Dollar General 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

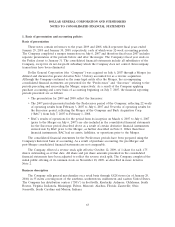

1. Basis of presentation and accounting policies (Continued)

Goodwill and intangible assets with indefinite lives are tested for impairment annually or more

frequently if indicators of impairment are present and written down to fair value as required. No

impairment of intangible assets has been identified during any of the periods presented.

The goodwill impairment test is a two-step process that requires management to make judgments

in determining what assumptions to use in the calculation. The first step of the process consists of

estimating the fair value of the Company’s reporting unit based on valuation techniques (including a

discounted cash flow model using revenue and profit forecasts) and comparing that estimated fair value

with the recorded carrying value, which includes goodwill. If the estimated fair value is less than the

carrying value, a second step is performed to compute the amount of the impairment by determining

an ‘‘implied fair value’’ of goodwill. The determination of the implied fair value of goodwill would

require the Company to allocate the estimated fair value of its reporting unit to its assets and liabilities.

Any unallocated fair value would represent the implied fair value of goodwill, which would be

compared to its corresponding carrying value.

Other assets

Other assets consist primarily of qualifying prepaid expenses, debt issuance costs which are

amortized over the life of the related obligations, and utility and security deposits. Such debt issuance

costs increased substantially subsequent to the Merger as further discussed in Notes 3 and 7.

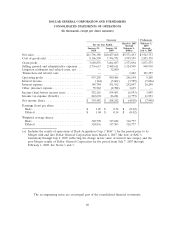

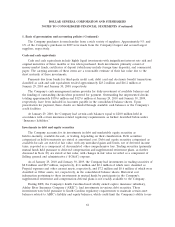

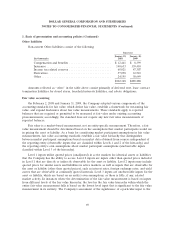

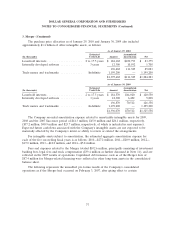

Accrued expenses and other liabilities

Accrued expenses and other consist of the following:

Successor

January 29, January 30,

(In thousands) 2010 2009

Compensation and benefits ......................... $100,843 $ 87,451

Insurance ...................................... 65,408 65,524

Taxes (other than taxes on income) ................... 72,902 66,983

Other ......................................... 103,137 155,087

$342,290 $375,045

Other accrued expenses primarily include the current portion of liabilities for legal settlements,

freight expense, contingent rent expense, interest, electricity, lease contract termination liabilities for

closed stores, common area and other maintenance charges, store insurance liabilities and income tax

related reserves.

Insurance liabilities

The Company retains a significant portion of risk for its workers’ compensation, employee health,

general liability, property and automobile claim exposures. Accordingly, provisions are made for the

Company’s estimates of such risks. The undiscounted future claim costs for the workers’ compensation,

general liability, and health claim risks are derived using actuarial methods. To the extent that

subsequent claim costs vary from those estimates, future results of operations will be affected. Ashley

River Insurance Company (or ARIC, as defined above), a South Carolina-based wholly owned captive

67