Dollar General 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

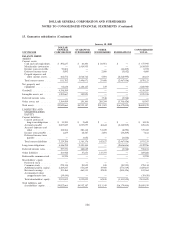

11. Share-based payments

The Company accounts for share-based payments in accordance with applicable accounting

standards. Under these standards, the fair value of each award is separately estimated and amortized

into compensation expense over the service period. The fair value of the Company’s stock option grants

are estimated on the grant date using the Black-Scholes-Merton valuation model. Forfeitures are

estimated at the time of valuation and reduce expense ratably over the vesting period. The application

of this valuation model involves assumptions that are judgmental and highly sensitive in the

determination of compensation expense.

Prior to the Merger, the Company maintained various share-based compensation programs which

included options, restricted stock and restricted stock units. In connection with the Merger, the

Company’s outstanding stock options, restricted stock and restricted stock units became fully vested

immediately prior to the closing of the Merger and were settled in cash, canceled or, in limited

circumstances, exchanged for new options of the Company, as described below. Unless exchanged for

new options, each option holder received an amount in cash, without interest and less applicable

withholding taxes, equal to $22.00 less the exercise price of each in-the-money option. Additionally,

each restricted stock and restricted stock unit holder received $22.00 in cash, without interest and less

applicable withholding taxes. Certain stock options held by Company management were exchanged for

new options to purchase common stock in the Company (the ‘‘Rollover Options’’). The exercise price

of the Rollover Options and the number of shares of Company common stock underlying the Rollover

Options were adjusted as a result of the Merger. The Rollover Options otherwise continue under the

terms of the equity plan under which the original options were issued.

On July 6, 2007, the Company’s Board of Directors adopted the 2007 Stock Incentive Plan for Key

Employees, which Plan was subsequently amended (as so amended, the ‘‘Plan’’). The Plan provides for

the granting of stock options, stock appreciation rights, and other stock-based awards or dividend

equivalent rights to key employees, directors, consultants or other persons having a service relationship

with the Company, its subsidiaries and certain of its affiliates. The number of shares of Company

common stock authorized for grant under the Plan is 31,142,858. No more than 4.5 million shares may

be granted to any one Plan participant in the form of stock options and stock appreciation rights in any

given fiscal year of the Company, and no more than 1.5 million shares may be granted to any one Plan

participant in the form of other stock-based awards in any given fiscal year of the Company. As of

January 29, 2010, 17,495,729 of such shares are available for future grants.

During 2009, 2008 and the 2007 Successor period, the Company granted options that vest solely

upon the continued employment of the recipient (‘‘Time Options’’) as well as options that vest upon

the achievement of predetermined annual or cumulative financial-based targets (‘‘Performance

Options’’). According to the award terms, 20% of each of the Time Options and Performance Options

generally vest annually over a five-year period, and virtually all Time Options and Performance Options

granted through January 29, 2010 have been subject to these terms. However, in late 2009, the

Company began granting awards whereby 25% of each of the Time Options and Performance Options

generally vest annually over a four-year period. In the event the performance target is not achieved in

any given annual performance period, the Performance Options for that period will subsequently vest,

if at all, upon the achievement of a cumulative performance target. Vesting of the Time Options and

Performance Options is also subject to acceleration in the event of an earlier change in control or

certain public offerings of the Company’s common stock. Each of these options, whether Time Options

or Performance Options have a contractual term of 10 years and an exercise price equal to the fair

value of the underlying common stock on the date of grant.

96