by the participants. The current portion of these balances is

included in Accrued expenses and other and the long term portion is included in Other liabilities in the

consolidated balance sheets.

95